In light of the upcoming U.S. election, it is worth looking at how elections in previous years have affected Bitcoin. In the past, there have been notable patterns in U.S. stocks around elections. Given Bitcoin’s correlation with equities and, most notably, the S&P 500, these trends could offer insights into what might happen next.

S&P 500 Correlation

Bitcoin and the S&P 500 have historically held a strong correlationThe most notable periods are BTC’s bull cycle and times of risky sentiment on traditional markets. This could phenomenon could potentially come to an end as Bitcoin matures and ‘decouples’ from equities and it’s narrative as a speculative asset. But there is no concrete evidence that it’s the case.

Post Election Outperformance

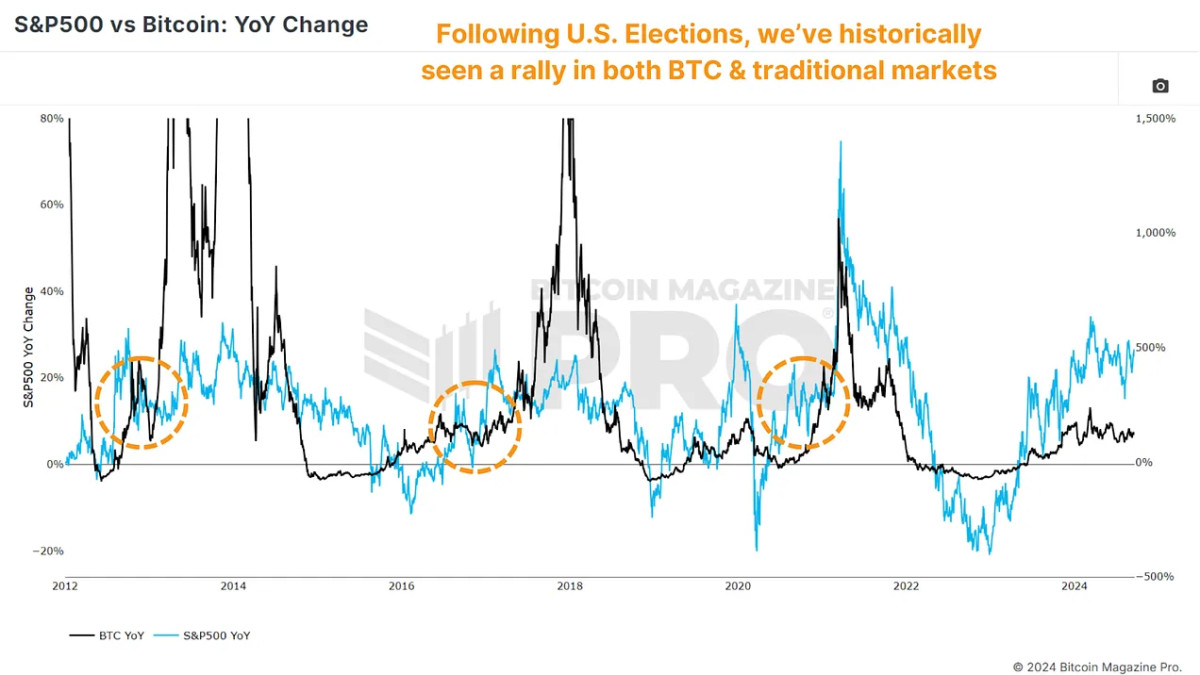

The S&P 500 has typically reacted positively following U.S. presidential elections. Over the last few decades this pattern has been repeated, and the stock market usually experiences significant gains the year after an election. This pattern has been consistent over the past few decades, with stock markets often experiencing significant gains in an election year. S&P500 vs Bitcoin YoY Change chart we can see when elections occur (orange circles), and the price action of BTC (black line) and the S&P 500 (blue line) in the months that follow.

2012 Election: In November 2012, the S&P 500 saw 11% year-on-year growth. The growth rate jumped to about 32% one year later.

2016 Election: In November 2016, the S&P 500 was up by about 7% year-on-year. It increased again by 22% a year later.

2020: Elections in 2020 continued the pattern. The S&P 500’s growth was around 17-18% in November 2020; by the following year, it had climbed to nearly 29%.

