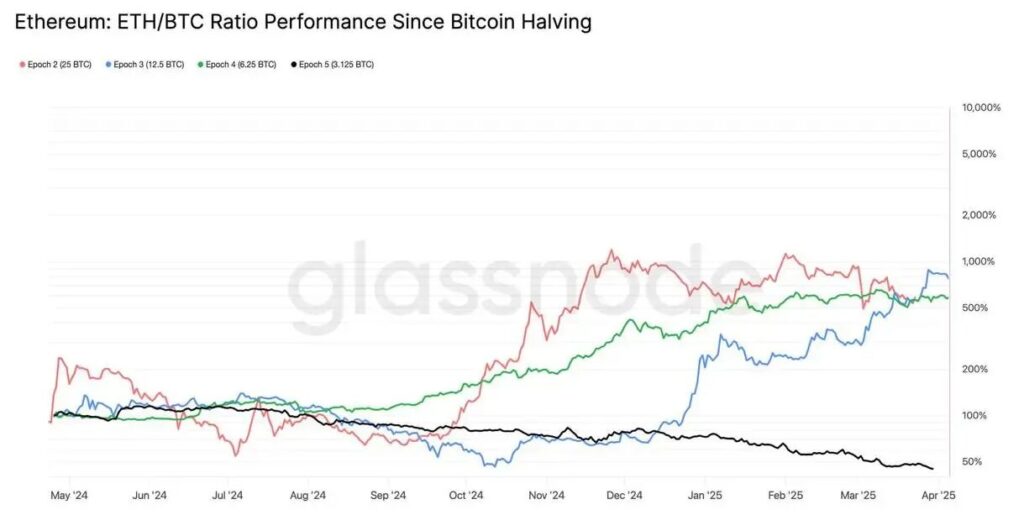

Investors are concerned about the Ethereum price decline as we approach Q1’s end. ETH has plummeted 39% in comparison to Bitcoin, reaching a 5-year low. ETH/BTC has a ratio of 0.02191 at the time of this writing. That’s a significant change from the previous patterns of Ethereum vs Bitcoin.

As we enter Q2, this dramatic ETH price crash raises serious concern about the overall volatility in the crypto markets.

You may also like: Michael Saylor’s ‘Strategy’ Buys 22,048 Bitcoin Worth $1.92 Billion

Ethereum’s Outlook in Q2: Price Forecast, Risks & Market Impact

The historic ETH/BTC decline

Ethereum’s price has dropped to a critical level, and it is down by nearly 46% in the first quarter of 2019. The sharp Ethereum vs Bitcoin difference is notable also because this is the first time ETH underperformed BTC after halving, a feat that is unheard of. To make things worse, ETH ETFs have experienced outflows of 17 consecutive days, a streak which ended on the 27th March.

Bitcoin’s more Resilient performance

Bitcoin is also struggling but not as badly. BTC is currently headed toward a 12.18% Q1 decline – which is, in fact, its worst first-quarter performance since 2018. The current ETH crash is in stark contrast to the historic patterns, which show that average gains for Q1 for Ethereum are around 77% and for Bitcoin about 51%.

This crypto-market volatility is being driven by several factors. These include a noticeable decline in the institutional interest for spot Bitcoin ETFs. Inflows totaled approximately $1 billion this year, while the longest run of consecutive inflows was just 10 days.

You may also like: Shiba Inu: SHIB Price Prediction 6 Months From Now

Recoveries Signals in Q2

Analysts and market observers are optimistic about Q2 despite the current Ethereum price decline. Diverse market analysts are suggesting catalysts to reverse the Ethereum-Bitcoin underperformance that has been observed.

21st Capital co-founder Sina G. stated:

“Within a quarter or less, uncertainty around tariffs and government spending cuts will likely be resolved. Focus will then shift to tax cuts, deregulation, and rate cuts.”

Positive investor behaviour signals are emerging as well, including the fact that over 30,000 BTC has been withdrawn from exchanges in the last seven days, which indicates historically a change from short-term trade to a longer-term strategy.

In theory, ETH could reverse its course very soon. After all, historical data indicates that Ethereum and Bitcoin have performed better in the second quarter than in the first. But it is also important to note that short-term cryptocurrency market volatility could continue, especially with the announcement of President Trump’s tariffs on April 2 and upcoming US Inflation data release April 10.

You may also like: Ripple: With SEC Lawsuit Settled, Will XRP Hit $4?

The Ethereum price decline continues to be a concern for investors and traders. Market participants are advised to keep an eye on the regulatory developments and macroeconomic trends, as well as the resolution of any trade tensions which could affect both assets during the next quarter.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: watcher.guru