The key take-aways

-

Bloomberg analysts give 95% chances for the creation of an XRP-based ETF. A SEC decision is expected in October.

-

XRPL adoption lags behind peers. It holds just 2% Real World Assets despite the stablecoin’s growth.

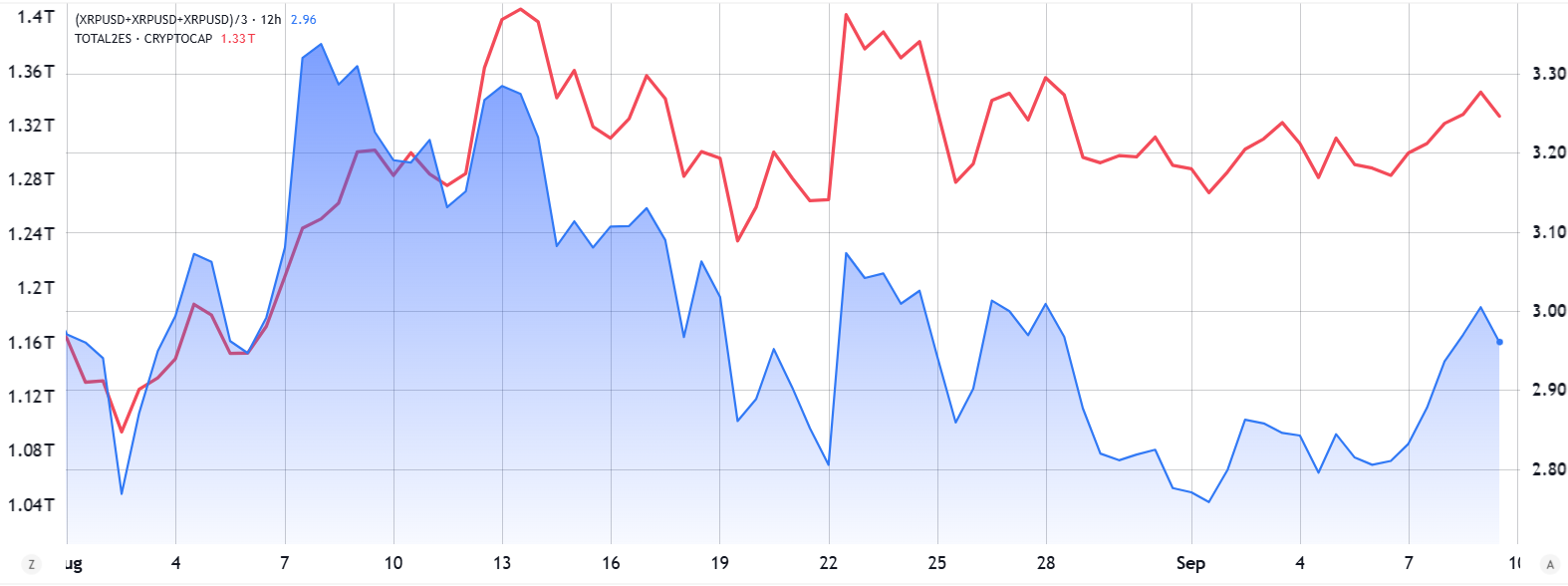

The XRP currency (XRPPrice faced rejection after it reached its highest in almost two weeks, $3.04. It was a result of speculation about XRP ETF approvals in the United States, and an increase in institutional interest in XRP-based derivatives. This led to expectations that XRP could return to the $3.60 mark seen in July.

Demand for XRP futures climbed 5% from the previous month, totaling 2.69 billion XRP —equivalent to $7.91 billion at prevailing prices. In addition, during that same period of 30 days, the Chicago Mercantile Exchange’s (CME) XRP Futures contract list grew by 74%, reaching 386 Million XRP. It is clear that professional investors and market-makers are more active.

