- Ethereum consolidates under the 50-day EMA while MVRV accumulation and whale accumulation point to a breakout.

- NVT spikes, liquidation clusters and smart money position warn against potential volatility.

Ethereum [ETH] Between $2,500 and $2600 is considered a consolidation. repeatedly Over a period of a few weeks, the 50-day EMA has been tested without a break out.

The price range has narrowed during this period. It reflects traders’ indecision.

Ethereum is currently trading slightly under the EMA resistance area. The setup is similar to previous phases of accumulation that have preceded significant rallies.

But bulls could continue to face rejection unless ETH clears $2,800.

The 50-day EMA has shown a strong tendency to consolidate. This could quickly become a breakthrough opportunity.

Source: CryptoQuant Insights

When is there a danger of overheating? If usage exceeds valuation

The data from on-chain revealed a mixed image.

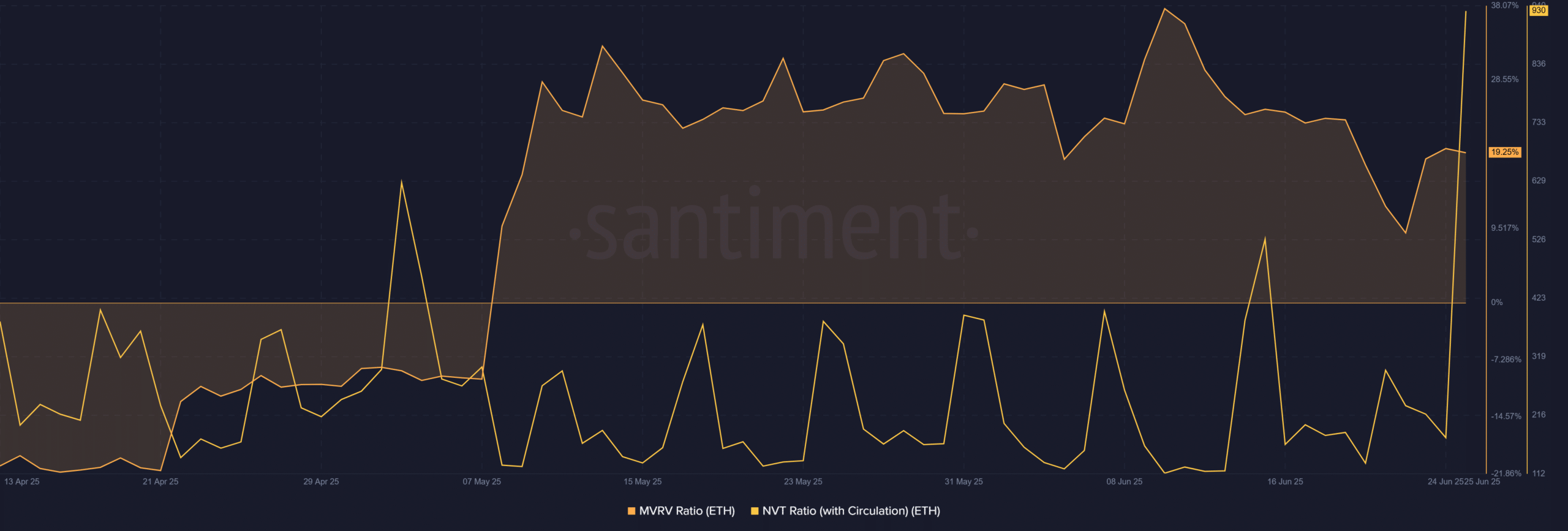

Ethereum’s MVRV Rate climbed up to 19.25%. It indicates that many holders still have gains they are not able to realize.

Historiquely, levels higher than 15% indicate an increased desire to profit, which could potentially limit the short-term upside. Having said that, the NVT Ratio climbed to 550—its sharpest rise in recent months.

This divergence indicated that the market is overheating.

If the transactional rate does not match up with valuations, ETH is likely to be exhausted in near future.

While retail is cautious, smart money has moved in.

While institutional investors and whale wallets quietly accumulate. Whale Holdings rose 2.23% over the last thirty days, and Institutional Inflows shot up 9.28%.

Retail Holdings, on the other hand, only increased by 0.19%. This shows a muted level of interest from smaller investors. This divergence may indicate that larger companies are preparing for an upcoming breakout.

Are they going to act as a resistance, or will they be the catalyst for a break-out?

