- BONK’s token burning reduced the supply by 1,8% but BONK was still facing resistance at $0.00003517.

- BONK technical indicators are weak and the market is still bearish.

BonkDAO burns 1.69 trillion dollars Bonk [BONK] Tokens are part of the “BURNmas” The crypto community has been captivated by this event.

BONK’s supply is down 1.8% after $54.52 Million worth of tokens are removed.

It could be a significant impact on the market. BONK was trading at $0.00003144 as of press time. This represents a decline of 6.50% in the last 24 hours.

Question: Does this action deflationary affect BONK’s stock price or market sentiment?

How will BONK’s prices move in the future?

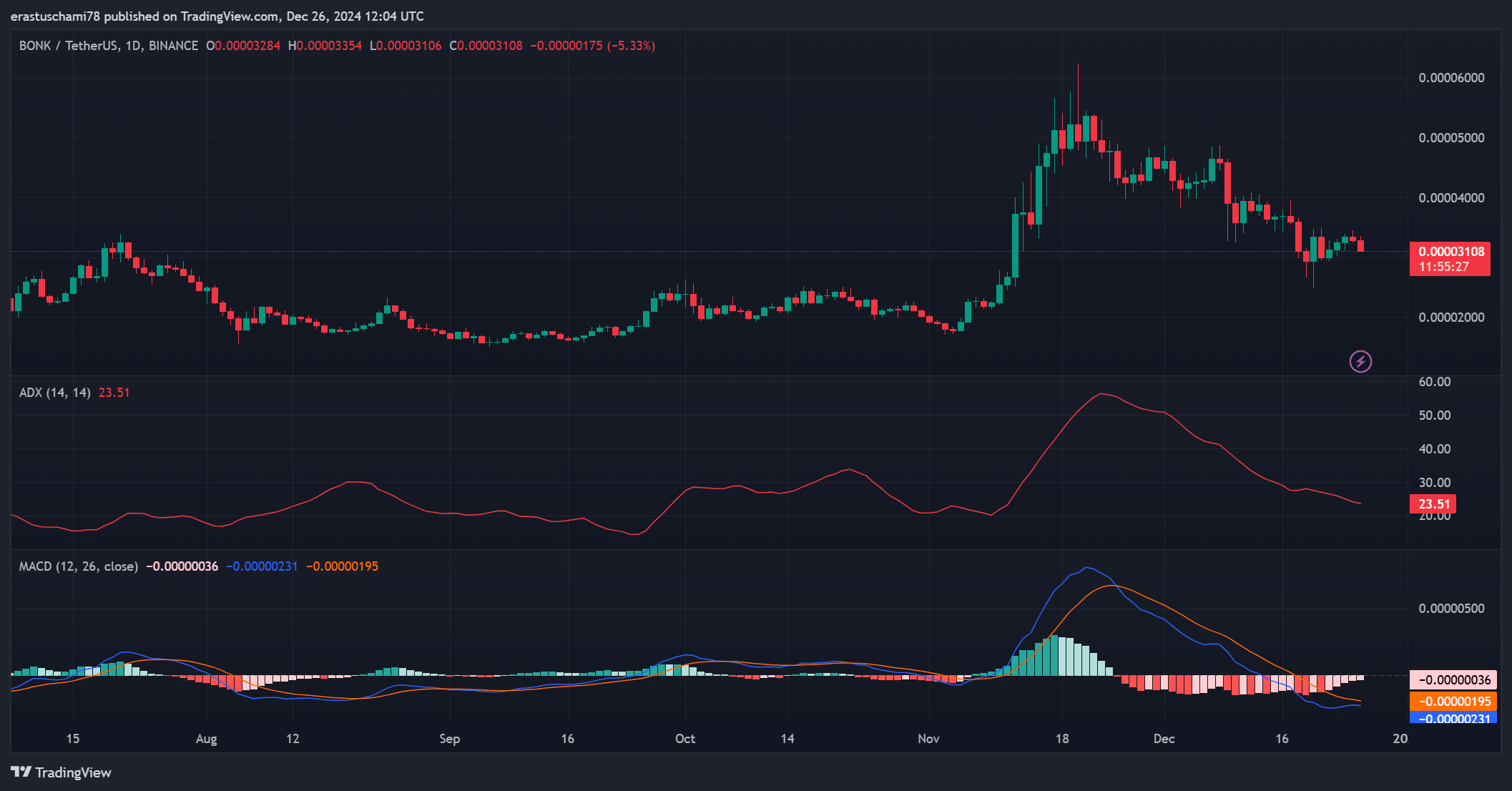

BONK’s recent price movement reveals an apparent pattern of resistance. This is particularly evident at the level $0.00003517. This point of resistance could serve as a roadblock to future upward movements if there are no significant buying volumes.

BONK is currently trading for $0.00003144, but it will be difficult to break through the resistance without more market support.

The 6.50 % drop over the past 24 hour period indicated that this trend was in its consolidation phase.

Of Social Volume

