After the recent crash in the market and a weakened structural, Uniswap [UNI] slipped to a two‑year low. Before staging a modest recovery, the altcoin dropped to $4.1, which was a price last seen in Nov 2023.

At press time, UNI traded at $4.15, down 1.14% on the daily charts, reflecting increased volatility.

Uniswap whale dumps 2.49M UNI

You can also read our article on After UNI] suffered a major slump. A long-term holder panicked, and sold his entire UNI holdings. The following is a list of Arkham A dormant dolphin returned to the ocean after five long years, and dumped 2,49 million UNI at a cost of $10.62M.

The whale who sold the tokens purchased it in the beginning of Uniswap, when they were first introduced. Whale realized $1.72million profit from this sale. That’s only 19% growth in 5 years.

When whales are selling during a downturn in the markets, they usually do so out of a lack confidence and fear for further losses.

The pressure to sell increases!

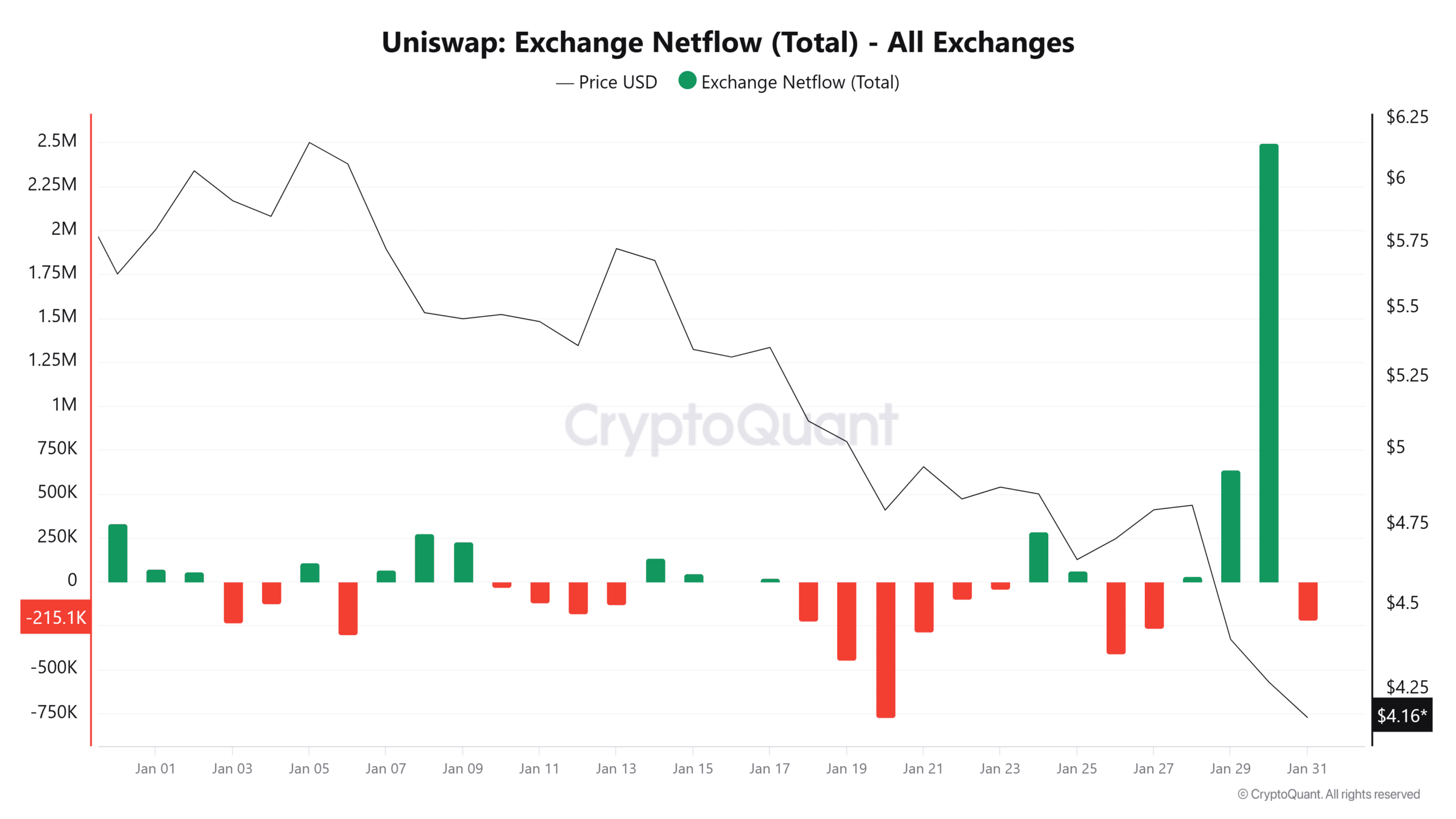

Uniswap also experienced a significant sell-off from other participants in the market on January 30th.

CryptoQuant reports that Exchange Inflow reached a high of 4.2 millions UNI in two months, but then dropped significantly at the time of this writing. The altcoin also recorded an Exchange Outflow of 1.7 Million.

