The key takeaways

-

Bitcoin’s steepest drop has occurred in the last month. A ghost-month trend suggests further declines to as low as $105,000.

-

Onchain data indicates a surge in US and Korean demand for spot metals, which could indicate a recovery on a shorter-term basis.

BitcoinBTCIn a dramatic move, the price fell below $117,000 for the first time in over a month on Thursday. For the first time in over a month, the daily chart displayed a bearish pattern of engulfment. This raises concerns about seasonal weakness. “ghost month” The downturn could be prolonged.

Onchain data indicate that dip buying activity is resilient despite the dip. The Coinbase Premium Index climbed Yesterday, the US Spot Index reached a new monthly high. This indicates strong demand for US-made products. In Asia, Kimchi Premium Index turned Positive signs indicate renewed Korean demand.

Hansolar, the crypto trader summed ккуаи увелиени о том, каетс, нава, традиионне ворос относит сеодн конликт меду Coinbase, Bitfinex та sоо рни минималноо вида.

This bullish tone is further supported Stablecoins are a result of stablecoin flow. Crypto analyst Maartunn says that USDC flows to exchanges have risen to $3.88billion since the recent price drop, indicating traders are preparing to deploy their capital.

What is also known as indicates The capitulation was muted. STHs sold only 16,800 BTC to exchanges for a profit, which is far less than the volumes of previous sales. To put things in perspective, before, during a Bitcoin drop of more than 5% over 48,000 BTC was sold by short-term holders at a profit.

📊MARKET UPDATE: #Bitcoin While the market dropped 5%, capitulation signals were muted. $BTC The exchanged were at a significant loss for Short-Term holders, compared to previous drawsdowns.

STH pressure is decreasing as shown by the blue arrow. 👍 pic.twitter.com/sVUvRSVXj5

— Cointelegraph Markets & Research (@CointelegraphMT) August 15, 2025

Related: Analysts see Bitcoin buyer exhaustion as retail shifts to altcoins

Can ‘ghost month’ extend BTC’s correction period?

Exitpump for Anonymous Analyst notes Order books show that Bitcoin’s support could be between $116,000 to $117,000 where spot and futures trading interest are showing.

Although this may lead to a rapid recovery, the recurring seasonal patterns tied to Asia could cause a slower pace of recovery. “ghost month” The sharpest pullbacks have often been accompanied by a rapid rise in the price of goods.

This year, the ghost month The period from August 23 until September 21 is known as the ‘September Month. It is the seventh lunar month in the Chinese calendar. This period, which has been associated with bad fortune for many years, can be seen as a time of bad luck within Asian cultures. The phenomenon may not have an impact directly on markets but its effect can be profound, as it influences traders’ risk appetites and their profit-taking behaviors.

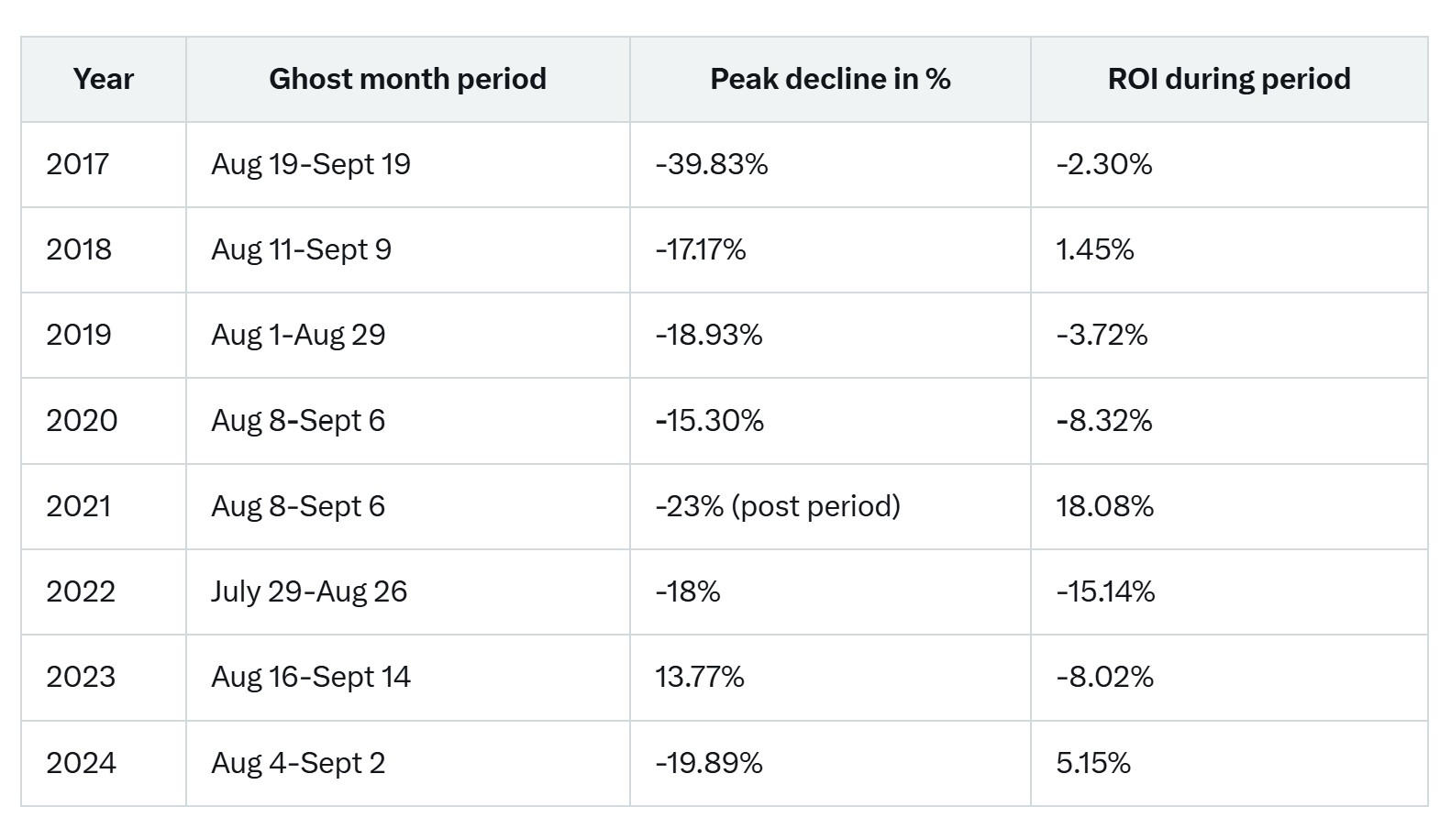

Bitcoin tends to fall during the ghost month. BTC’s peak average decline during this time period is approximately 21,7%. Notable drops include -39.8% and -23%.

With Bitcoin currently hovering near $117,320, a drawdown in line with the historical average could drag prices into the $105,000–$100,000 range before any meaningful rebound. It is also in line with important technical support zones where buyers could be interested.

Traders should be cautious, even though some ghost months have had positive returns. The volatility that is recurring in the middle of periods means they need to remain vigilant. If the correction continues into August, it could be the catalyst for Q4’s stronger recovery after the short-term bulls have been tested.

Related: BlackRock Bitcoin, Ether ETFs buy $1B as BTC price mostly fills CME gap

This article contains no investment recommendations or advice. Each investment or trading decision involves some risk. Readers should do their own research before making any decisions.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com