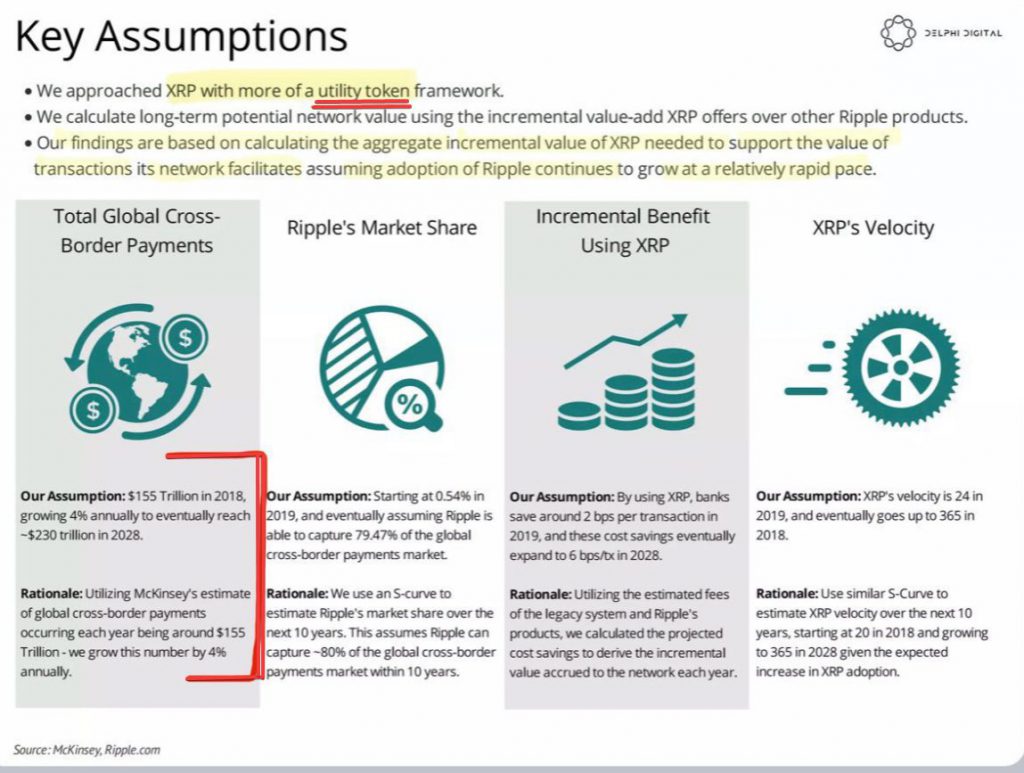

Former Ripple employees are gaining momentum in the Ripple-BlackRock alliance. Robert MitchnickBlackRock’s Digital Assets division is led by. The time this was written Deutsche Bank has confirmed regulatory clarity is driving XRP to a $75 price target. Ripple’s latest news is coming at a moment when regulatory clarity has been confirmed. XRP Ledger It is gaining recognition in EU regulation and positioning itself for institutional adoption within traditional finance.

🚨Ripple “ex”BlackRock’s head of digital asset is a -employee🚨

Please, Ladies and gentlemen do not forget!

Ripple “ex”Robert Mitchnick works as the Head of Digital Assets at BlackRock🤔

2) Larry Fink (BlackRock), Trump and Ripple were all in the Middle East together… pic.twitter.com/SFjK4Hzv8g

— The Real Remi Relief 🙏✝️💪 (@RemiReliefX) June 5, 2025

Please Read This: $300M Ripple XRP SEC Plan by Chinese Firm Sparks $11K Rally

Ripple’s BlackRock Alliance drives XRP price prediction to $75

Robert Mitchnick was once a Ripple worker. now heads BlackRock’s digital assets strategy. The Real Remi Relief, a proponent of XRP, has drawn attention to this link and is projecting XRP prices between $25 and $75 by the end of 2025.

The Real Remi Relief was:

“Ripple ‘ex’-employee Robert Mitchnick is the head of digital assets at BlackRock”

Deutsche Bank Validates an Upcoming Cryptocurrency Price Surge

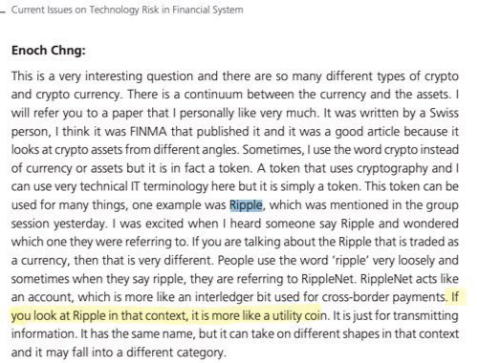

Deutsche Bank’s Ripple latest news validates Ripple and BlackRock partnership potential. Research by the bank shows that regulatory frameworks influence XRP’s price predictions across European markets.

