Takeaways from the conference:

-

Bitcoin Implied Volatility Index is at its lowest since September 2023. This could indicate a possible breakout.

-

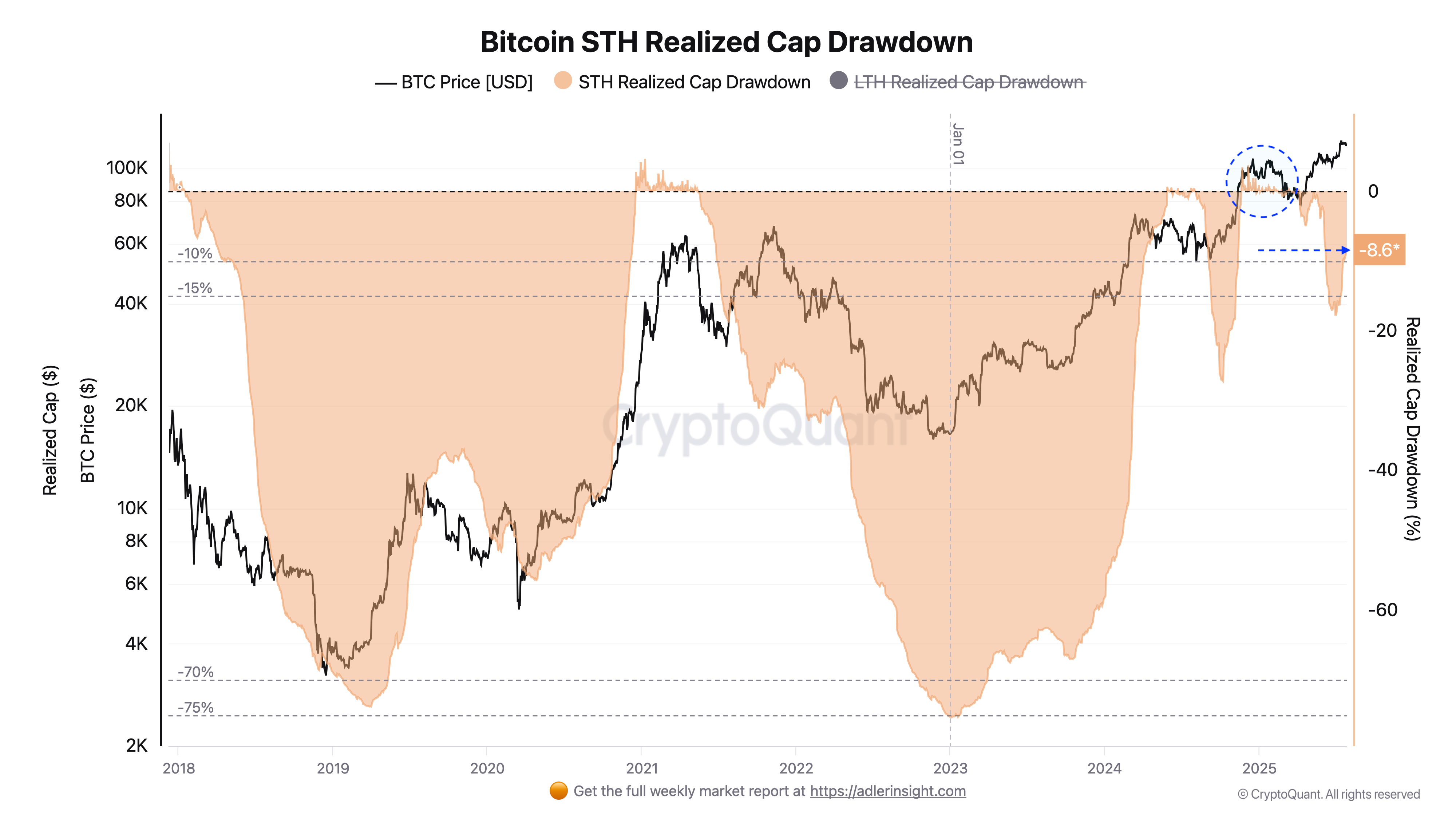

Short-term cap realization is at -8%. It is a historically bullish zone for accumulation.

Bitcoin’s (BTCRecent price movements point to an accumulation phase, however data indicates that this low volatility scenario rarely lasts long.

The implied 30-day volatility index for BTC is now at 40.84. It has now fallen below the threshold of 45. A level that’s only been breached 22 times in the past 149 week (since September 2022). In the past, periods of local bottoms or accumulation have preceded this zone. Strong upward movements were then followed. BTC surged almost 50% when BVIV reached this low in September of 2023.

Every weekly close under 45 on the BVIV has coincided with price consolidations or bullish reversals of Bitcoin since late 2022. This reinforces the notion that current volatility compression may once again be the catalyst for an upward breakout if historic patterns are true.

There are currently signs of structural change. BTC may have reached new record highs, but the realized 30-day volatility is still very low. continued The 10th percentile for the past decade is being compressed.

Ecoinometrics pointed out that this could be a sign of a shift in the market: Bitcoin is maturing and becoming an asset with lower volatility, which would appeal to institutional investors who manage their exposure to volatility.

If the new volatility regime is maintained, then it may be possible for BVIV to remain calmer than previous cycles. A sharp price increase driven by volatile volatility could therefore be delayed. It’s important to note that past behaviour around these levels was bullish. Therefore, investors should be on the lookout for any deviation.

