- Last week, the buying pressure against UNI remained strong.

- Several market indicators have turned negative on the token.

Uniswap’s [UNI] The price chart showed a huge drop in price when it turned red. In the past 24 hours we have seen a trend reverse. This doesn’t mean that the bull market will continue, because there are still some red flags.

Uniswap’s recovery is a priority

Uniswap has had a bad week. While most other cryptos have enjoyed bull runs, Uniswap saw its value drop.

The following is a list of CoinMarketCapUNI fell by more than 7% during the last week. A whale took this opportunity to stock up on UNI at a low price.

Lookonchain has recently published a tweet Binance revealed that a whale had withdrawn 86,467 UNI worth $1,23 million. UNI rice registered a bullish trend soon after purchase.

In just the past 24 hours, UNI has seen its price increase by over 3.5%. UNI traded at $14.32, and its market cap was over $8.5 Billion.

Glassnode’s data was analysed and it revealed a high probability of an upward trend continuing. Uniswap recently saw its Network Value-to Transactions (NVTs) ratio drop.

When the indicator drops, this suggests an undervalued asset, which could lead to a rise in price.

Red flags are a warning sign.

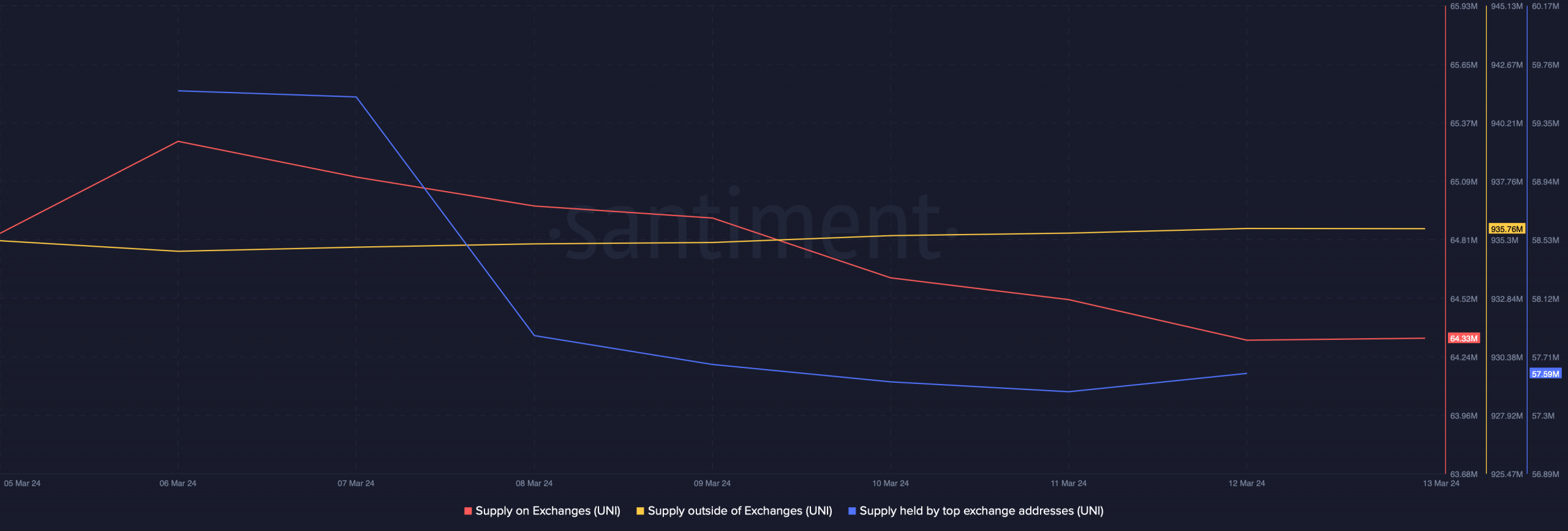

The fact that investors bought Uniswap was very interesting. Santiment data analysis revealed that UNI’s exchange supply dropped, while the supply of UNI outside exchanges increased. This indicates that there was a high level of buying pressure.

The top players, or whales, sold all their UNI as the supply of UNI held by the addresses that ranked highest fell.

We found a possible explanation when we looked at the data from Hyblock Capital. A significant amount of UNI is liquidated once its price reaches the $14.60 mark.