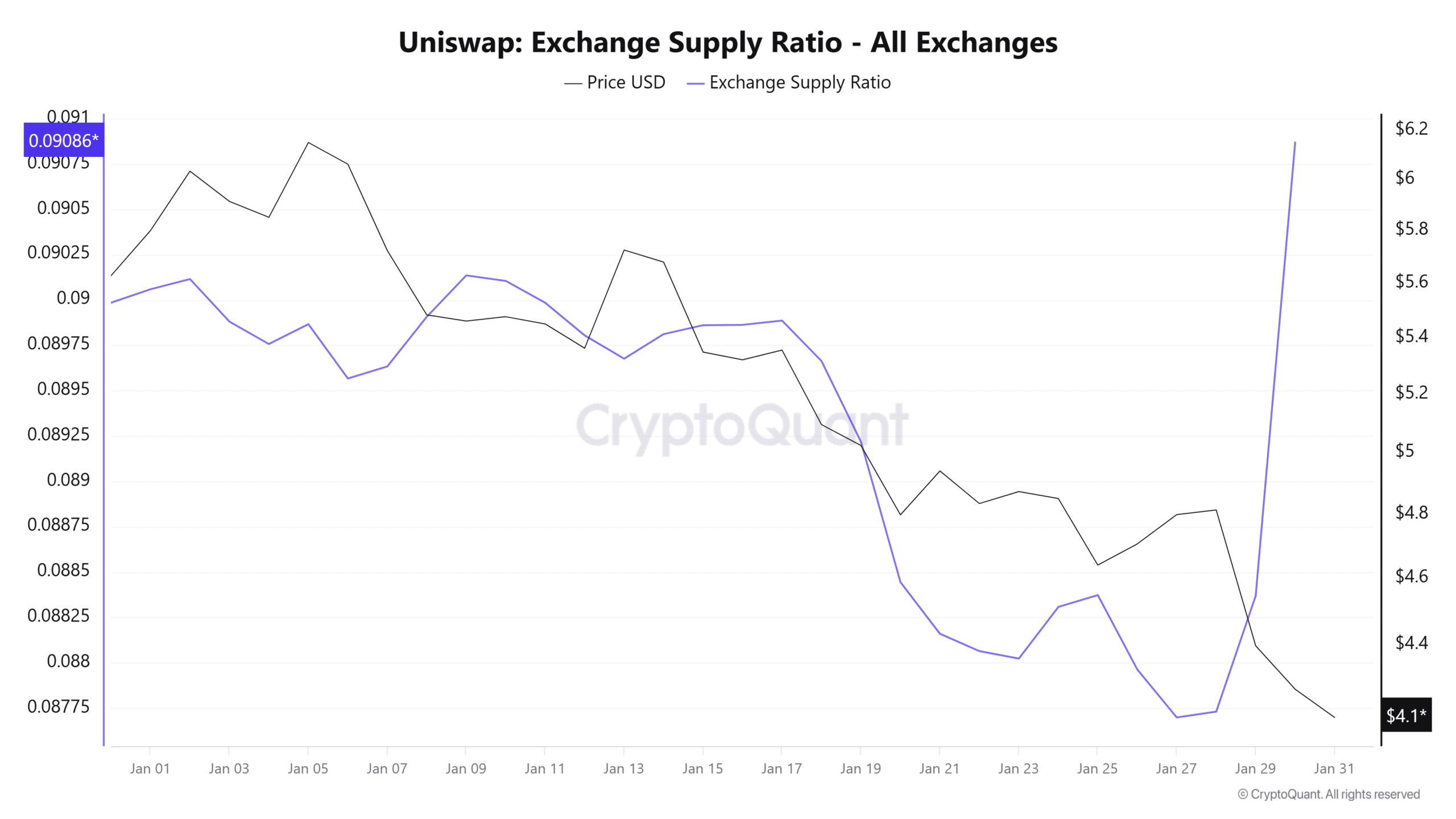

Exchange flow soaring to new highs, the Exchange Supply Ratio reached a 2-month-high of 0.09. A rising ratio of supply often indicates increased distribution and a higher dump risk.

In the past, these market conditions led to a reduction in scarcity and accelerated downward pressure. This was often an indication of lower prices.

Is $4 support at risk?

Uniswap prices dropped as retail investors and traders panicked. They sold their shares, which further accelerated the trend.

In response, Relative Strength Index’s (RSI) for the altcoin dropped further into oversold terrain, reaching a minimum of 27 as at the time of press.

If RSI falls to extreme levels it indicates that sellers are dominating the market. Uniswap’s Relative Vigor Index fell from 0.12 to -0.12 after crossing the bearish line.

The RSI, RVGI, and RSI-R have dropped to extreme levels, which suggests a strong downward trend, where sellers dominate the market.

These market conditions can often be a sign of an upcoming downturn and its potential continuation. If sellers continue to buy, UNI may breach the $4 level of support and fall towards $3.80.

If holders choose to take advantage of this discount and buy, Uniswap will be able to hold more than $4, and reclaim upto $4.8 if there is a major reversal.

Last Thoughts

- Uniswap sank to a low of $4.11 after 2 years, but has since slightly recovered to $4.19 as we went to press.

- The UNI Whale awoke after five years and dumped 2,49 million UNI at $10.62 Million.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: ambcrypto.com