The key take-aways

-

Bitcoin futures interest dropped by 2 billion dollars in just five days.

-

The market is waiting for the Fed to announce its interest rate.

-

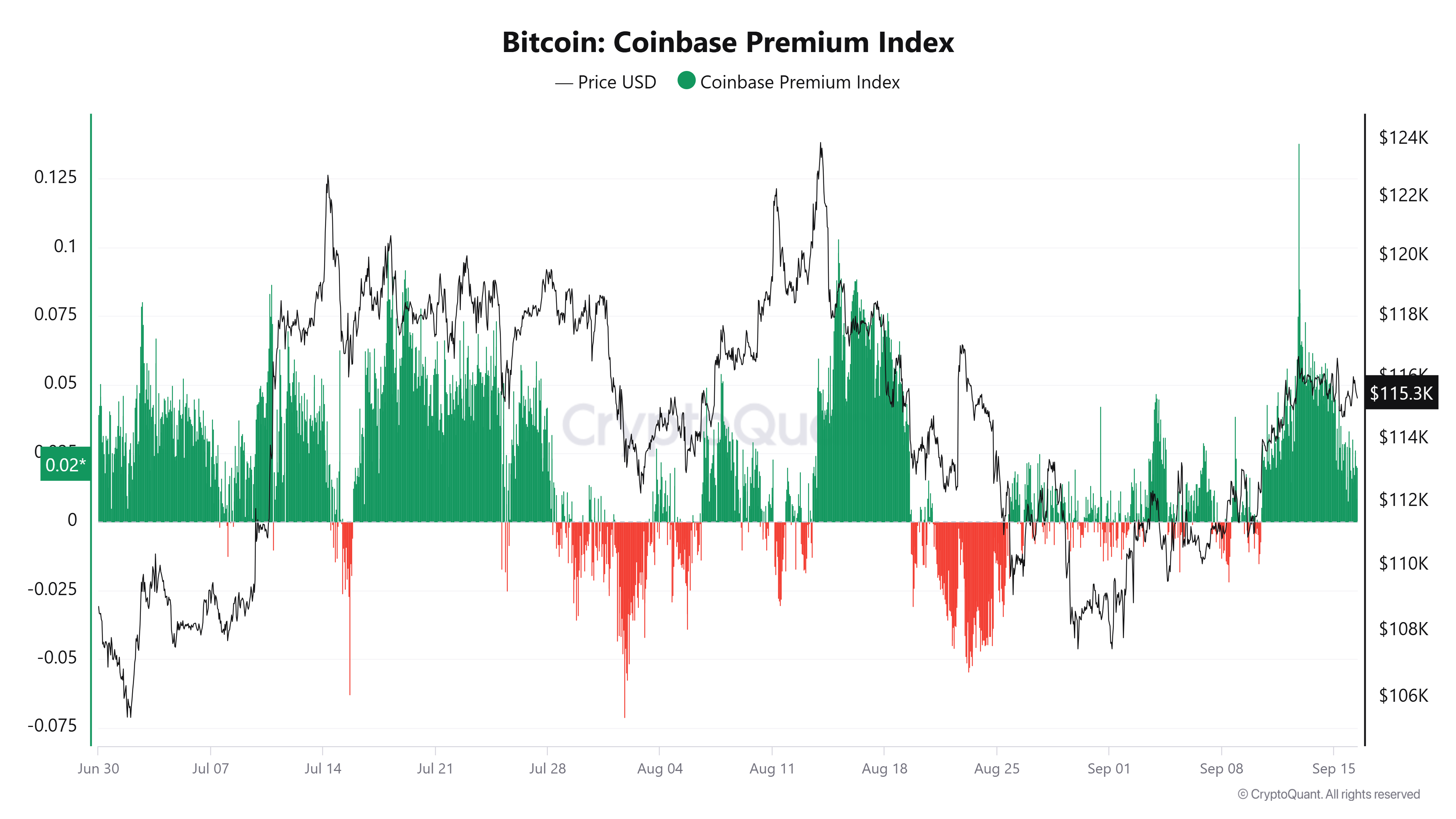

Coinbase’s premium indicates a steady US demand of $115,000.

BitcoinBTC(Traders appear to be reducing exposure in advance of this week’s US Federal Reserve policy announcement. Onchain and derivatives show a significant reduction in leverage, along with signs of steady demand for buying around the $115,000 level.

Bitcoin open interest dropped by $ 2 billion last Friday. The number of bitcoins now below $40 billion is a drop from the previous $42 billion. Bitcoin reached a high of $116,700 briefly on Monday. The aggregate volume of futures has also been minimal, indicating that traders are still cautious and have not taken aggressive positions in any direction.

Funding rate, which is a measurement of how much it costs to hold positions in perpetual options, has also been on the decline. The London session of Tuesday was notable for the biggest hourly funding surge since August 14. This move coincided back then with a top in the local market.

Crypto analyst says MaartunnBinance’s net takers volume has dropped below $50m, which is well below the average of $150m. The low activity suggests a sidelined marketplace, where participants wait for clarification from the Fed to take new capital positions.

Related: Bitcoin faces resistance at $118K, but ETFs may push BTC price higher

Strong demand for Coinbase premium at $115,000

The spot market on Coinbase tells a very different story. The Coinbase premiumThe price differential between Bitcoin on Coinbase versus other exchanges is steadily increasing since Tuesday. This is a reflection of the robust US demand for Bitcoin, as the buying group that has been forming since August 1st represents the largest one in recent memory. According to the flows, buyers appear to be actively defending a $115,000 price level.

The balance of caution and quiet confidence is also reflected in other sentiment indicators. Bitcoin Bull Score is a score that measures the Bitcoin bulls. tracks Market momentum has shifted to the upside. “neutral” The 50th Anniversary of the a “bearish” The reading has been 20 for the last 4 days. This shows that there is less selling pressure, and the market has entered a more balanced stage ahead of Fed announcement.

The Bitcoin Risk Index is at 23.3% and near the cycle low, according to Axel Adler Jr. This measure gauges relative risks of a sharp drop in the price compared with the previous three years.

Adler notes Low readings are indicative of “calmer environments” Reduced likelihood of quick liquidations. Last time, between September 2023 and December 20, Bitcoin’s price traded slowly before settling into a new trend.

Related: Bitcoin price drop to $113K might be the last big discount before new highs: Here’s why

The article is not intended to provide investment advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making a final decision.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com