Bitcoin (BTC), U.S. Stocks and the overall crypto market have been showing a recent negative correlation. Bitcoin is often going in the opposite direction to traditional markets. Investors and analysts have been drawn to this divergence as Bitcoin enters its consolidation period along with the wider crypto market. Historically, shifts in this correlation—from negative to positive—have often signaled a bullish trend for Bitcoin.

Related Reading

In a time when both markets are facing challenges, the shifting dynamics between BTC & U.S. Stocks could give crucial insight into the future direction of the market. Investors watch this relationship closely, expecting that any shift in the dynamics could signal a breakout of Bitcoin.

Bitcoin data suggests potential uptrend

The negative correlation between Bitcoin (BTC) and the U.S. stock market, particularly the S&P 500 (SPX), has become increasingly evident. Daan on X, a prominent analyst and trader recently brought this issue to light. overlaying The BTC/USDT chart with the SPX prices.

According to his research, Bitcoin’s recovery has lagged behind that of traditional markets such as the SPX. This divergence highlights the decoupling of these markets. Bitcoin is lagging the recovery in the broad stock market.

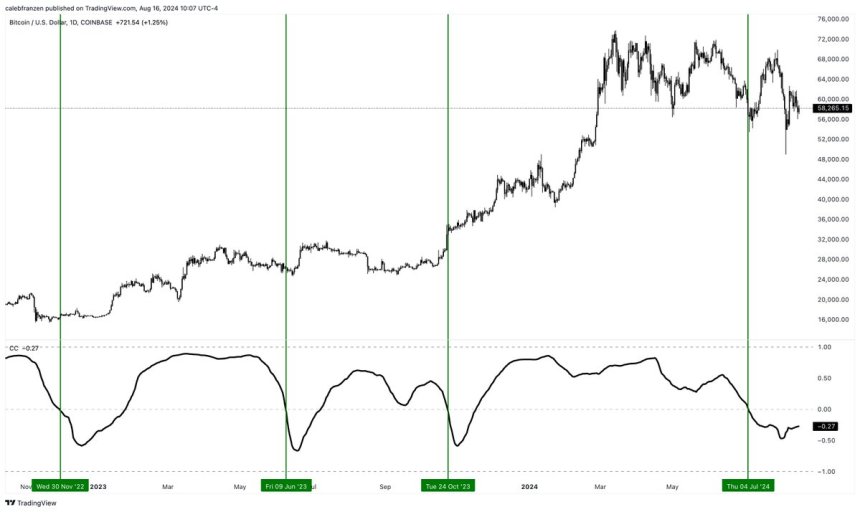

Caleb Franzen is another key analyst who shared data that revealed Bitcoin’s trend. negative correlation With major stock indexes. Franzen explains that, at the moment, the 90-day relationship between Bitcoin ($QQQ), and the Nasdaq 100 ($QQQ), is -27%. The negative correlation indicates that Bitcoin is moving the other way as technology stocks are recovering. This can indicate unique market dynamics.

Although periods of negative correlations between Bitcoins and stocks may not be bullish in themselves, history suggests positive shifts to the market often occur after such phases. The critical point for investors is to monitor a potential reversal of this correlation—when Bitcoin begins to move in tandem with the Nasdaq-100 ($QQQ) once again.

Bitcoin may be able to gain momentum if the correlation between Bitcoin and tech stocks is positive. This change could be a crucial indicator to time potential market entry points.

BTC Price Below Key Indicators

Bitcoin is trading at $59350. This price is below the daily moving average of 200 days (MA), which stands at $62,915. Many analysts use this moving average to determine market trends. BTC’s price below the 200 MA daily is a sign of a downward trend or significant correction. Trading above the 200 MA indicates market strength, bullish momentum and market strength.

Bitcoin must reclaim its daily 200 MA, and close consistently above it. It would indicate a possible shift in trend and give traders or investors confidence that the bullish phase remains intact.

BTC currently hovers just below the psychologically important level of $60,000. The market has been undergoing months of instability and unpredictability.

Bitcoin has to rise above $63,000 and regain daily 200 MA, as well as surpass the high local of $62,729 on August 8, in order to trigger the bullish scenario. The market would then be able to show a strong recovery.

Related Reading

A failure to reach a closing price of $57.500 could lead to further downtrend pressures, possibly leading to levels below $50,000. It will be important to see if Bitcoin’s upward trend can continue or if there is more downward pressure ahead.

Charts from TradingView. Cover Image from Dall E.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com