- Cardano formed an bearish Head-and-Shoulders pattern on the 1-day chart

- In the short term, a drop of 8% could occur due to a lack in buyer support in midst of a rise in selling activities

Cardano (ADA) Was trading At the time of publication, this price was $0.344, after a drop of 1.5% in just 24 hours. ADA’s price is down 16% over the past 14 days.

A look at the chart for one day revealed that the bearish trend may continue. Cardano has formed a pattern of a head and shoulders, which suggests that it could be entering a downtrend. Chart pattern showing the relationship between rally ADA has weakened since late September, when it gained more than 26%. Market bears may start to sell, causing the price charts to drop.

A bearish pattern will be confirmed if ADA breaks the neckline at $0.344. On 9 October the price tried this bearish break out, but bulls quickly reentered.

You can also contact us by clicking here. Cardano If the level above the neckline is not maintained, it will be likely that the price drops by 8 percent to $0.311 to test support. ADA must breach the $0.368 resistance level to end this pattern.

This is a list of technical indicators.

Technical indicators indicated that recent bearishness was in effect at the time this article was written. Relative Strength Index, or RSI for short, was 44. This indicated that the sellers had control.

The RSI Line dropped below the Signal Line, indicating a strong momentum.

Moving Average Convergence Divergence – (MACD) showed a negative value and trended below the Signal line. It further supported the negative case for ADA.

ADA may continue to move sideways due a large number of liquidations over its price at press time. A hot zone of liquidation is usually a good level for resistance.

It is a sign that there are more potential liquidations at a price above than below.

If Cardano breaches above this area, then it may force short-term traders to exit their positions. This could create buying pressure, and lead to a positive reversal.

Cardano wallets for profit

IntoTheBlock’s data showed that, after Cardano rallied reached its exhaustion at the end of September, wallets were still able to be used. “In The Money” At the time of press, (in profit) had dropped from 34 to 16 percent.

At the same moment, wallet losses soared from 63% – 78%.

Price depreciation could be triggered by this drop in wallet profit. Cardano. Specially when holders sell their shares to reduce losses.

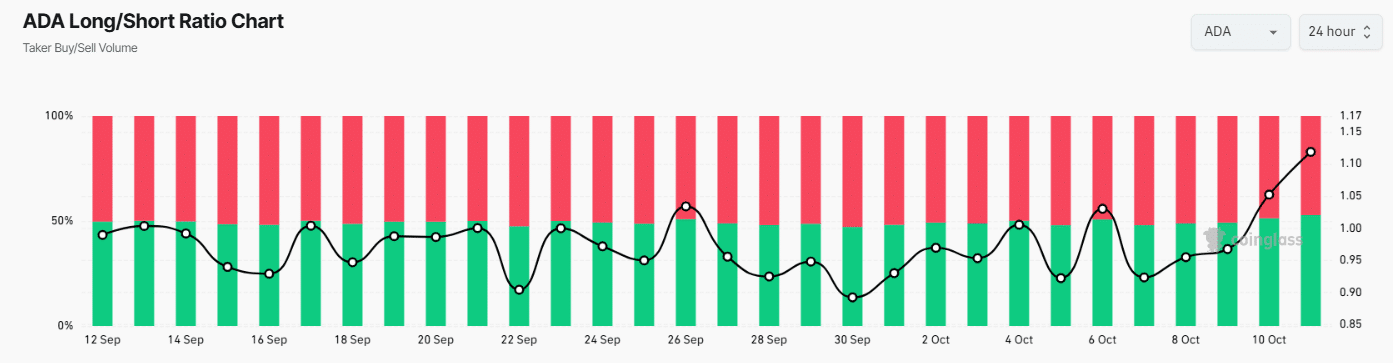

ADA’s sentiment remains positive and could help to prevent a steep price decline. For instance – The long/short ratio shot up to its highest level since early September. The long/short ratio is a good indicator that traders expect future price growth.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: ambcrypto.com