The Pump Fun [PUMP] holder Recently transferred FalconX has sold approximately 3.8 million tokens worth $7.57million after about three-month holding.

The wallet that initially withdrew Binance tokens for $19.53million realized a total loss of $12.2million. These exits are rarely the result of a strategic rebalancing. A lot of times, such exits signal capitulation following a loss in conviction.

Notably, the transfer occurred near $0.00183The bearish implications are strengthened by the fact that. FalconX facilitates access to liquidity rather than long-term storing.

This move likely indicates an intention to market. This exit, which is not accompanied by any similar whale accumulations visible at the time, adds to supply during a fragile period.

Bears under control despite PUMP structure breakdown

PUMP The price is firmly under a long term descending trendline which has defined the action of prices since October.

Price fell toward $0.00183 when it failed to hold support at $0.00210, which confirmed the structural breakdown. Every attempt to rebound continues to fail earlier and form consistent lower highs.

Both the MACD and signal lines were trending down at the time of press. While histogram bars are showing a slight contraction, there is no bullish cross-over.

This setup is a continuation of the trend, and not a reversal. The volatility is also compressed below resistance and not above the support.

Sellers retain the control of price until $0.00210 is reclaimed with force.

The exits of the leverage signal declining participation

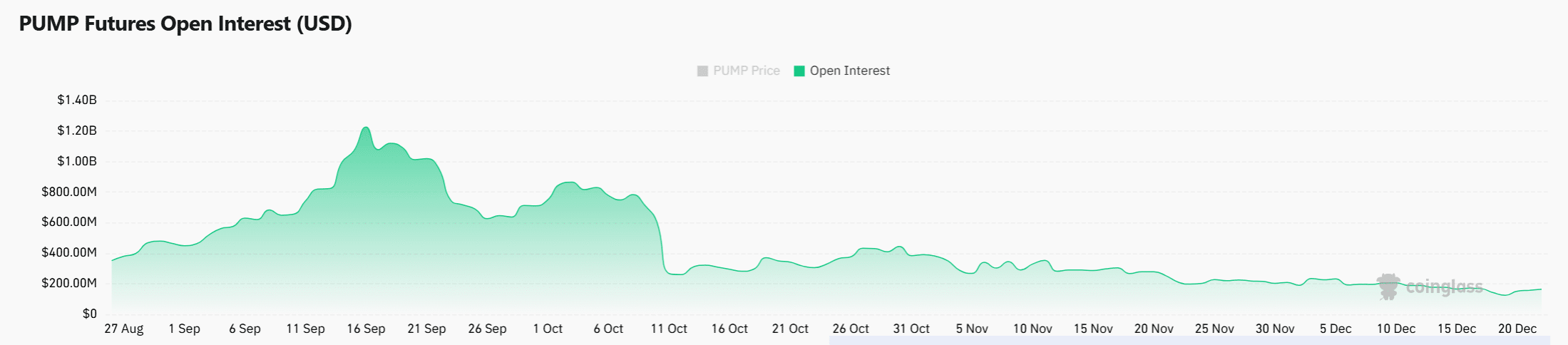

Derivatives data highlights growing disengagement. Open Interest (OI), as of the date this was written, dropped by 9.24% and fell to approximately $153.8 million.

This drop is the result of leverage unwinding, not aggressive short positions. Trading stops instead of taking a position.

OI grows as the price rises in a healthy recovery. In this case, OI contracts when prices are falling and also minor price increases.

The behavior of speculators is indicative of a lack in confidence. In addition, the price doesn’t respond well to resets in leverage. This suggests weaker underlying demand.

Derivatives markets have reinforced the bearish structural. Upside attempts are often short-lived and lack durability without renewed participation.

Source: CoinGlass

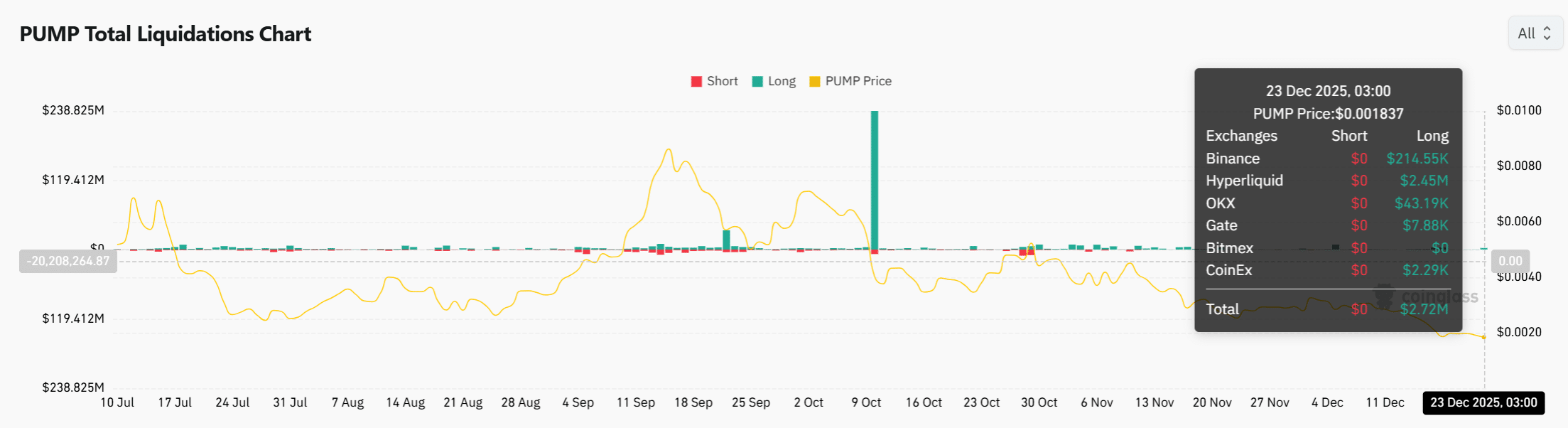

PUMP liquidations reveal persistent long-side stress

The liquidation trend continues to be bearish. Recent liquidations of short positions were very minimal, and long position losses were approximately $2.7 Million. The traders are consistently positioning themselves against the trend.

The price drops were accelerated by each downward push. It is important to note that these liquidation episodes do not result in strong price rebounds.

This is not the case. Instead, prices continue to decline. The price continues to fall afterward.

Also, the exchanges indicate that there was limited aggressive purchasing during these flushes.

In this way, liquidations serve as continuation fuel and not an exhaustion indicator, which keeps downside pressure in place.

Source: CoinGlass

PUMP is still vulnerable to further downsides before any recovery becomes meaningful.

Acceptance is still incomplete and the price hasn’t forced out sellers. In the current market conditions, it is possible that demand will stabilise at $0.000426.

The rebound will only begin after this level is sustained by buyers. Up until then, the most likely path is to explore downside, so patience will be more important than early position.

Conclusions

- PUMP is still in favor of exploring the downside first before attempting a sustainable recovery.

- PUMP might test support at $0.000426 until sellers are exhausted and the rebound begins.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: ambcrypto.com