EtherETHTechnical charts and data from onchain suggest that the downward trend will continue.

The key takeaways

-

Ether’s triangles in descending order and those with symmetrical setups are both $2,100.

-

Onchain data shows that Ether has reached levels which have preceded previous price corrections.

Ether’s Chart Technicals Converge at $2.100

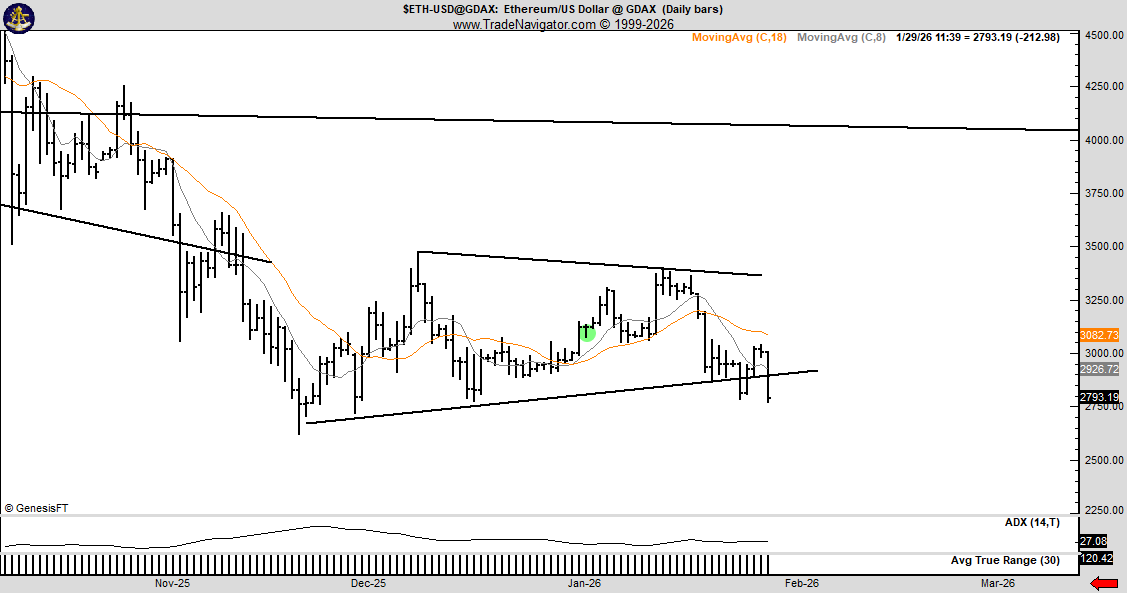

In the past three days the ETH/USD has fallen by more than 10%, falling below the important support level of $2,800.

Ether is currently trading at a level that hasn’t been seen since Dec. 3rd, 2025. If it drops below this price point then ETH prices could fall.

Related: Crypto market weakness persists, but Ethereum metrics hint at rally to $3.3K

ETH traded at around $2700 when this article was written. “do or die level for bulls,” said Metacryptox, adding:

“A failure to hold here confirms the bearish dominance, potentially opening the doors to the $2,500 mid-range.”

The level of $2,800 coincides with the line horizontal in a triangle that is descending, and was breached Thursday.

After that, you will receive $2,500 in support. simple moving average The chart below shows the SMA.

Under that price, we could see a drop towards the calculated target of the triangular pattern at $2150. This would be a fall of 20% from current levels.

Divergence to the downside from relative strength indexPrice momentum is weakening as.

Peter Brandt, a veteran trader, said that “burden of proof” After the ETH/USD pairs broke below the lower line of a symmetrical Triangle, the market was in favor of the bulls.

Brandt’s chart indicates a greater downside risk after the price fell below $2,800.

By adding the length of the triangle and the breakout point to determine the measured target, the price is reduced by 22%.

You can also read about the advantages of using Cointelegraph reportedThe area between $3,000 to $2,800 is a crucial support zone for Ether. losing it ETH faces further losses.