Related: Strategy skipped Bitcoin buys last week amid new equity offering

Bitcoin short-term holders are calm and confident

Onchain data Shows that the behavior of STHs continues to indicate confidence. STH realized caps drawdowns are currently at -8%. This indicates that market newcomers have manageable losses on paper. This zone is more of a launchpad than a break point historically, which indicates limited panic and little forced selling.

STH’s market value-to-realized value ratio (MVRV), which is currently 1.19, supports the same view. It was at its cycle high in November of 2024 (1.33). It shows that holders have chosen to stay put rather than sell on small gains.

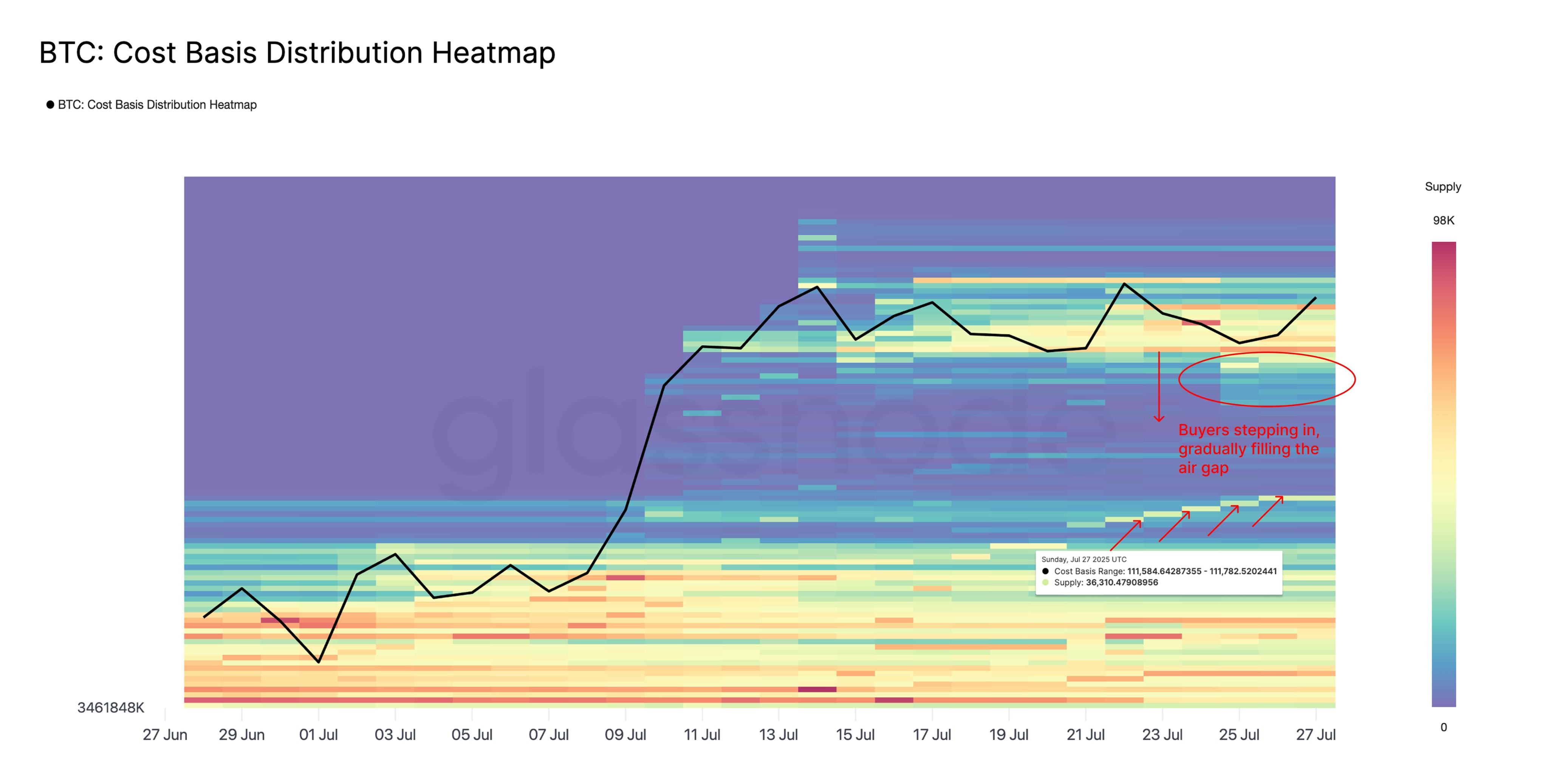

Glassnode also provides data noted that the $110,000–$117,000 range is gradually filling in. BTC gets accumulated both on high and low levels, as buyers step in during dips. Early investors are comfortable buying at higher levels. It has led to a staircase cost-basis distribution. This is a structural bullish pattern that suggests accumulation and not emotional trading.

STH’s supply has increased to 4,58 million BTC from 4,36 million BTC. This represents an addition of 227,000 BTC in active circulation. It is possible that new demand has entered the market or holders have been rotating their BTC holdings.

Related: ‘Biggest trade deal ever’ — 5 things to know in Bitcoin this week

This article contains no investment recommendations or advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making a final decision.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com