Michael Saylor’s team, formerly MicroStrategy, has outperformed Bitcoin by a significant margin since their first investment. Investors can increase their return with the help of data and strategies. We’ll look at how you can improve your MSTR investments by leveraging various metrics.

What you need to know

- MSTR outperformed Bitcoin since the initial investment by more than 3,000%.

- Key indicators, such as MVRV-Z-Score or Active Address Sentiment, can aid in time investment.

- MSTR is also affected by global liquidity trends.

- Multi-data points are a great way to simplify and optimize investment strategies.

MSTR outperforms Bitcoin

MicroStrategy has been rebranded to Strategy and is making headlines for its Bitcoin investment. The company has seen returns of over 3,000% since it began to accumulate Bitcoin. Bitcoin has grown by around 700%. It is clear that investing in Bitcoin-related companies can be a good idea.

Understanding Key Metrics for MSTR Investing

To improve your MSTR investment strategy, it’s essential to utilize various data points. Consider these key metrics:

- MVRV z-ScoreThis helps determine if Bitcoin is being undervalued. Investors can determine the optimal points to buy and sell by comparing the market capitalization with the actual cap.

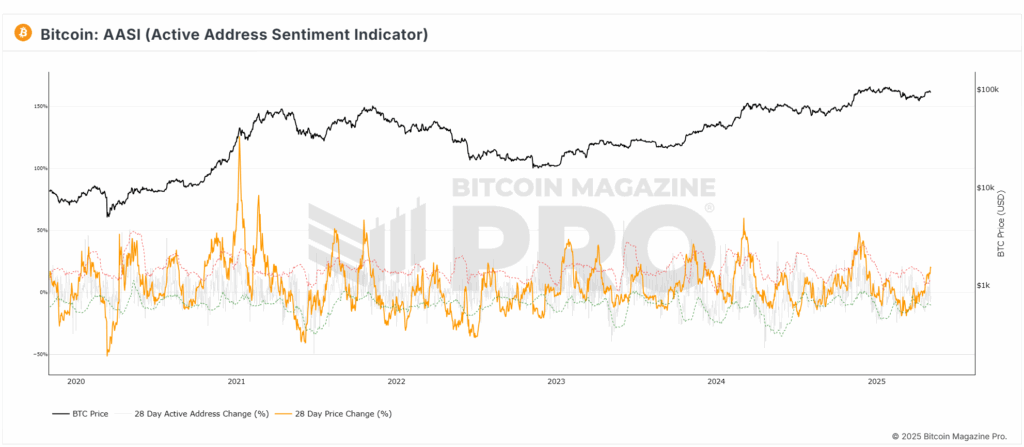

- Active Address Sentiment IndicateIt tracks changes in network usage and users, giving you a good idea of the market’s mood. It can be a signal to either take profit or increase your accumulation when the price changes cross certain thresholds.

- Crosby RatioThe technical indicator can help identify market peaks or troughs and better time trades.

- Global LiquidityMSTR’s share price can be affected by broader movements in the market.

Using MVRV z-score for MSTR Investing

It is important to note that the word “you” means “you”. MVRV Z-Score It is an effective tool to assess the market’s conditions. It is a sign that it’s a good idea to purchase when the score dips in the green area. When it hits the red zone it might be a good idea to sell. MSTR is also a good candidate for this metric due to the strong correlation between Bitcoin and MSTR.

The Active Address Sentiment Indicate explained

You can also find out more about the following: Active Address Sentiment Indicator Tracks the change in Bitcoin price and network usage. The price movement may signal an overheated markets when it crosses a specific level. This could be a sign to lock in your profits. When it drops, you might want to consider buying more.

MSTR and Global Liquidity

Global liquidity MSTR’s performance has an important correlation. Investors can predict price changes by tracking trends in liquidity. A 365-day relationship between global liquidity, MSTR and MSTR can be improved by changing the analysis timeframe.

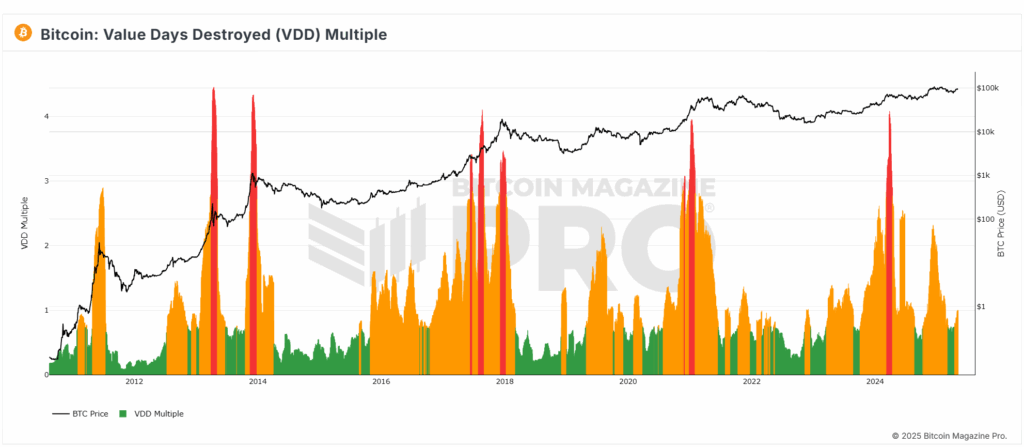

Value Days Destroyed Indicator

The following is a list of the most popular ways to contact us indicator Impact of Bitcoin price MSTR action. Investors can find the best buying and selling options by analyzing MSTR’s value days destroyed. It is possible that MSTR’s leverage over Bitcoin volatility makes this metric particularly useful.

MSTR Strategies based on Data

MSTR is strongly correlated with Bitcoin, which means many of the metrics for Bitcoin investment can be used to evaluate MSTR. Investors who use tools like Active Address Sentiment Index, MVRV Z Score and monitor global liquidity can optimize their MSTR investments.

Michael Saylor’s accumulation of Bitcoin will continue to be a positive factor for MSTR. You can make your investments easier by keeping track of these indicators.

Consider exploring additional resources and analytical tools to keep informed on both Bitcoin and MSTR. You can transform your investing journey with the right data!

To access more research and analysis, including technical indicators, live market alerts, as well as a community of analysts growing, please visit BitcoinMagazinePro.com.

Disclaimer: This is not financial advice. It’s just for informational purpose. Before making an investment decision, always do thorough research.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: bitcoinmagazine.com