- Cardano’s MVRV has flipped to the negative side, indicating that buyers are now losing money.

- Will HODLers remain firm or will FUD in the markets force them to reconsider their decision?

Although the monthly drop was a dramatic 12.60%, Cardano [ADA] The stock is still 87% over its opening day price. This outperforms many other large-cap stocks. It is an indication of strong investor conviction. They are choosing to keep their unrealized profits rather than selling.

The fundamentals of the chain, however looked to present a very different picture.

Cardano has been around since the early 1990s. TVL (Total Value Locked) fell below pre-election level, indicating liquidity outflows. Simultaneously, Whale Transaction Count (>100K USD) fell to a cycle low – Indicative of a fall in institutional activity.

To reignite FOMO on the market, ADA needs to confirm their support in the charts. Then, there is weakening fundamentalsEven HODLers could waver in their commitment, choosing to surrender over hold on.

Which side will triumph?

Altcoins’ price charts were a test of endurance at the moment of this writing.

The stock has fallen three times in a row since February. These lows have broken key support levels, signaling structural weaknesses.

The latest breakdown on 06 April saw ADA lose the $0.58-support – A level it had held post-election. The profit margins were also compressed, which raised concerns about a further correction.

This was evident in the ratio of Market Value to Realizable Value (MVRV), a measure that reflects market value against realized value. flipped negative. The study found that recent ADA home buyers, on average are currently underwater.

Here’s where it’s worthwhile to point out that ADA’s rapid recovery has flipped market sentiment. A 7% rise in price at the time of publication, to $0.6283 may have restored some confidence that a recovery is underway.

But is the rebound due to a “market-wide” supply squeeze – A relief rally, perhaps? Cardano is not erasing its post-election gain because HODLers are confident in a bull market.

The structural weakness of HODLers could threaten their conviction

With every failed support, ADA holders face a critical decision – Hold strong or exit before deeper losses unfold. MVRV could remain negative, and if the buying pressure is weakening then capitulation might be on its way.

Investor confidence is more vulnerable the closer Cardano gets to the price of election day. If there are no strong fundamentals that can support sentiment, the selloff could reach breakeven levels.

Encouragingly, trading volume on 07 April surged to $1.98 billion – Up from $941 million the previous day. Additionally, the whale cohort – holding 100 million to 1 billion ADA – accumulated 250 million ADA on 10 April alone.

Short-sellers were blindsided by this demand, which led to $901k of liquidations. Shorts were unwound and a rebound of 7% followed. This gave the market a new boost.

Bullish reversal, right? But not so fast.

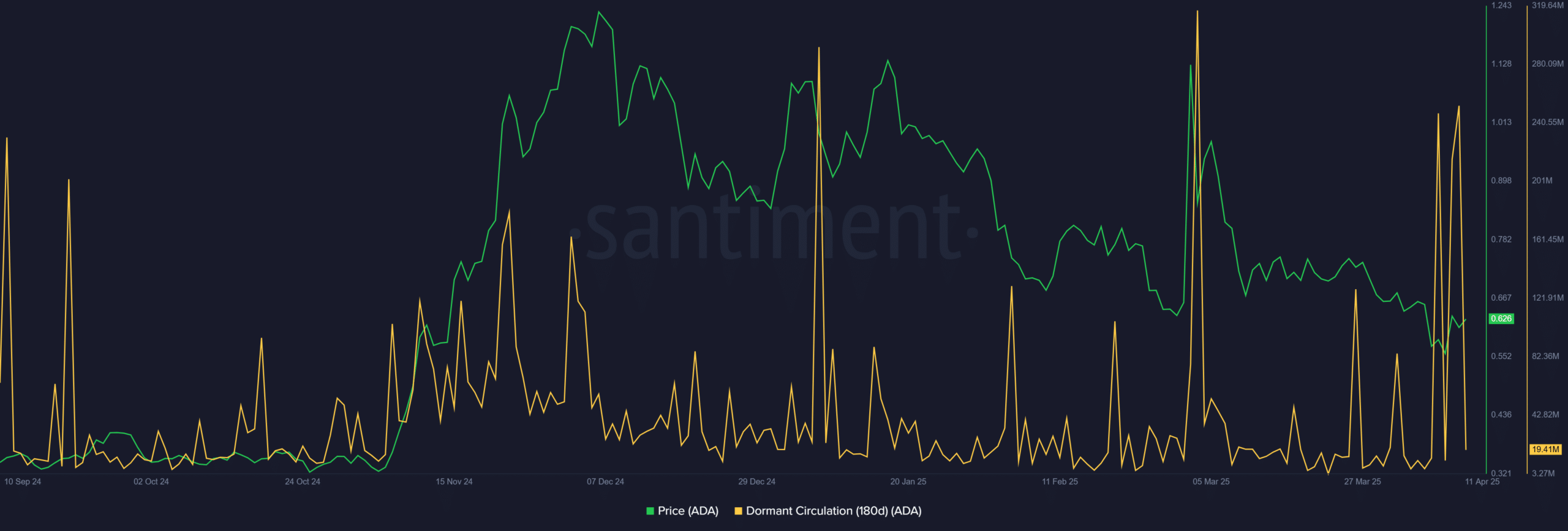

Then, you’re in luck. largest whale cohort This is a sign of caution. Plus, dormant whale circulation (180-day) spiked – A historical warning sign of market tops.

Selling pressure may increase as previously idle coins enter circulation, and the accumulation of these coins remains low.

If ADA is unable to maintain a price above $0.58 per ADA, the structural weakness can escalate and lead to a full-scale collapse.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: ambcrypto.com