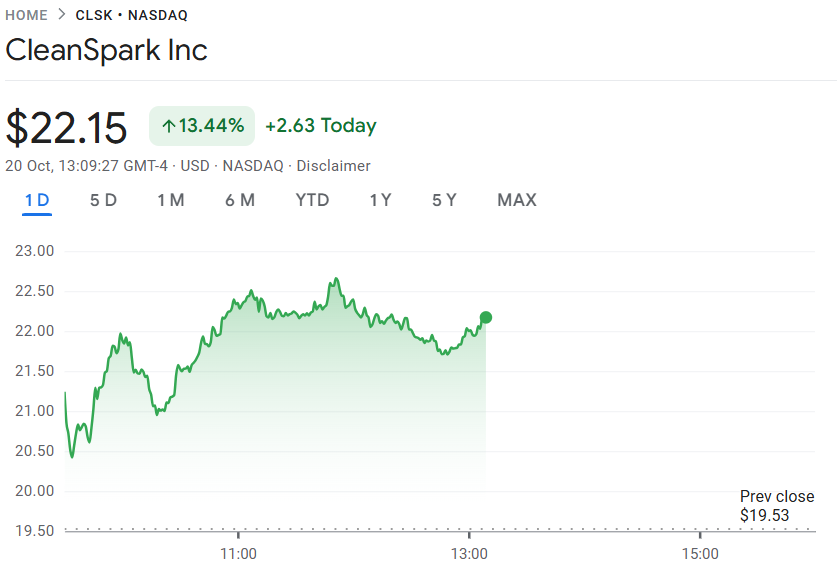

CleanSpark, a Nasdaq listed Bitcoin mining company, saw its shares soar over 13% after it announced an expansion strategy into artificial intelligence.

CleanSpark, a fifth largest Bitcoin (BTC( based on market capitalization) announced its new expansion strategy into AI data center technology, with the aim of diversifying revenue streams and strengthening long-term cashflow potential.

CleanSpark has appointed Jeffrey Thomas to lead this initiative as its senior vice president for AI data centres. announced On Monday,

Thomas led Saudi Arabia’s billion-dollar AI data centers program when he was president of AI Data Centers at Saudi AI Company Humain. The announcement states that Thomas created more than $12 billion in shareholder value over the course of his career.

“We have been reviewing the entire portfolio from first principals to evaluate AI suitability and have identified Georgia as a strategic region for both potential conversion as well as expansion,” Scott Garrison wrote, Chief Development Officer and Executive Vice President at ClearSpark:

“We recently contracted for additional power and real estate in College Park to deliver high-value compute to the greater Atlanta metro area and are evaluating giga-campus opportunities across the portfolio and pipeline that are well positioned to satisfy significant off-taker demand.”

Shareholders welcomed the strategic expansion, as CleanSpark’s stock price rose over 13% on Monday, after rising 140% year-to-date in 2025, according to data Google Finance

Related: Elon Musk touts Bitcoin as energy-based and inflation-proof, unlike ‘fake fiat’

After the halving of Bitcoin, miners seek new sources of revenue

CleanSpark’s pivotal strategic shift comes after the postBitcoin halving Other mining companies are being pushed to find new revenue streams.

Some of the biggest Bitcoin mining firms Core Scientific Hut 8 Iris Energy and others have all announced AI strategic pivots since 2024.

In June 2024, Core Scientific announced CoreWeave, a cloud AI provider with a revenue of $3.5billion, has agreed to provide CoreWeave an extra 200 megawatts in infrastructure. This will be used to support CoreWeave’s high-performance computer (HPC) operation.

Cointelegraph reports that the deal will generate an initial revenue total of $3.5 billion over the first 12 years of contract terms for the largest Bitcoin mining company in the world.

Core Scientific has filed for bankruptcy, but the AI expansion strategy saved their business. Chapter 11 bankruptcy Two years prior to getting married in 2022. relisted on the Nasdaq Its AI pivot is ahead.

Related: Grok, DeepSeek outperform ChatGPT, Gemini with epic crypto market long

Hut 8 has launched AI services after it began mining bitcoins in September 2024. GPU-as-a-Service offering Highrise AI, a newly formed subsidiary.

June, Hut 8 received Coatue Management a tech-focused investment firm, has invested $150 million in the company to assist it. “capitalize” On the increasing demand for AI computing.

Magazine: Bitcoin mining industry ‘going to be dead in 2 years’ — Bit Digital CEO

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com