Key takeaways:

-

Bitcoin clears the $120,000 hurdle as long-term holder promoting stress eases.

-

Brief-term holders are absorbing losses, signaling market stabilization.

-

Impartial LTH flows could set the stage for a decisive breakout.

Bitcoin (BTC) rallied above $120,000 for the primary time since Aug. 13 as onchain knowledge suggesting the market could also be coming into an accumulation section as long-term holders (LTHs) promoting stress eases.

In accordance with Glassnode, the Brief-Time period Holder Realized Worth (RVT) ratio has been steadily compressing since Might, reflecting a cooling of speculative extra. Traditionally, elevated RVT ranges have coincided with overheated markets, whereas contractions towards the “full market detox” zone indicated that short-term merchants are capturing fewer earnings relative to general community exercise. If sustained, this development may lay the groundwork for renewed accumulation as traders place for clearer market course.

On the provision facet, the steadiness between long-term holders and institutional inflows remained important. After months of constant distribution, knowledge present that the Lengthy-Time period Holders Web Place Change (3D) metric has now shifted towards impartial territory.

This prompt that the heavy bout of profit-taking that capped latest rallies could also be really fizzling out, probably leaving exchange-traded funds (ETFs) and new inflows because the dominant drivers of near-term momentum.

If this cooling provide dynamic holds, Bitcoin may very well be forming a structural base within the $115,000 to $120,000 zone, just like the consolidation section noticed in March and April, when neutralized LTH flows preceded a pointy upward continuation.

With LTH distribution waning and short-term extra unwinding, evaluation prompt the market could also be making ready for a decisive breakout try, with $120,000 rising as the important thing threshold to look at.

Related: Bitcoin’s next ‘explosive’ move targets $145K BTC price: Analysis

Brief-term holder losses present indicators of absorption

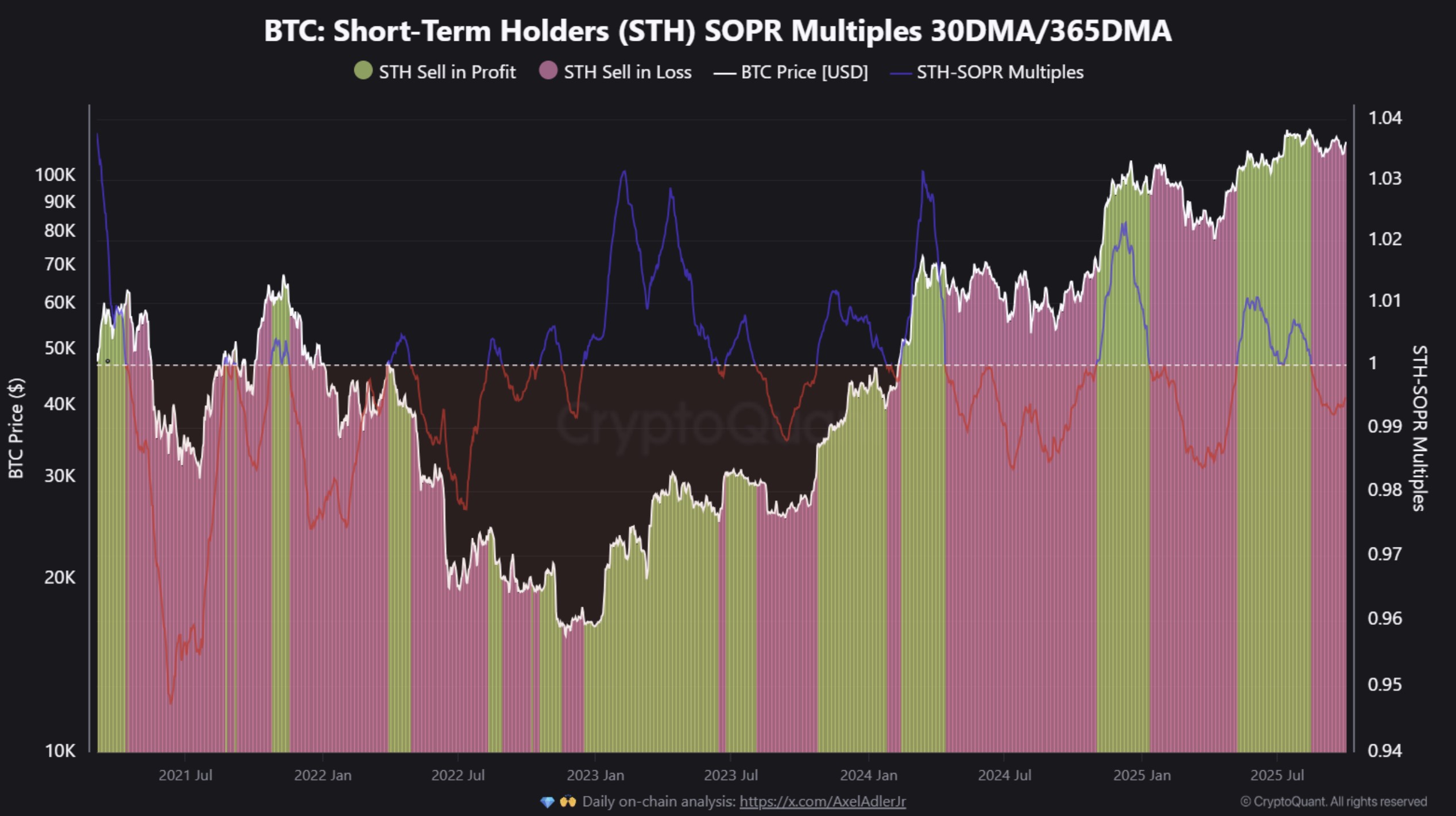

Whereas long-term provide dynamics look like cooling, short-term investor conduct additionally flashed essential alerts. In accordance with CryptoQuant, short-term holders (STHs) have not too long ago undergone a interval of stress, with the STH-SOPR dipping as little as 0.992 via September. This marked a section the place speculative wallets persistently realized losses, usually an indication of weak arms exiting the market.

Nonetheless, final week, the metric rebounded barely to 0.995, nonetheless under August’s 0.998, however signaling early stabilization.

Traditionally, such resets are likely to play out in two methods: prolonged loss realization that drives corrective phases, or a “healthy reset” the place promoting stress is rapidly absorbed. With BTC comfortably consolidating above $115,000, the restoration in STH-SOPR may very well be a possible marker of market resilience forward of a brand new bullish leg.

Related: Bitcoin bulls charge at $120K with traders expecting new all-time high

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Supply: cointelegraph.com