The key takeaways

-

Bitcoin short-term holders lost money on 15,000 BTC throughout the entire week.

-

Onchain data suggests a Bitcoin price bottom in the $97,000–$94,000 zone.

BitcoinBTCThe week has been relatively quiet, with investors and traders staying away from the markets due to concerns over the conflict between Israel and Iran as well as uncertainty surrounding FOMC. Onchain data has been a constant source of information despite the calm markets. CryptoQuant This week, over 15,000 BTC owned by short-term investors (STHs), moved at a significant loss.

Glassnode reported that on Monday 959 BTC had been transferred into exchanges, at a cost of $16,500. By Wednesday, the number of BTCs was 16,700, and BTCs’ price dropped to $103,500. This behavior is consistent with the usual pattern of STHs. “weak hands,” During price declines, many people panic sell and suffer losses.

This is a sign of increased STH activity when the market drops. The coins are often transferred to the long-term holders or LTHs when these weaker investors exit their positions. “strong hands,” Contributing to market stability and more stable price bases.

It is notable that the total supply of STHs, in particular after large drawdowns, has decreased. This reduction of weak-hand sales pressure creates opportunities for accumulating and can indicate the appearance of a floor price.

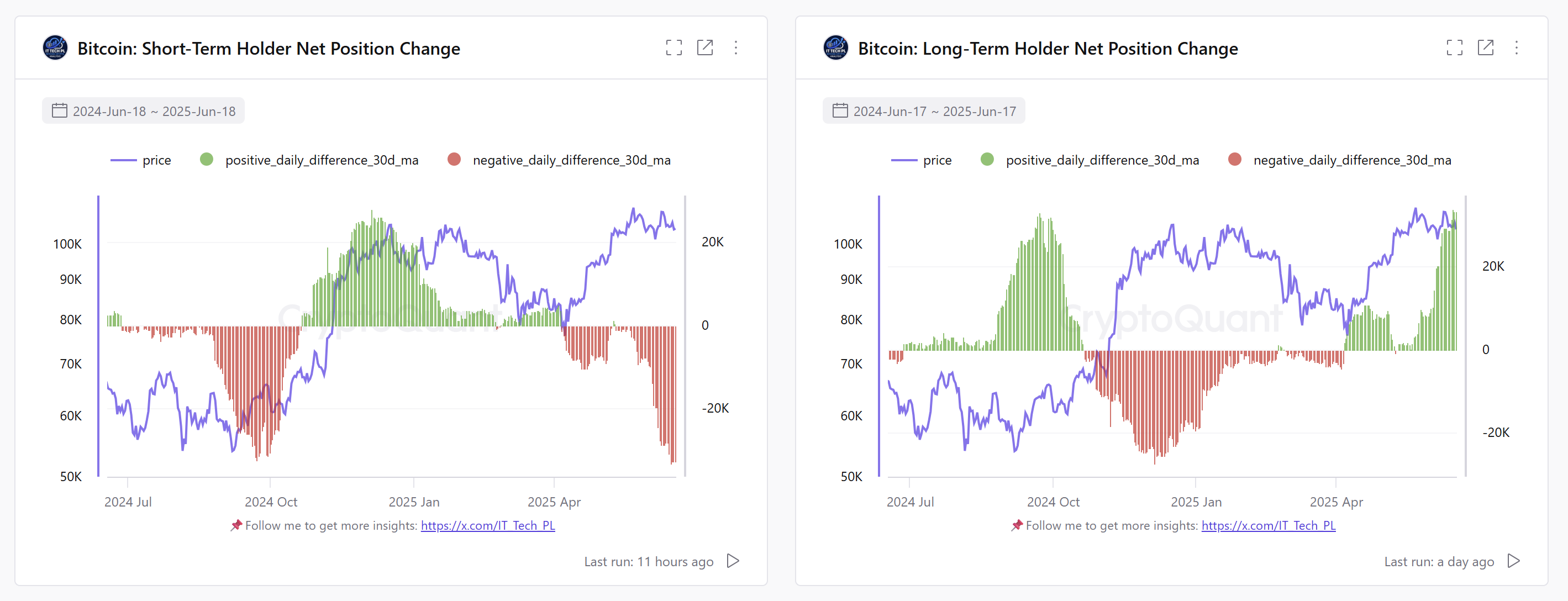

STHs were aggressive sellers over the month, according to the STH/LTH Net Position Change Chart. This selling was absorbed by the LTHs.