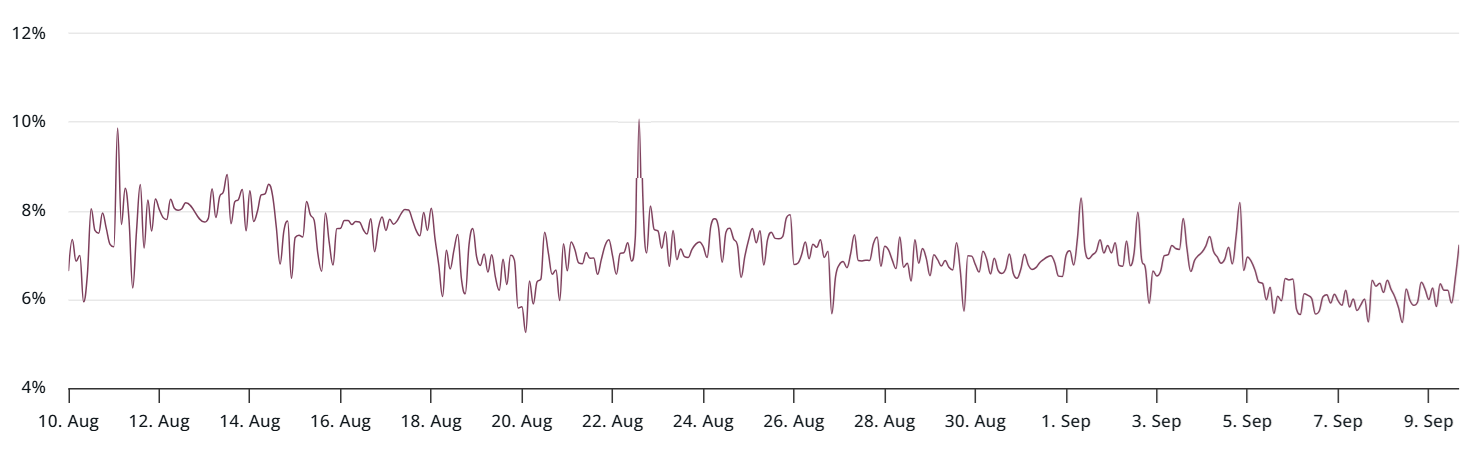

Even though higher activity in the futures market is a sign of interest, there are still always equal numbers of long and short positions. Even so, the monthly contracts of futures may indicate a leverage imbalance. XRP contracts typically trade 5% – 10% higher than spot prices under neutral market conditions to reflect the longer settlement time.

XRP’s monthly futures are currently trading at a 7% discount, indicating that leverage demand is still balanced. This pattern has been consistent for the last month. XRP has underperformed compared to the broader altcoin markets, which is one reason why the outlook remains muted.

The XRP market has been flat since August while altcoins have grown by 14% during the same time period. This rally was backed by Hyperliquid’s (HYPE) gains of 32 %, Solana SOL’s (SOL), and gains in the amount of 28 %.SOLCardano ADA’s ADA gained 19%.ADAEther (18%) is the most common Ether.ETH). The most noticeable XRP growth in August was the settlement of a years-long dispute Ripple and US Securities and Exchange Commission

XRP rallies depends on upcoming US ETF decision

An anticipation of an XRP ETF approval Recent price movements of XRP have been largely influenced by the US. Bloomberg analysts put the approval odds at 90% and higher. However, the SEC is not expected to make a final decision until late October. REX Osprey’s products, which combine ETFs with ETNs, may arrive sooner than expected. They could follow a similar model to Solana Staking.

Ripple’s stablecoin RLUSD Attracting attention was also the fact that assets had surpassed $700,000,000. The milestone is impressive but nearly 90% of supply has been issued via the Ethereum network. This means that there was little or no demand directly for XRP Ledger. The market for stablecoins is still dominated by issuers that have a higher level of liquidity. This includes Circle’s USYC as well as World Liberty’sUSD1, who are both formidable competitors.

Related: Trump family’s wealth grew by $1.3B following ABTC and WLFI debuts–Report

Some investors are expecting XRPL’s growth to become a major asset class. facilitator of international paymentsThe SWIFT system is not a replacement for the existing SWIFT infrastructure. RWA.xyz shows that XRPL is only 2%. Real World AssetsThe smaller blockchains, such as Avalanche Stellar and Aptos, are lagging behind.

XRP’s rise to $3.60 is not ruled out. However, given XRPL’s modest total value locked of $100 million (TVL), it appears unlikely that such momentum will continue.

The article does not provide legal advice or investment recommendations and it is intended only for informational purposes. These are solely the opinions, views, and thoughts of the author and may not reflect the opinions and views of Cointelegraph.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com