Ethereum mirrors previous pre-bear markets

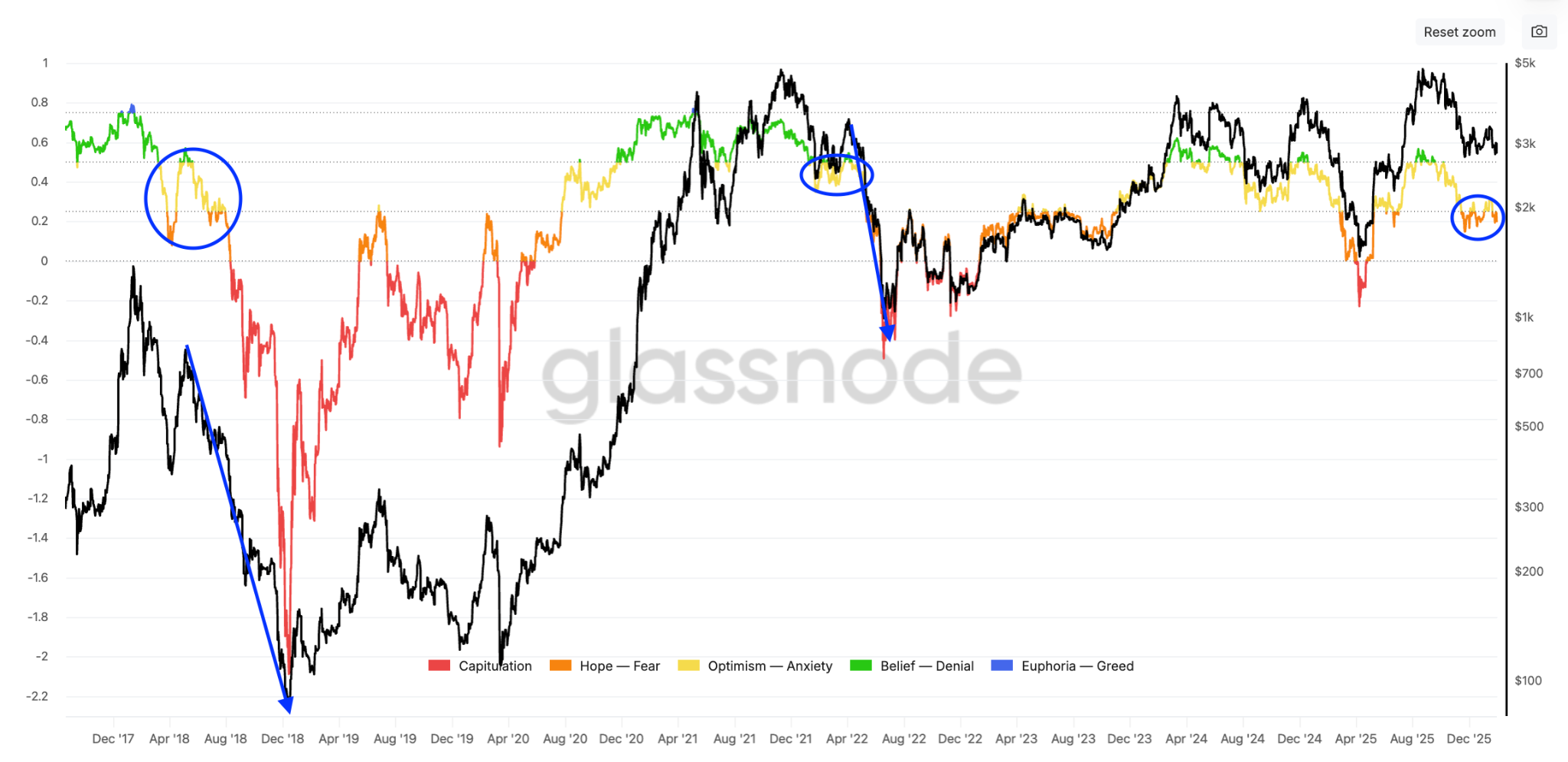

The Onchain data shows that the current ETH price setup is similar to previous bear cycles.

Ether’s NUPL indicator (Net Unrealized Loss/Profit) has changed to “anxiety (yellow)” You can also find out more about the “fear zone (orange),” A position usually associated with the beginning of a bear market.

NUPL is the ratio between unrealized profits and losses.

As shown by the graph below, in previous cycles the shift from fear to uncertainty was accompanied by extended price declines.