Related: Here’s when Bitcoin analysts expect new BTC price volatility

Bitcoin is a cryptocurrency that can be used to buy and sell goods. “blind spot,” needs buyer demand

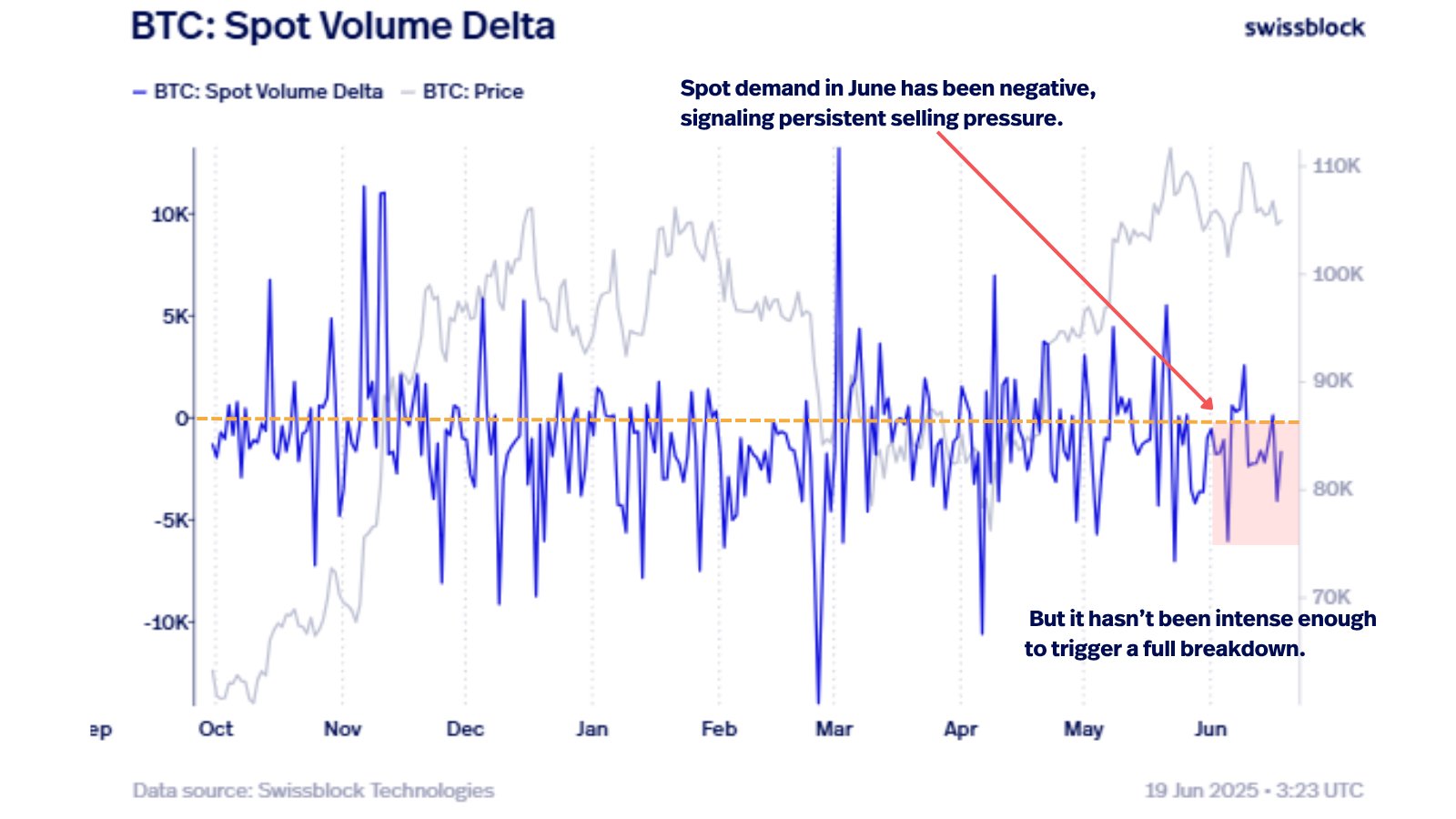

Bitcoin has been a popular cryptocurrency for a while now. “blind spot” The market is booming, says a data analysis platform, Swissblock. Since June 2025 there has been a constant negative delta in spot volume, which signals selling pressure. However, recent price gains are due to low purchasing volume. The downside pressure may be easing but this could indicate a longer dip, before the breakout.

Bitcoin’s price is expected to rise after the short-term drop. onchain cost-basis This range of support for holders who are short-term is $97,000 to 94,000. This range may be a bottom for the market, with key levels of liquidation below $100,000.

Related: Bitcoin volume metric suggests ‘$130K-$135K BTC will happen’ in the summer

This article contains no investment recommendations or advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making a final decision.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com