Trust is a good thing

A strict editorial policy that emphasizes accuracy, relevancy, and impartiality

Expertly created and reviewed by professionals in the field

Reporting and Publishing at the highest level

Editorial policy strict on accuracy, impartiality, and relevance

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

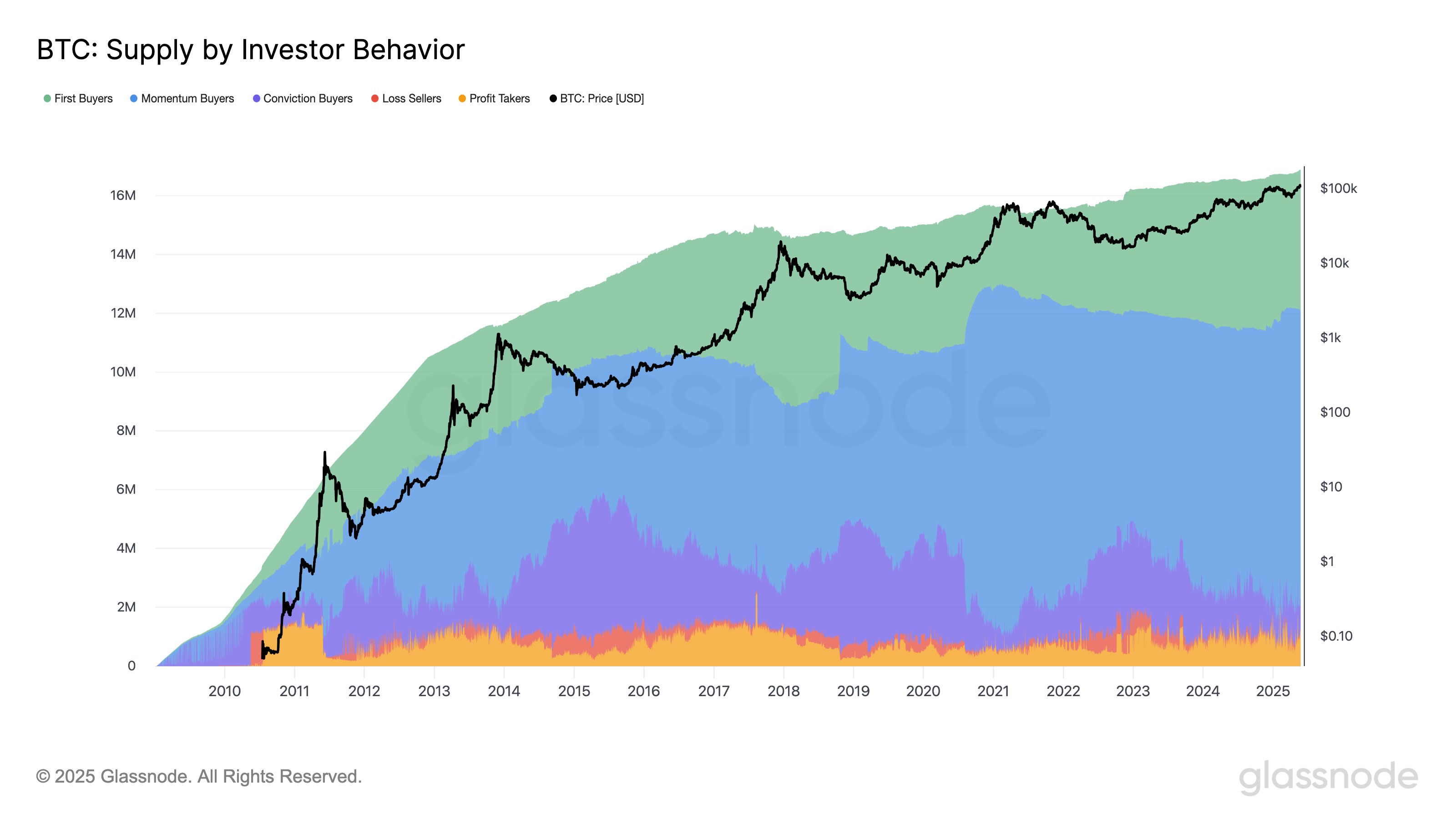

Glassnode, an on-chain analysis firm, has revealed how Bitcoin investors’ behavior is reflected in the price trends.

Glassnode highlights key behavioural patterns behind Bitcoin moves

The new thread Glassnode, a company that specializes in Bitcoin investment management and trading has introduced a way of categorizing Bitcoin investors based upon their spending habits on the blockchain. This indicator is called Supply by Investor Behaviour and it has five cohorts. These are Conviction Buyers (first buyers), Momentum Buyers (momentum buying), Loss Sellers (loss sellers), Profit Takers.

It is pretty obvious what First Buyers and Loss-Sellers mean. Profit Takers also makes sense. Momentum Buyers, on the other hand, are investors that purchase during an uptrend.

Related Reading

“The metric tracks the cumulative token supply held by each cohort over time,” Note the analysis firm’s chart on their website. “To focus solely on investor behavior, we exclude exchanges and smart contracts.”

Glassnode has shared a chart showing the evolution of the Bitcoin indicator.

For example, to illustrate how these cohorts affect the asset trajectory, an analytics firm focused in on data from two cohorts – Conviction Buyers (first buyers) and First Buyers.

This chart is for Bitcoin Conviction purchasers only.

The graph shows that Conviction Buyers’ BTC stock tends to spike at the same time as the price of the crypto currency reaches a certain point. Their supply tends reach a maximum coinciding With bear market lows. They also buy at the bottom of an uptrend to help stabilize it.

“But conviction alone isn’t enough to spark a rally – that’s where First Buyers come in,” Glassnode explains. Here is a graph that illustrates the role played by the first buyers.

According to the graph, the demand of First Buyers grew along with Bitcoin’s recovery from the bear-market, and a sharp increase coincided with Q1 2024’s bull market.

Related Reading

During the first week of September, the supply to the First Buyers was dropped. consolidation The rally was followed by a phase, but the demand for the stock returned to the market in the second half, which helped fuel it beyond $100,000.

This year, the Bitcoin market decline was accompanied by a decrease in supply from the First Buyers. However, the drawdown this year is much more severe than the one last year. However, new capital flows have returned once again, with the metrics’ value now showing rapid growth. This could be the reason for the rise in the price of Bitcoin. all-time high.

BTC Price

Bitcoin’s price is currently around $109800. This represents an increase of 4% over the last week.

Charts from TradingView.com and Glassnode.com. Featured Image: Dall-E.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com