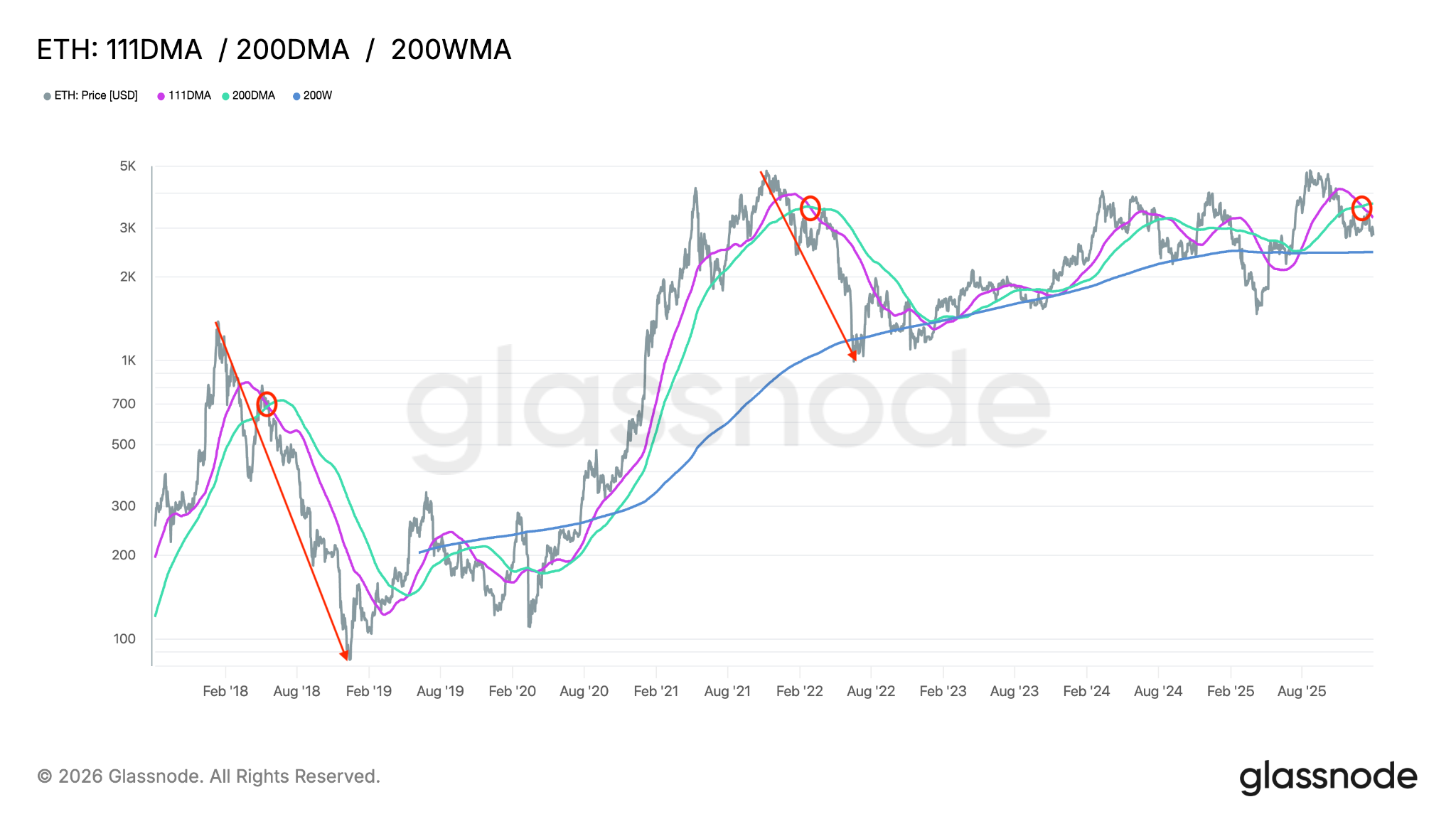

Chart technicals shows the 111-day MA is trading below 200-day MA. Chart below shows how similar crossovers triggered a deeper ETH drawdown during 2018 and 2022’s bear markets.

The information in this article is neither investment advice nor a recommendation. Risk is inherent in every investment decision and trade. The reader should always do research prior to making their decisions. Cointelegraph strives to deliver accurate, timely and reliable information. However, Cointelegraph cannot guarantee that the information contained in this article is complete, accurate, or reliable. The article could contain statements which are forward-looking and subject to risk. Cointelegraph shall not be responsible for any damage or loss arising out of your reliance on the information.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com