- SOL dropped by 27.91% during the last month.

- As the bear market continues, it is possible that Solana’s ecosystem will collapse.

In the last month, there has been a noticeable increase in the Solana[SOL] The ecosystem is struggling to expand. It was initially presented as an alternative to Ethereum [ETH]This dream is now a distant memory.

Analysts are concerned about the potential for a crash in Solana’s ecosystem.

Alphractal Founder Joao Wedson Has expressed his concerns over the potential collapse of Solana’s ecosystem.

Wedson claims that SOL’s ecosystem is at risk of collapse, with a market in bearish territory. The Solana Market has also shown poor performances compared with BTC.

To give you some context, Solana is a collection of 11 crypto-currencies, which includes Render [RNDR], Dogwifhat [WIF], Jupiter [JUP], Bonk [BONK], Book Of Memes [BOME]GMT [GMT]Jito [JTO]Raydium [RAY]Pyth network [PYTH]Tensor [TNSR].

At the time of press, WIF had declined 54% within 30 days. BOME was down 50%.

All assets within the Solana eco-system are now in the bear markets.

What has happened to the Solana eco-system?

Solana’s ecosystem is now highly speculative. This has led to whales and bots exploitation, and caused market swings.

These speculative actions have led to extreme market speculation and created a “win-win” bubble for developers.

In the past when a network became too speculative it experienced a liquidity crisis, and projects died as major players took profits. Solana could have been affected by this, since most of its projects are fueled by hype and trading without organic growth.

These kinds of market structures often lead to an abrupt decline. There is therefore a chance that the network will undergo a significant reset.

What’s next for Alt?

The whole Solana SOL has been affected by the poor performance of SOL’s ecosystem. A declining market capitalization is evidence of this.

SOL’s market cap As of the press release, market capitalization has fallen from $151 billion to only $100 billion. The huge fall in market value indicates that both investors’ demand and capital are declining.

This could also indicate a bearish mood, which can lead to large-scale selloffs.

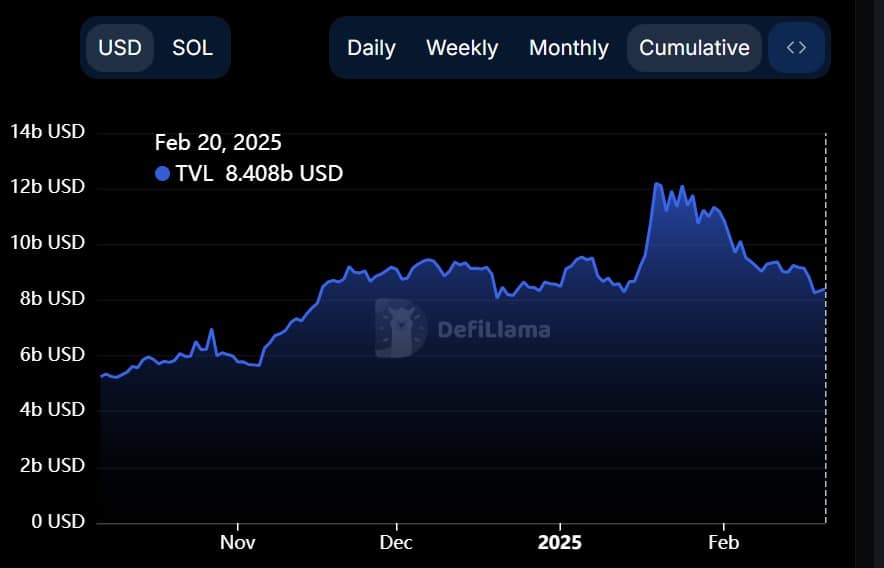

SOL’s Total value locked (TVL), which measures the network’s total value, has also declined. It is now $8 billion instead of $12 billion. TVL and Market Cap decline suggest massive capital outflows from the network. The decline in liquidity could cause higher volatility, and even slippage.

Solana could suffer further losses if the current market conditions continue.

SOL may drop as low as $164 if investors keep pulling capital. SOL can regain 200 dollars if speculation is restored.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: ambcrypto.com