Bitcoin reserves are a hot topic for global finance. Recent events in Hong Kong, the United States and elsewhere have sparked much discussion.

After former U.S. president Donald Trump’s backing, the plan of a Hong Kong legislator to include Bitcoin as part of the financial reserves in the region has attracted the attention both from the crypto community and the traditional economic sectors.

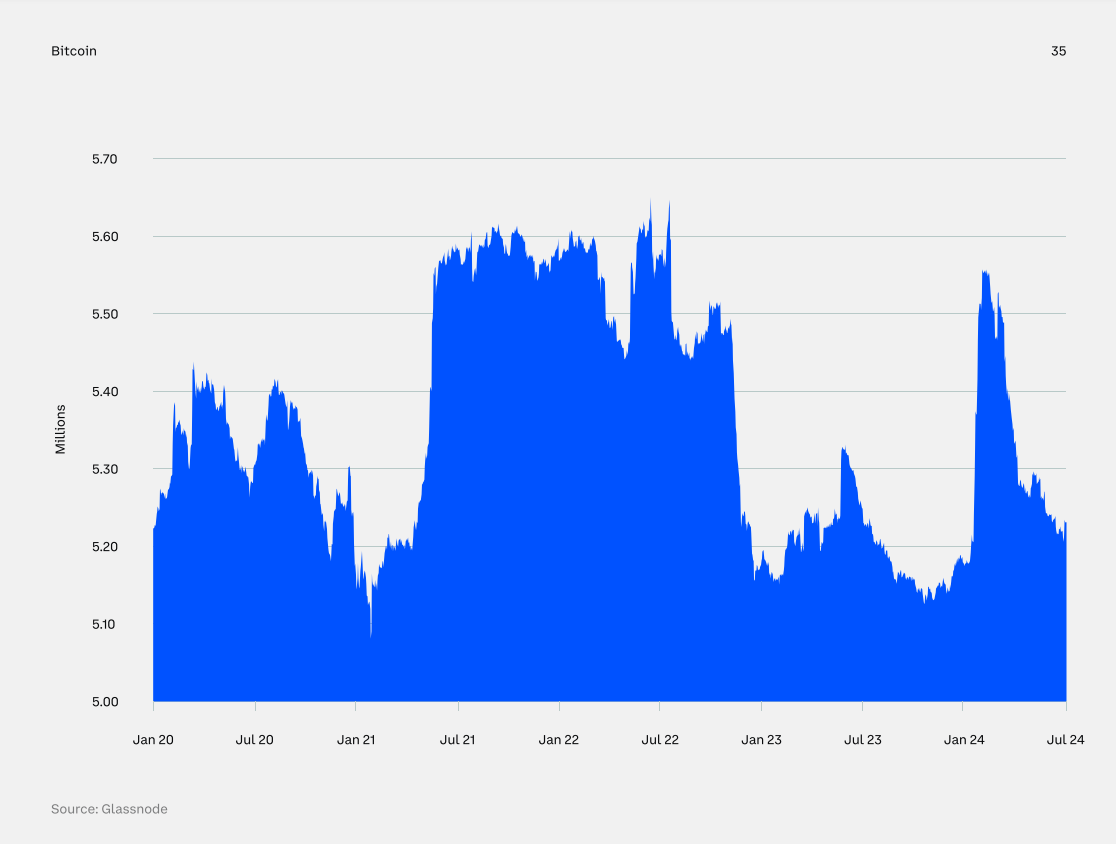

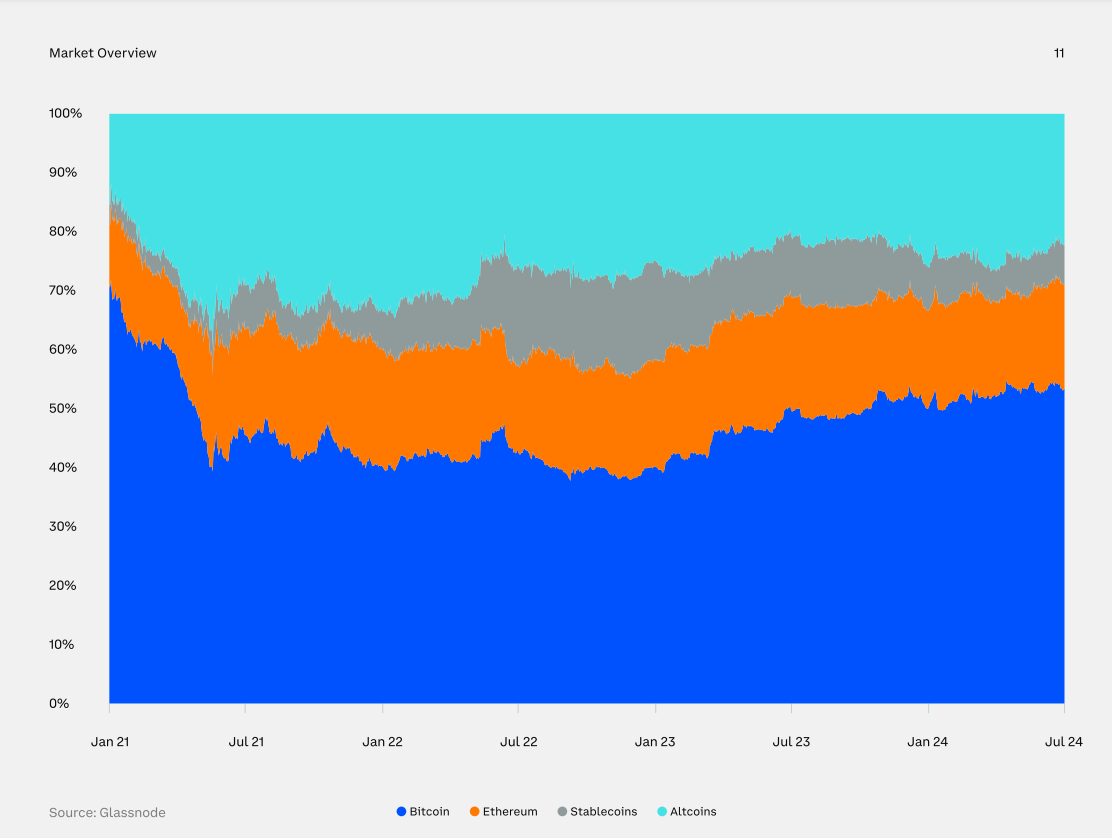

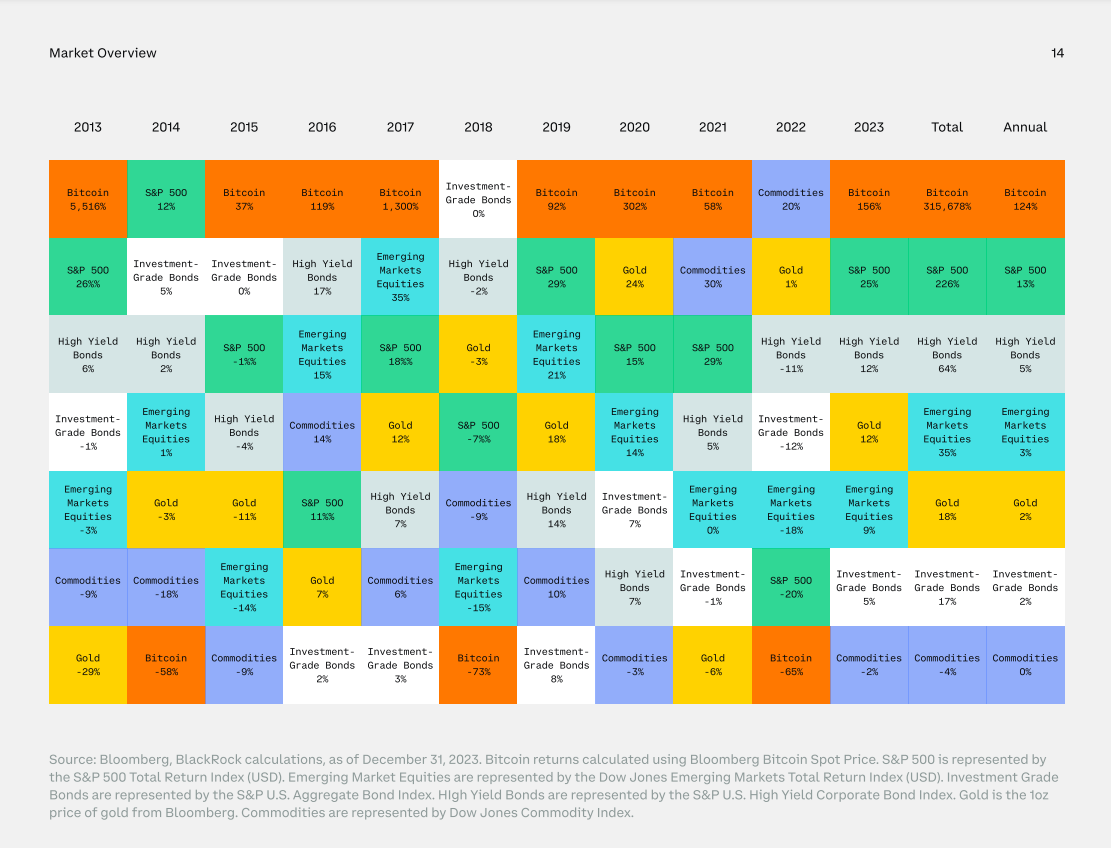

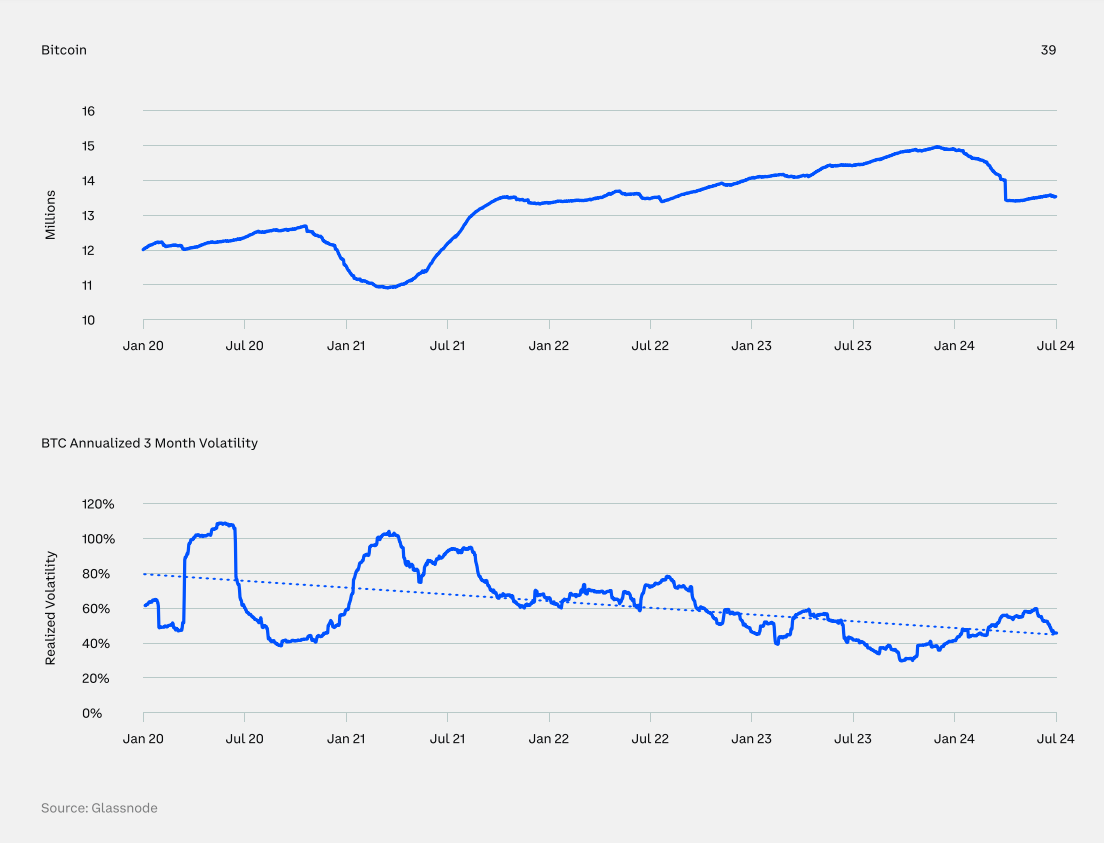

It is important to note that this article contains data taken from the Crypto Markets Q3 2024 report by Coinbase Institutional and Glassnode.

Please Read This: Currency: Why Trump’s US Dollar Devaluation Plan Might Be A Bust?

Bitcoin Reserves: Hong Kong and Trump’s Insights

Hong Kong to Consider Bitcoin Reserves

Hong Kong Legislative Council Member Johnny Ng promised to begin talks on adding Bitcoin to financial reserves in the region.

