TradingView’s data indicates that Solana is down nearly 29% from the beginning of 2025 despite the addition of $10 billion to its new liquid assets and inclusion into the US Digital Asset Stockpile.

Solana has not been able to stop the decline (SOLThe US president has included a list of three alternative currencies, including. Donald Trump’s Digital Asset StockpileCardano, together with (ADAThe XRP currency (XRP).

SOL/USD, year-to-date chart. Source: Cointelegraph/TradingView

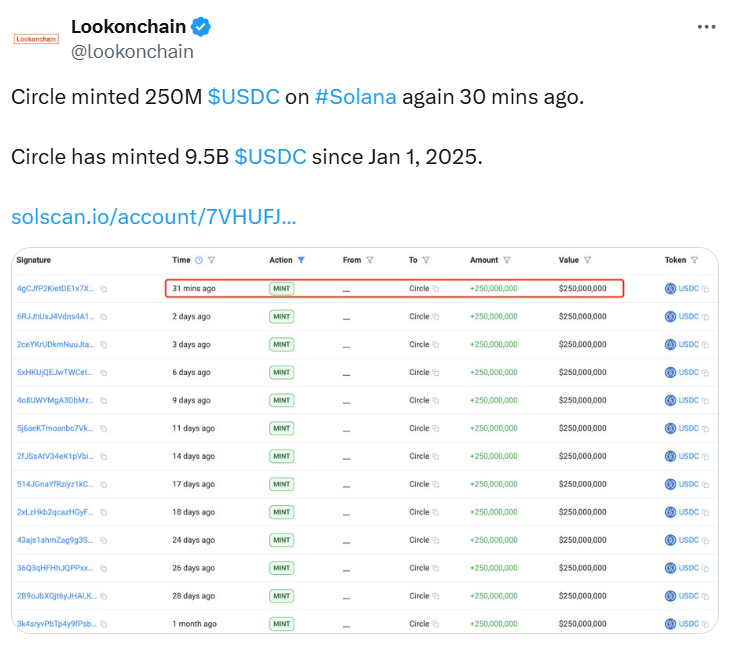

Solana, despite the fact that USDC worth over $9.5 billion has just been issued (USDCStablecoins will be available on Jan. 1, 2020. according Lookonchain is a crypto intelligence platform.

Lookonchain

Analysts suggest that newly-minted liquid assets have a number of benefits. flowed into memecoins SOL should not increase its price.

SOL’s value has fallen by 49%, going from $261 in January to $133 as of March 9, since Trump’s official Trump token (TRUMP), was launched.

SOL/USD, 1-day chart. Source: Cointelegraph/TradingView

The Trump coin was launched during the launch of the Trump campaign. “most of the inbound liquidity was outflow from other crypto assets, people selling their crypto portfolio to buy TRUMP in extreme FOMO [fear of missing out],” Dan Hughes, the founder of Radix’s decentralized financial platform, spoke to Cointelegraph.

Solana’s price drop comes amid a larger market decline that has seen the total capitalization of all cryptos fall by nearly 17% from the start of 2025.

Related: Binance is not ‘dumping’ Solana and other token holdings — Spokesperson

Investors seek safety as Solana faces capital outflows

Investors seeking safe assets after the recent memecoin scams may be responsible for a part of Solana’s downward trend.

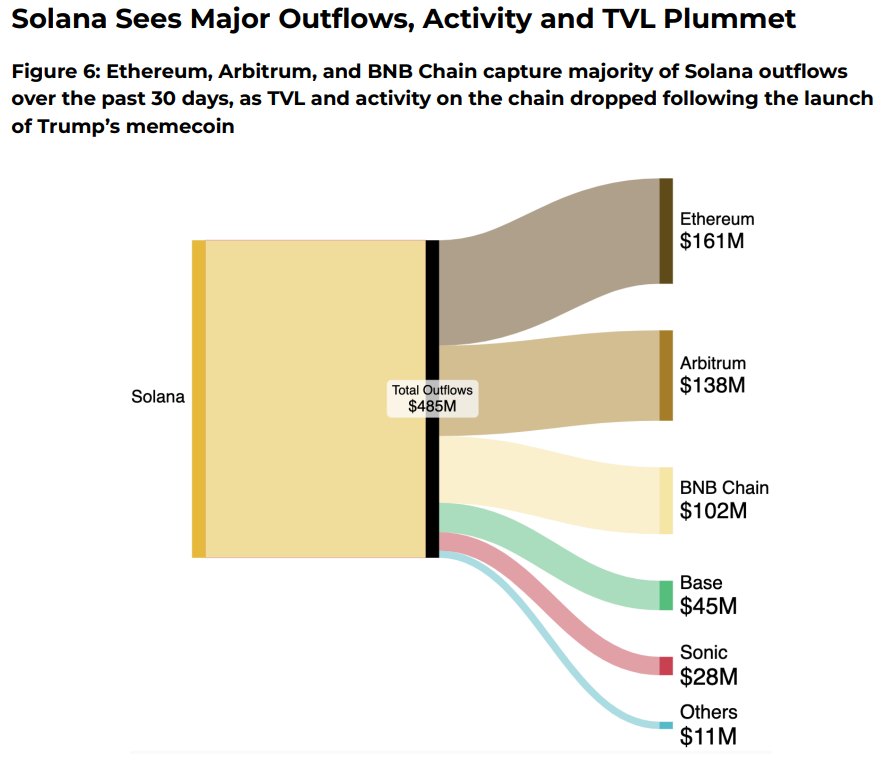

Solana suffered a loss of over $485m in February. Investors shifted their capital to Ethereum, Arbitrum, and BNB Chain.

Exodus from the capital was part of a larger flight away. “safety” Binance Research found that there is a growing interest in crypto among market participants. report Cointelegraph shares this information.

Solana outflows. Source: deBridge, Binance Research

“Overall, there is a broader flight towards safety in crypto markets, with Bitcoin dominance increasing 1% in the past month to 59.6%,” According to the report,

“Some of the capital flowed into BNB Chain memecoins, driven in part by CZ’s tweets about his dog, Brocolli,” Additions

Related: Bitcoin reserve backlash signals unrealistic industry expectations

The disappointment in the Solana memecoin launch has also dampened investor interest, particularly since the launch of Libra tokens, which were endorsed by Argentine President Javier Milei.

Insiders of the project allegedly stole over $107 million worth of liquidity A rug pulling triggered a 94% collapse in price within hours, wiping out 4 billion dollars in capital from investors.

Magazine: ETH whale’s wild $6.8M ‘mind control’ claims, Bitcoin power thefts: Asia Express

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com