Trust is a good thing

Editorial policy that is strict and focuses on accuracy. relevance and impartiality

Expertly crafted by experts in the industry and thoroughly reviewed

Highest standards of reporting and publication

A strict editorial policy that emphasizes accuracy, relevancy, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

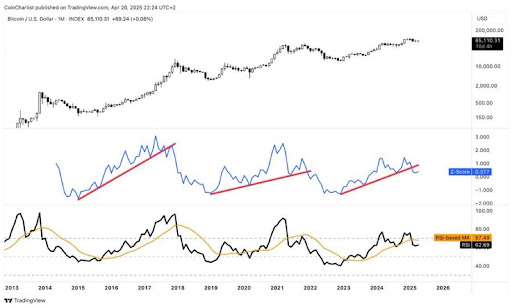

Bitcoin has experienced a bullish trend that started in the last few months, which saw the price of Bitcoin rise to an all-time high of over $109,000 Analysts now debate whether the rise earlier this year was the official top. Strengthening this argument, a confluence of technical indicators suggests the market cycle may have already peaked—most notably, the behavior of the Market Value to Real Value (MVRV) Z-Score It is important to note that this viewpoint has been reinforced.

MVRV Score Shows Bitcoin Has Reached Its Highest Price

New technical analysis The MVRV-Z-Score combined with the monthly Relative Strength Index, calculated by Tony Severino of crypto analyst Tony Severino is flashing warning signals that Bitcoin‘s market top may already be in.

Related Reading

Bitcoin’s MVRV z-Score, when viewed in a logarithmic graph of the price, has fallen below a previously established uptrending support line. The Z-Score always followed the upward trending support lines in bull markets. Similar breaks were only seen after Bitcoin reached an official top.

This is not the first time Bitcoin displayed this trend. BTC experienced similar breaks in the support line before its market peak. 2017 and 2021 bull cycles. Bitcoin’s bearish argument may already be outdated reached a price peak It is reinforced by the correlation of the Z-Score with the monthly RSI for Bitcoin, shown as a line black on the graph.

In past cycles, Bitcoin’s RSI The price fell twice below 70, which indicates a weakening of momentum. Such moves are more common after price peaks than before.

The RSI Moving Average (MA) is also curling down, as shown by the orange line in the chart. In the past, this subtle yet strong signal appeared only after the stock market had already reached its top. This was more of a confirmation than a predictor.

These technical indicators, along with historical data, strongly indicate that Bitcoin’s peak of $109,000 may be the end of this cycle. Bitcoin’s current behavior could be similar to that of previous bull markets. prolonged bear market. The recent sharp price corrections have reinforced the bearish view, as has reduced investor trust and a shift in sentiment towards caution and uncertainty.

Bulls attempt to revert Bitcoin Bearish outlook

In another one of his recent Bitcoin analyses, Severino revealed The bulls are pushing to get a price recovery. Analyst acknowledged his bearish narrative about Bitcoin could soon change if bulls are able to maintain momentum through April’s close.

Related Reading

The chart shows that Bitcoin has now tested a major area of interest, while also showing some early signs of bullishness in reversing a bearish crossover. Moving Average Convergence Divergence (MACD). Adding intrigue to the mix, there is the possibility that a Morning Star candlestick pattern The possibility of Bitcoin’s reversal to the bullish side is increased.

In 2022 and early-2023, there were similar charts setups, marking major turning points in the market. Bitcoin’s long-term outlook. It is possible that a cryptocurrency will close the month of April showing a Morning Star. This could lead to a significant revaluation. bearish expectations.

Chart from Tradingview.com, image from Adobe Stock

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com