High selling pressure is a sign of a high liquidation rate, and this could put an abrupt end to the bull run in tokens in the next few days.

What is the cost? 1,10,100 UNIs worth today

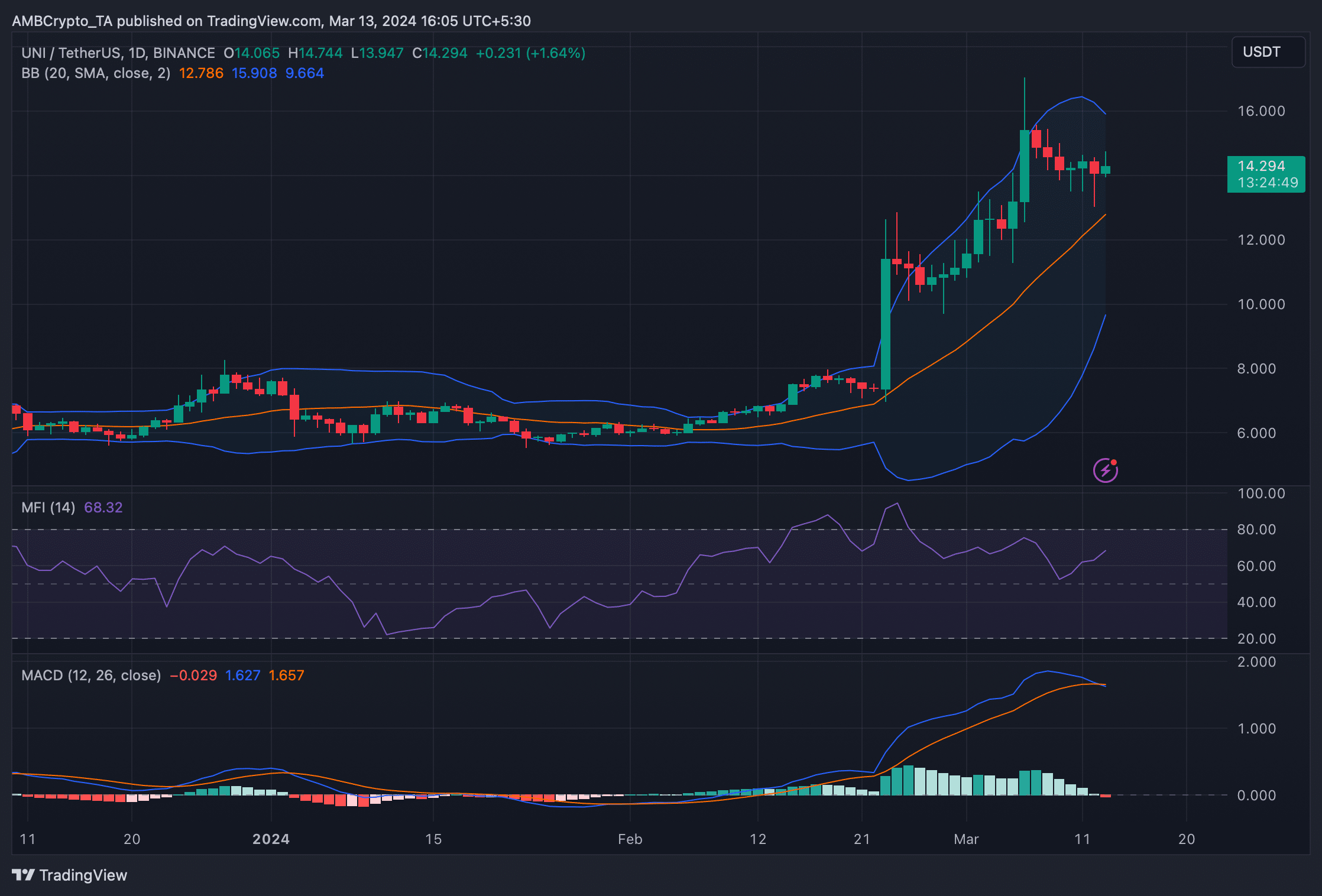

We analyzed Uniswap’s daily chart to see what we can expect. Bollinger band analysis revealed UNI price entering a lower volatility zone.

MACD showed the same bearish crossover. This further suggests that bull rally could end in the near future. Money Flow Index registered an increase, which is a positive development.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

Source: ambcrypto.com