The key takeaways

-

Bitcoin could be a beneficiary of a surprise Federal Reserve interest-rate cut, which would reduce the attractiveness of fixed-income assets.

-

Bitcoin is a beneficiary of loose monetary policies as excessive liquidity and macroeconomic conditions increase risk appetite.

BitcoinBTCThe price of () could rise above $140,000 in the event that the United States Federal Reserve makes a surprise reduction below its current 4% rate. Most market participants expect no changes in interest rates at today’s Federal Open Market Committee policy meeting. However, even a slight reduction can lower fixed income returns, causing traders to seek out higher yielding assets and increase demand for them.

Fed meets amid macro-data and inflation ease

CME FedWatch, which uses US Treasury Note pricing to calculate implied interest rates, says that 97% of the time, current levels will be maintained. What makes the situation unusual is that the meeting comes as macroeconomic data has been consistently strong — inflation The recession has receded and the growth rate has been stable.

Bureau of Economic Analysis estimates that the US economy grew by 3% annually in the 2nd quarter. Imports surged ahead of the President Trump’s inauguration. global trade war. In May, market sentiment was at its highest. Today the likelihood of an US recession in the year 2025 has dropped to just 17%.

Also, inflationary pressures seem to have eased. In June’s Producer Price Index, published on 16 July 2016, the index rose by just 2.3% over a previous year. It is now at its lowest since September of 2024. CNBC reported US import tariffs have only marginal effects on consumer prices and the economy. Fed officials are still cautious about the potential effects of trade policy.

US President Trump has repeatedly criticised Fed’s monetary position, and urged Chair Jerome Powell not to delay in cutting rates. “No Inflation! Let people buy, and refinance their homes!” The President insisted. Yahoo Finance reported that Powell did not indicate he would change his course of action this week.

Bitcoin is a beneficiary of loose monetary policy but also depends on the growth in money supply.

Bitcoin investors will generally benefit from a looser policy, but it depends on more factors than the Fed’s benchmark interest rate. Growth in money supply has a significant impact on risky assets. This includes savings accounts, certificate of deposits, money market funds, as well as cash. Decisions made by the US Treasury on debt issuing also have an impact on M2.

A higher liquidity environment tends to benefit both the S&P 500 and Bitcoin, though the effect is often gradual. Rate cuts to 3.75% and 4% from each other could drive investors away from $25.4 trillion in government and corporate debt. bond markets. Risk assets would become more appealing even if the inflation rate remained below 2,5%.

As interest rates fall, so do borrowing costs. This encourages greater leverage in the long run. This increased liquidity stimulates economic activity, which in turn increases the willingness of investors to accept risk. Bitcoin is historically more profitable during these phases when there are greater capital resources and stable job markets.

Related: Bitcoin momentum loss is pre-FOMC derisking, not a trend change

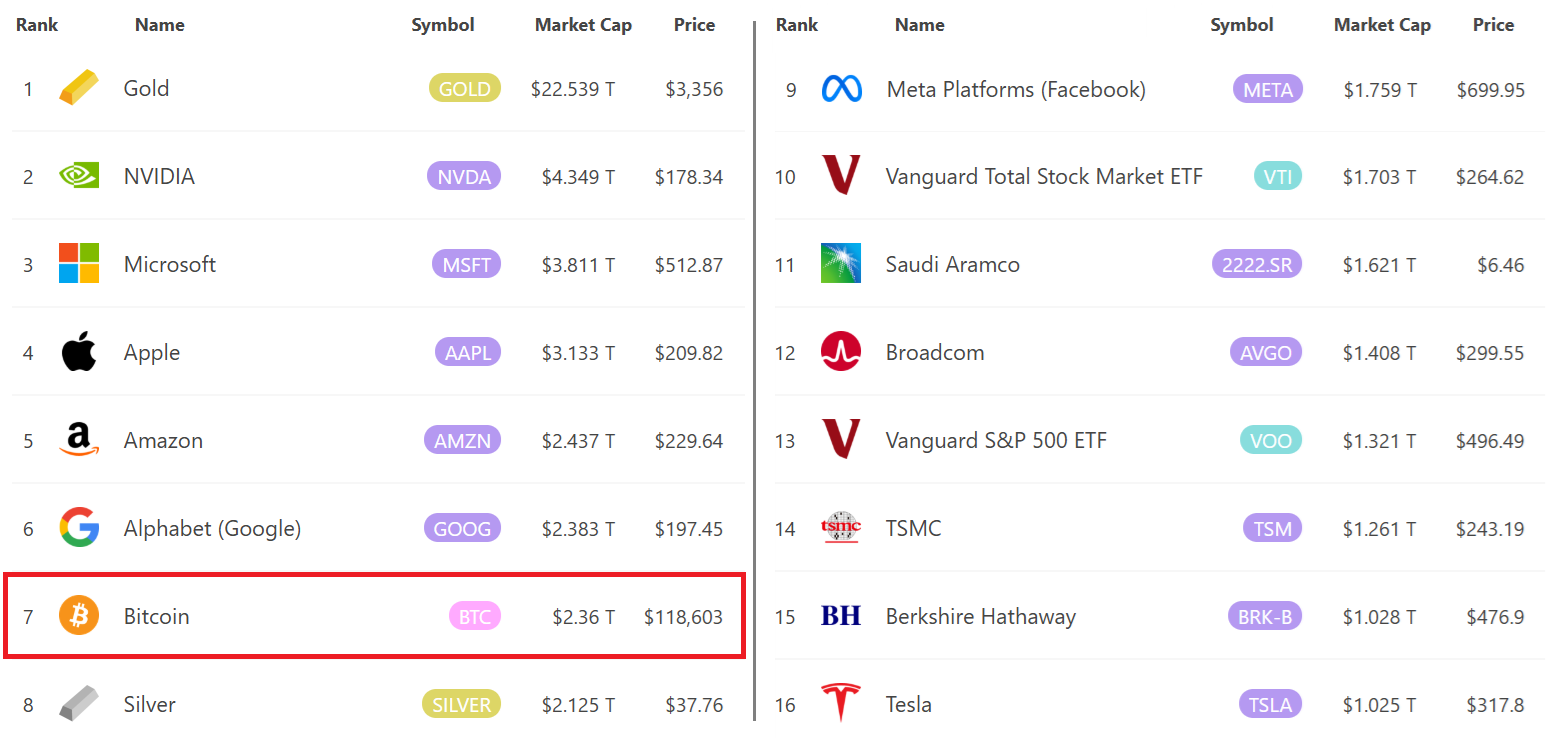

A $140k Bitcoin may appear ambitious at first, as it would require a 19% increase from $117,600. A move of this magnitude would result in a market capitalization of $2.78 billion, an 87% reduction from the valuation for gold, $22.5 trillion. To put things in perspective, Nvidia’s (NVDA) $4.36 trillion valuation is the highest of any company.

Bitcoin will be the largest beneficiary if a rate reduction occurs this Wednesday, even though the likelihood is very low. The S&P 500, already valued at $56.4 trillion, has far less room to gain from investors shifting out of fixed income.

This article was written for general information, and not to provide investment or legal advice. These are solely the opinions, views, and thoughts of the author and may not reflect the opinions and views of Cointelegraph.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com