After weeks of pressure on the cryptocurrency market, Ethereum has seen its price rebound. For the very first time in three weeks, ETH ended with a gain of almost 4%, after it made a sharp bounce off the $1800 level. The price rebound brought ETH to around $2,000 briefly before a decline began. While this Ethereum price rebound continues, buyers must really push ETH above $2,000 to reverse the downtrend which has been present since late 2024.

You may also like: Crypto Czar David Sacks Meets With UAE Officials to Talk Crypto, AI

Ethereum Price Rebound: Market Trends and Key Support Levels to Monitor

Ethereum Price Recent Performance

This Ethereum bounce is a crucial moment in ETH’s trajectory and future price direction. ETH is currently below $2,000 in a pullback that looks normal. In order for a sustainable Ethereum price recover to occur, it is important that buyers defend the key Ethereum support levels as well as push the price above the $2,000 psychological barrier.

Several ETH trends have emerged around the key support areas in the market. The $1800 level was a key support point for the recent Ethereum rally. It also aligns with the Fibonacci level of 23.6% that is closely watched by many traders.

If this support level does not hold, it is most likely that the next one will be around $1600. There are also additional supports near $1500 where many long term holders have built positions.

The Long-Term Prospects of the ETH Market

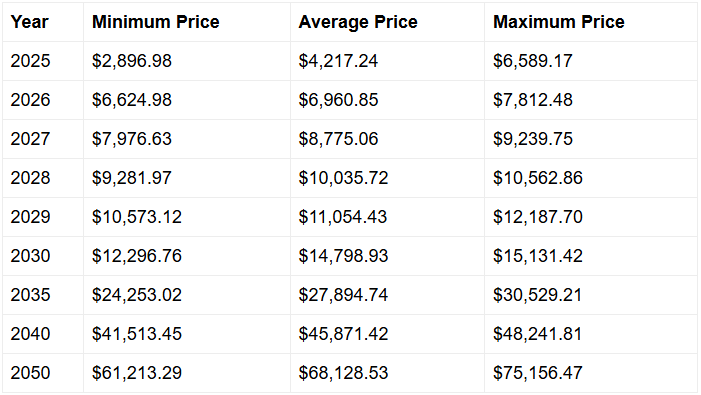

The following is a list of Telegaon‘s prediction:

“The average price of Ethereum can reach $6,960.85 in 2026. If the current performance continues, the maximum price of Ethereum can reach $7,812.48 in 2026. However, if the market turns down, the minimum price level of Ethereum can be around $6,624.98 in 2026.”

This price point serves as both a psychological resistance and a key technical barrier that has been tested multiple times during this Ethereum recovery phase. The $2,000 price level is both a psychological barrier and a technical one that’s been repeatedly tested during the current Ethereum price recovery.

You may also like: BRICS: US Dollar Falls Against 8 Currencies in 2025

A break of $2,000 could potentially lead to the Fibonacci level 38.2% at about $2,400. Next, we have the 50% near $2.875. The levels above have also been major resistance areas throughout 2024, and even into early 2025.

Despite all of the recent volatility, longer-term ETH markets trends appear to be positive. Ethereum’s technical analysis indicates that some consolidation at current levels will allow for a base to be built before attempting another uptrend.

Ethereum’s price rebound from $1,800 provided temporary relief to investors. However, several factors will determine whether this is a true recovery.

Ethereum Recovery: Key Factors

It is crucial to keep an eye on the price movement in order to prevent any further declines. If ETH maintains levels above the recent lows this may signal a stronger market.

A rise in the trading volume is another important factor to watch. The higher volumes of green candle would indicate real buyer interest, not just a technical jump.

Regulatory development affecting crypto markets could play a key role in ETH’s trajectory. A major announcement from a jurisdiction could cause ETH’s price to move in either direction.

According to the Ethereum technical analysis, traders are advised to watch out for an increase in buying volume. This is a sign that this rebound has been confirmed. Regulatory clarity in major jurisdictions may also have a significant impact on Ethereum’s trajectory over the next few months.

You may also like: If You Invest $5,000 in Solana Today, How Much Could It Be Worth in 2030?

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: watcher.guru