Marion Laboure You can also find out more about the following: Cassidy Ainsworth-Grace from Deutsche Bank stated:

“A clearer regulatory framework should drive corporate adoption, pushing up prices”

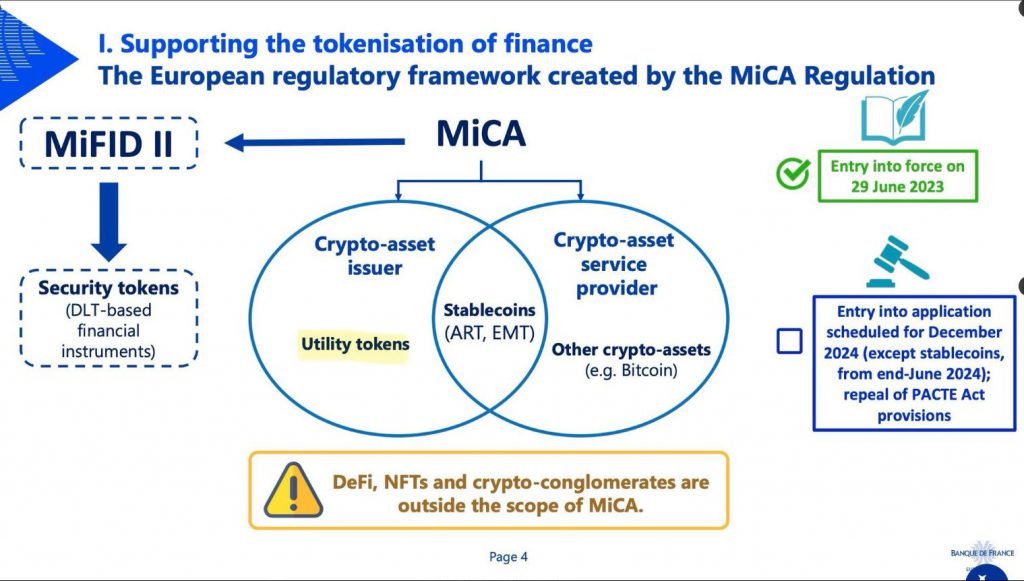

XRP Ledger Receives an important MiCA recognition

The XRP Ledger is now classified as a utility token under EU MiCA regulations, which provides legal certainty Bitcoin and Ethereum do not have at the moment. Ripple BlackRock’s alliance is strengthened by this Ripple News, which offers institutional investors compliance with cryptocurrency regulations.

SMQKE emphasized:

“Clearer regulatory frameworks like MICA WILL PUSH UP CRYPTOCURRENCY PRICES”

Major Confirmation from Deutsche Bank.🙇♂️

“Clearer regulatory frameworks like MICA WILL PUSH UP CRYPTOCURRENCY PRICES.”📈💰

Documented.📝💨 https://t.co/UJzZdZhXKx pic.twitter.com/i3DFLulVxt

— SMQKE (@SMQKEDQG) June 5, 2025

In this period, institutional ETFs are gaining more interest.

There are 18 ETFs currently being evaluated by the SEC. BlackRock’s iShares Bitcoin Trust is a successful example of how institutional products such as BlackRock can help XRP prices to be predicted through capital flows and supply restrictions.

Real Remi Relief – Beware!

“I am telling you, once these ETFs all just come in, they will be like a hurricane…wiping everything off the exchanges”

Strategic Timeline Points out an Important Date Between June and July 2025

Ripple’s BlackRock partnership timeline indicates that institutions will adopt Ripple in concert by 2025. The combination of this Ripple announcement, the regulatory approval from Deutsche Bank, and the XRP Ledger utility’s recognition creates the conditions for ambitious XRP prediction targets within the cryptocurrency industry.

Real Remi Relief Project:

“$25.00 – $75.00 XRP June/July”

Please Read This: Ripple RLUSD Approved in Dubai: XRP Eyes 21.5% Price Surge

The Ripple/BlackRock alliance and the institutional infrastructure will help XRP gain significant value as the traditional financial sector embraces cryptocurrency for global payments, asset allocation, and other applications.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: watcher.guru