The key takeaways

-

SOL’s rally of 5% ETF to $160, driven by SOL was completely reversed within 24 hours. This reveals persistent technical weaknesses on lower and higher timeframes.

-

SOL trades near a key $144.5–$147.7 supply cluster. A breakdown below $144 could trigger a drop to $124 or even $95–$100, where support thins out.

Solana (SOLOn Monday, ), rallied by 5% to reach $160 following news The first ETF went live on trading Wednesday. The altcoin’s momentum was brief, as it lost all its gains in just 24 hours. Price weakness is visible on several timeframes.

SOL failed to hold a higher position in the shorter timeframe than the exponential moving averages of 50 and 200 days for more than a month. The altcoin, despite several bullish breaks of structure formations including the recent rise above $148 last week, has yet to convert these uptrends into sustainable ones.

A drop below $137 will confirm that a new low has been reached, thereby negating any chance for a bullish near-term continuation. For SOL to regain upside momentum, a successful retest of the $145–$137 demand zone, followed by recovery above $160, remains pivotal.

The broader trend is still bearish on the HTF (higher time frame). SOL has been trending downwards within an descending channel since May when it failed to break the $180 resistance.

SOL’s sensitivity to Bitcoin weakness has not changed despite such patterns. Bitcoin (BTCSince Jan. 19, the cryptocurrency asset (which is nearing its highest point) has dropped nearly half, reflecting a relative performance.

In the event that the bearish tendency continues, it is possible to retest the daily order blocks between $120-$95, which would be a much more appealing entry point for long-term. A strong close of the daily order block above $160 could change sentiment in the next few weeks and speed up a bullish trend, extending short-term momentum to the longer timeframe.

Related: Analysts raise chance of SOL, XRP and LTC ETF approval to 95%

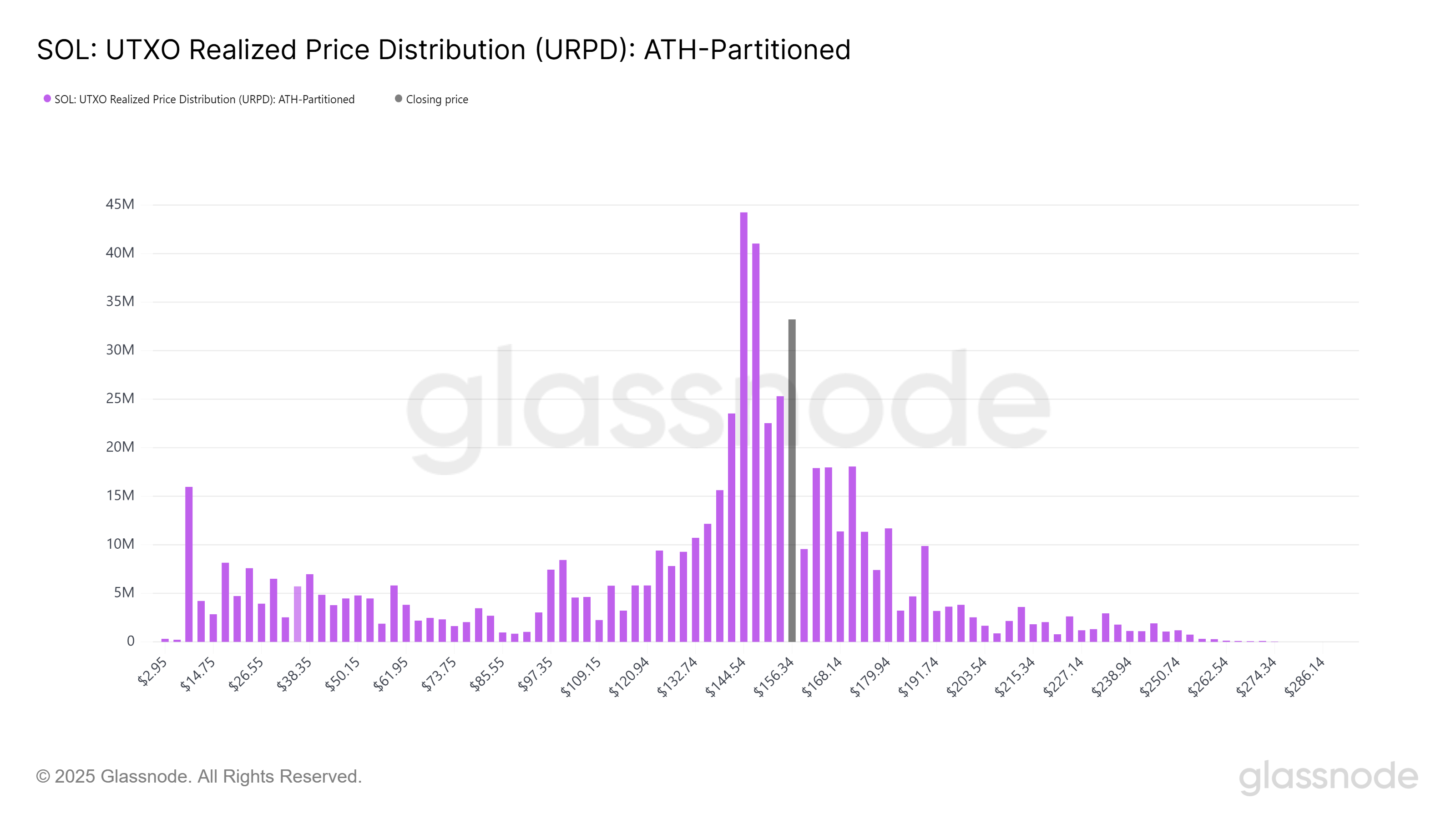

SOL UTXO realization price signals: Key price levels

SOL traded around $148 Tuesday. Its UTXO real-time price distribution (URPD), a metric that tracks the prices at which tokens are purchased, provides critical insight into resistance and support zones. Price is currently within the supply cluster at 14.3%, between $144.5 and $147.7. This suggests a strong concentration of holders. The current level of $144.5 to $147.7 is crucial, because it represents a price range which could be sustained if the buying pressure continues.

Glassnode’s data shows that staying above $144 per month is essential. If this level is breached, it signals weakness and increases the probability of another test of support levels below.

There are limited buffers in the $100-$97 price range, and $124 offers 1.58%. The market could fall further if the price does not hold at $144. This is because the supply will be thinner.

The $157 level is a resistance point, as 5.55% supply there poses a problem for the upward movement. The dense $144.5 – $147.7 cluster is a good base for now. Investors are advised to defend SOL’s price.

Related: SOL price rallies to $161 after ETF news, but is the rally sustainable?

This article contains no investment recommendations or advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making a final decision.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com