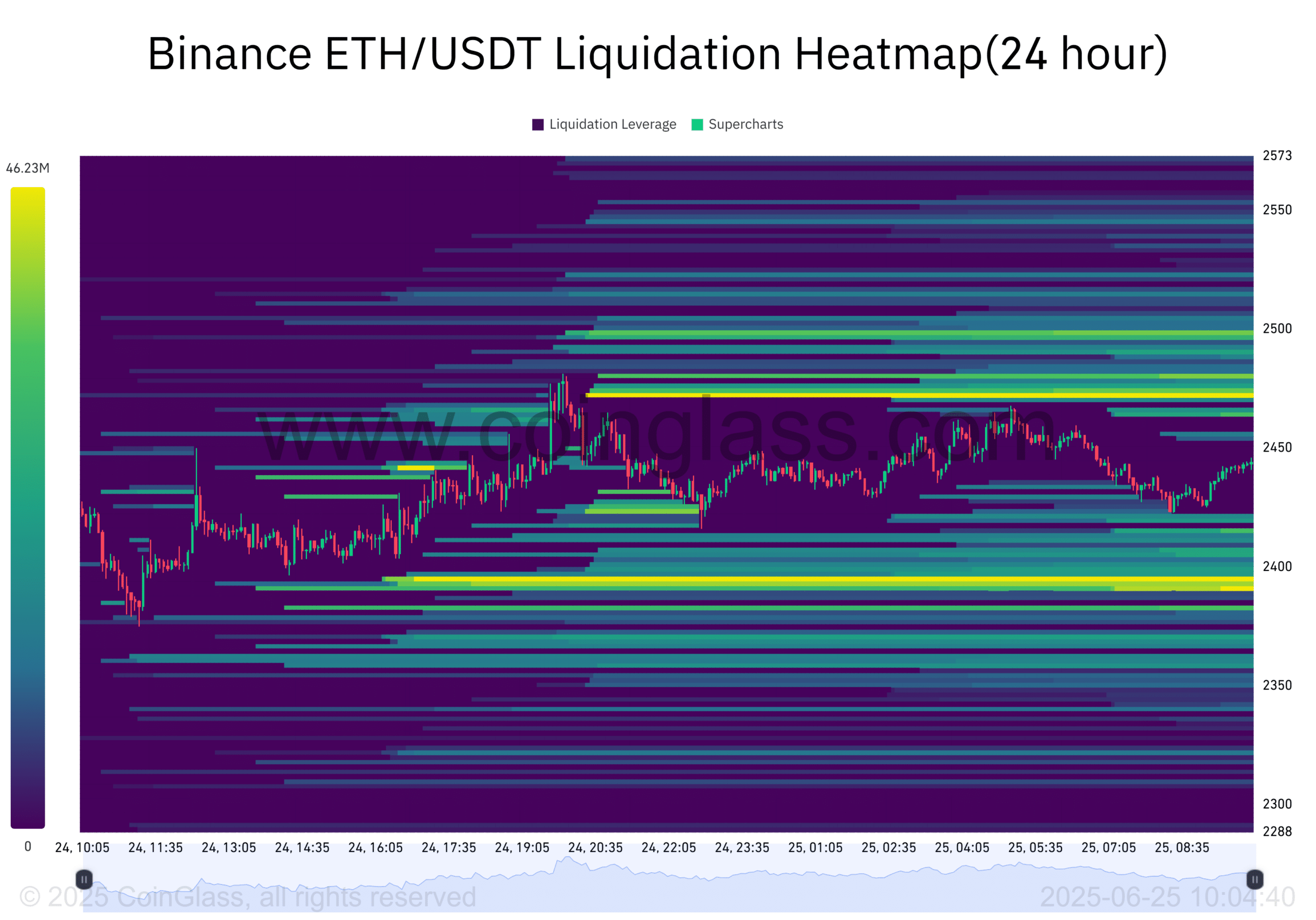

Coinglass reported that ETH’s Liquidation Map displayed a tightly stacked leverage of $2,500 to $2,550. The zones have a double purpose.

They are a symbol of resistance because previous rallies have failed here.

On the other hand, a sharp move through these clusters could trigger cascading short liquidations—amplifying any upward move.

Momentum above $2,550 might unlock rapid gains. Inversely, rejections at this level may encourage aggressive short positions.

Ethereum’s current setup has a reactive nature, with the MVRV, 50-day EMA profits and liquidity walls forming a tense skirmish.

Overvaluation and cautious retail sentiment indicate hesitation.

ETH will have to decide whether or not it is able to convert its consolidation into structural strength, and if so how.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: ambcrypto.com