- Ethereum is nearing $4,000 due to the optimism surrounding newly-approved ETFs.

- Analysts believe that Ethereum could reach a value of $10,000 during the current cycle.

After the U.S. Securities and Exchange Commission approved the applications for Ethereum [ETH]Exchange Traded Funds based on the altcoin, have shown a spectacular rise.

Ethereum’s price has risen by a substantial amount in recent weeks, with its value nearing $4,000, after a rise of 3.7% over the past 24 hours.

Ethereum’s price at the time of publication was $3,899, a notable rebound compared to earlier volatility.

Ethereum targets $4,500 for possible target

Arthur Cheong CEO of DeFiance Capital shares his thoughts on the price fluctuations in Ethereum. suggested Ethereum may reach $4,500 in value before its ETF trading begins – this could be as soon as August or July.

Cheong said that the spot Ethereum ETFs will be able to attract retail investors in a similar way as the 2017 crypto-boom.

It is very similar to its Bitcoin [BTC] Retail investors hold over 70% of the positions in comparison to their counterparts.

Ethereum is a hot topic amongst investors, traders and other market participants.

It’s important to remember that the market projections are speculative and depend on a variety of factors, including economic trends, investor sentiment, etc.

A current regulatory framework for the SEC is worth noting. shows a green light only for the initial 19b-4 requests The S-1 form is still waiting for approval.

Ethereum bullish trend

Ethereum has shown a robust market growth despite these regulatory obstacles, both in terms of price and fundamental metrics on the chain.

Data Santiment has highlighted the significant increase in Ethereum’s volatility. This metric, which was at its lowest point in just a fortnight ago is now at a high.

The fact that the volatility of cryptocurrency prices is rising along with their price indicates an increased trading and investment activity, which can be driven by speculation.

Glassnode has added to the interest. reported A rise in the number new Ethereum addresses suggests an expansion of users.

A rise in market activity is often a result of heightened market interest, possible boosted by a positive outlook and increased adoption.

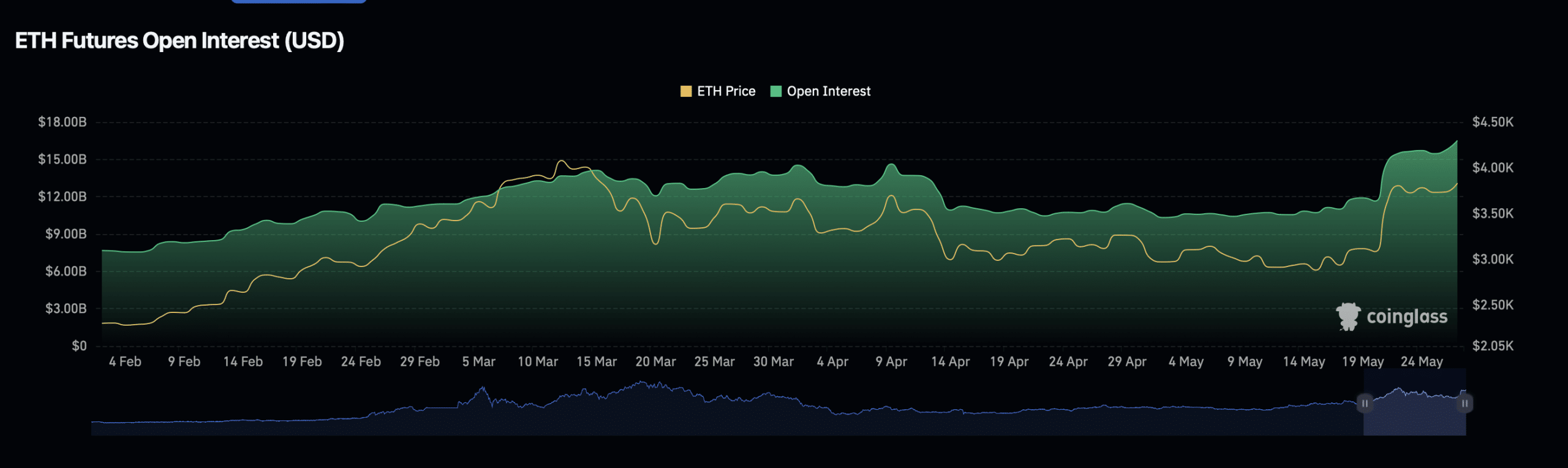

Moreover, Coinglass’ data Open Interest in Ethereum increased dramatically, signaling a derivatives market that is active and has high volumes of trading.

It was not just an increase in liquidity but also a rise in speculative interests, as traders began to anticipate future price movements.

A rise in Open Interest implies a greater level of market leverage. This could lead to both increased gains or losses depending on the direction that markets take.

According to a technical analysis of Ethereum’s chart, the crypto recently breached $3,700, converting it from resistance into support. The next important milestone is at $4,000.

This break-through suggests that the bullish momentum may be strong and could drive further gains.

Is your portfolio green? Have you checked out your portfolio? ETH Profit Calculator

AMBCrypto cites Glassnode data. According to a significant decrease In Ethereum’s network value to transaction (NVT),.

This ratio can be reduced to indicate that an asset’s market value is about to rise.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: ambcrypto.com