What is the latest phenomenon?

The data is not limited to just the three previous elections when Bitcoin was around. To get a larger data set, we can look at the previous four decades, or ten elections, of S&P 500 returns. One year only had negative returns 12 months after election day. That was 2000, when the dotcom bubble burst.

The data shows that the party winning doesn’t have a significant impact on these market trends. The upward trend is more about eliminating uncertainty and increasing investor confidence.

What will Bitcoin do this time?

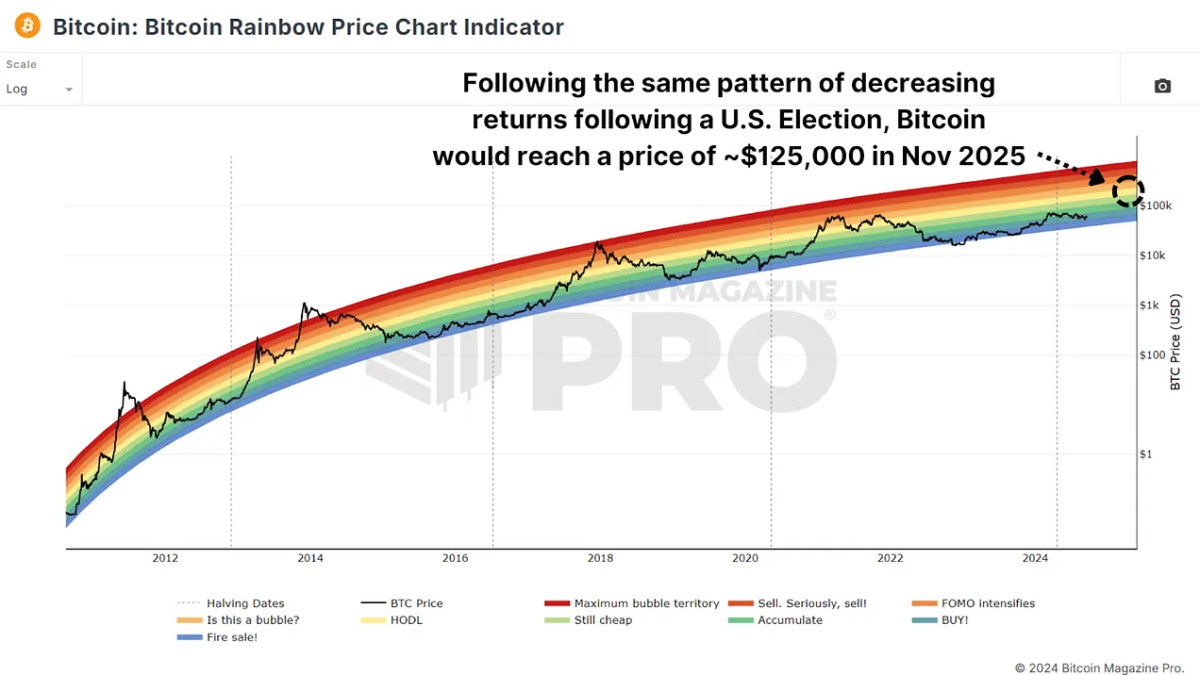

Bitcoins’ potential performance is tempting as we get closer to the U.S. Presidential election in 2024. Price increases could be significant if historical trends continue. Consider the following:

Bitcoin’s value could increase to more than $1,000,000 in the first 365 days after the elections if the gains are the same as they were in 2012. We could reach around $500,000 if we have the same experience as in 2016. Something similar to the 2020 election could bring us to a BTC of $250,000.

This is interesting because each of these occurrences has led to a decrease in return by approximately 50%. So maybe $125,000 for November 2025 would be a reasonable target, particularly since the price and the data are aligned with the middle bands on the Rainbow Price Chart. In all those cycles Bitcoin experienced even greater cycle peak gains.

You can also read our conclusion.

Data suggests that after an American presidential election, the market is bullish. Bitcoin investors have good reason to feel optimistic with less than two month until the next presidential election.

Here is a video that will give you a closer look at this subject. Will The U.S. Election Be Bullish For Bitcoin?

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: bitcoinmagazine.com