Takeaways from the conference:

-

Bitcoin is trading above its short-term holders cost basis of $114,000, which indicates a recovery in demand.

-

Bitcoin is expected to continue on its upward trajectory, reaching a target of $150,000.

BitcoinBTCOn Monday, the price of gold regained the $115,000 mark and recovered some of its losses. Friday’s historic sell-offThe liquidation of centralized exchanges resulted to a total value of over $20 billion.

Bitcoin’s macro-perspective remains positive, with traders predicting that $150,000 is still within reach.

Bitcoin recovery above key trendline

According to Bitcoin.com, the BTC/USD is currently trading at 8% over Friday’s low of $107,500. Cointelegraph Markets Pro The following are some examples of how to get started: TradingView.

BTC has recovered above its STH cost base, suggesting that it could be able to achieve higher gains.

Related: $120K or end of the bull market? 5 things to know in Bitcoin this week

Cost basis or the realized price is the average price at which BTC was purchased by investors that have owned Bitcoins for less than 15 days.

“BTC back above the STH cost basis of $114K,” said Frank Fetter is a quant at Vibes Capital Management.

“The show goes on.”

Cost basis STH trendline acts as support Investors gain confidence by reclaiming BTC during corrections in the Bitcoin bull market.

Glassnode data is also available. highlights that the cost basis of the 1w-1m holders has crossed back above the 1m–3m cost basis, signaling a rising momentum in demand and net capital inflows, as traders bought the dip.

Bitcoins’ uptrend is still intact

Bitcoin’s latest flash crash below $110,000 BTC’s rise was not short-lived, as traders asserted that it is likely to continue.

“The crucial factor is that Bitcoin holds the support above the 20-Week MA” Currently at $113.300 said MN Capital founder Michael van de Poppe in an X post on Sunday.

Van de Poppe also said Friday’s decline below this level. “provided a massive opportunity” For buyers and reclaiming indicates “we are continuing the uptrend.”

Mickybull cryptocurrency shares the sentiments of fellow Mickybull said Bitcoin “is still in bullish territory from a price action structural perspective,” adding:

“As long as $BTC and $ETH are still looking great on the HTF charts, the bullish vibe continues.”

Daan Crypto Trades said This is a “base case for this cycle has always been $120K-$150K.”

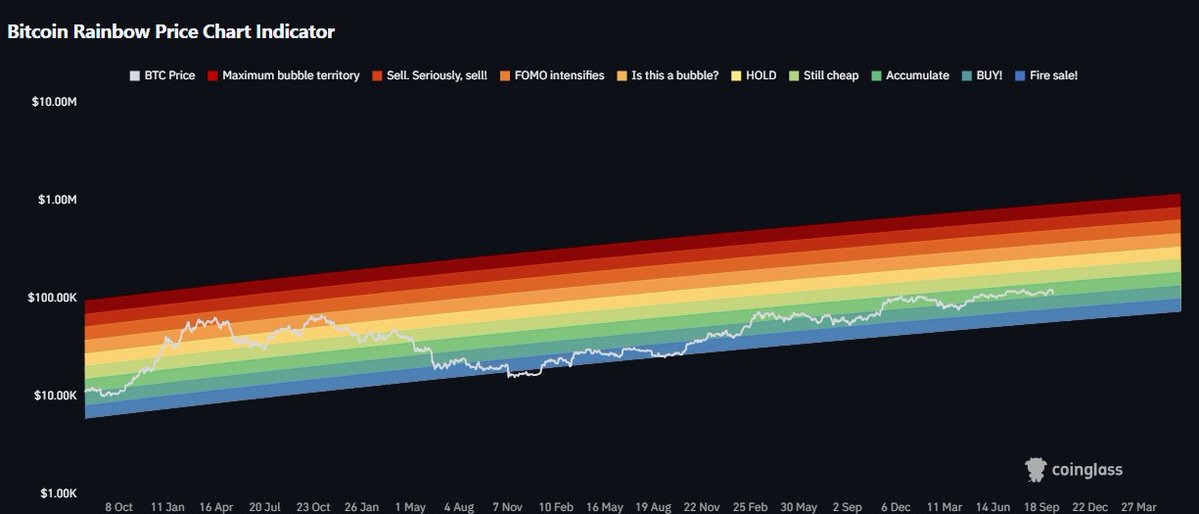

Analysts have said that Bitcoin is currently exhibiting a rainbow-colored price indicator. “light green/yellowish region ($140K-$200K)” It would make sense to scale back the prices once they reach these levels.

Crypto Analyst Jelle said Bitcoins have experienced an influx of a “2017-style washout” But still maintains key levels.

“I don’t really mind the way this looks. The target remains $150,000.”

You can also read about the advantages of using Cointelegraph reportedBitcoin is testing the “golden cross,” A bullish pattern has preceded historically rallies that have risen 2,200% in 2017, and 1,190% by 2020. Bitcoin’s value could skyrocket in coming weeks if the breakout pattern is confirmed.

This article contains no investment recommendations or advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making a final decision.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com