Trump announced plans to establish a ‘strategic Bitcoin reserve’ if he wins re-election during his recent speech at the Bitcoin 2024 conference.

Ng support Bitcoin as it is becoming more accepted globally. “digital gold.” Hong Kong could be a leader in the crypto industry if this move is successful.

Trump’s Influence over Bitcoin Adoption

Trump’s backing of Bitcoin has reverberated throughout the financial community. His promise to create a Bitcoin strategic reserve, if carried out could have a significant impact on U.S. currency policy.

Global discussions have been started about how cryptocurrencies can be used in economic policies.

Please Read This: Analyst Predicts Gold Price If Donald Trump Becomes President

Bitcoin Reserves Offer Potential Benefits

Bitcoin supporters believe that adding Bitcoin to national reserves is a good way to safeguard against inflation, and diversify the assets of the country. Bitcoin has been compared to gold because of its perceived ability to store value.

The potential of BTC to change financial strategies is closely studied by economists as well as policymakers.

Economic Growth and Stability

Bitcoin’s supporters claim that the digital currency could be a valuable asset for economies. Its decentralized nature, they claim, protects it against political issues and currency manipulators that can affect other reserve assets.

What are the challenges and considerations?

BTC is a challenge to add to the national reserve. The following are the key issues:

- Bitcoin’s price volatility

- Risk management in crypto investment

BTC Reserves require careful planning. Before using Bitcoin in national funds, leaders should consider the pros and cons of Bitcoin.

It is important to consider both the upsides and disadvantages of investing in cryptocurrencies for your country’s overall financial strategy.

What Global Impact Does Bitcoin Have?

The use of BTC by significant economies could lead to a change in the global money policy. The use of BTC reserves by significant economies could trigger a shift in global money policies.

These developments are closely monitored by countries, who consider their strategy in order to respond to the emerging trend.

Please Read This: Hong Kong Bitcoin ETFs Predicted to Hit $1B AUM in 2024

The push by a Hong Kong legislator for BTC reserve and Trump’s backing marks an important moment on the journey of cryptocurrency towards acceptance in mainstream finance.

Global financial changes may occur as more nations consider making similar decisions. Bitcoin reserves are gaining in popularity and have prompted a new way of thinking about financial strategy.

The full article is available for readers to read. Crypto Markets Q3 2024 report For more information, visit the Coinbase Institutional site.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: watcher.guru