Data from Social Volume painted a portrait of waning interest in BONK. Mid-November saw a high of more than 290 social mentions, but on the 26th December they were down to 22.

The social media activity was down significantly, which suggested the buzz around the token burning had faded.

High Social Volume is often a sign of strong price movement, but this decline could indicate that the markets are moving away from BONK. They may wait for another spark to revive their momentum.

Trading on further fall?

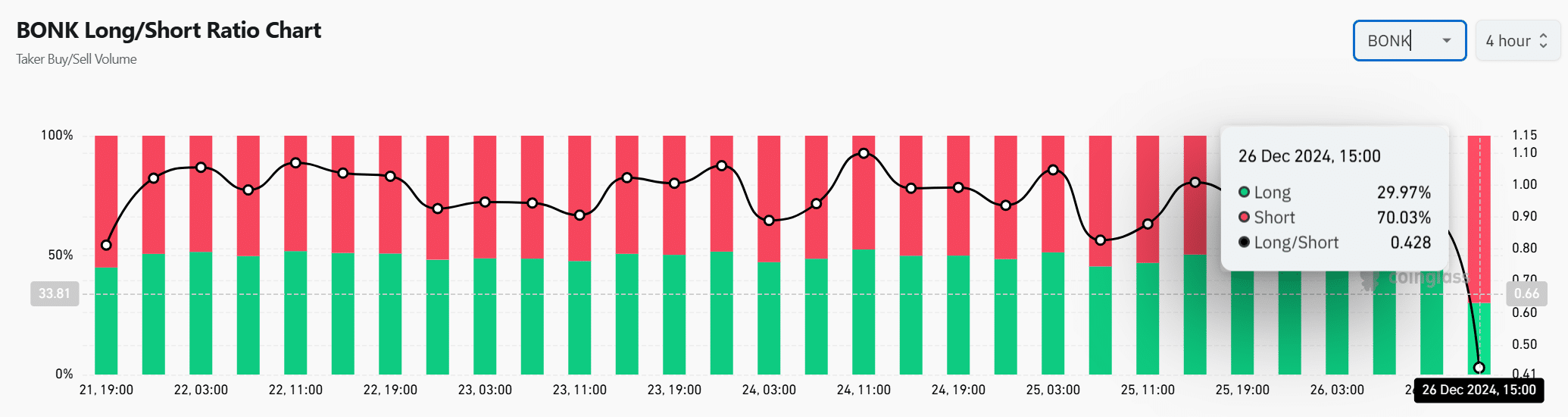

Short positions dominate the market. Only 29.97% were long positions as of December 26th, while 700.03% of them are short.

The traders expect BONK to continue its decline.

This large short interest indicates a negative outlook. However, it could also lead to an unanticipated market movement.

What are the technical indicators that suggest the direction of price?

Technical indicators are mixed. The Average Directional Index, or ADX, is currently at 23,51. This indicates that the trend has been weak. Meanwhile, Moving Average Convergence Divergence, also known as MACD, shows a negative value of -0.00000036.

This suggests that a slight rally may be possible but the market is not strong enough to maintain a price increase in the short term.

Market Sentiment

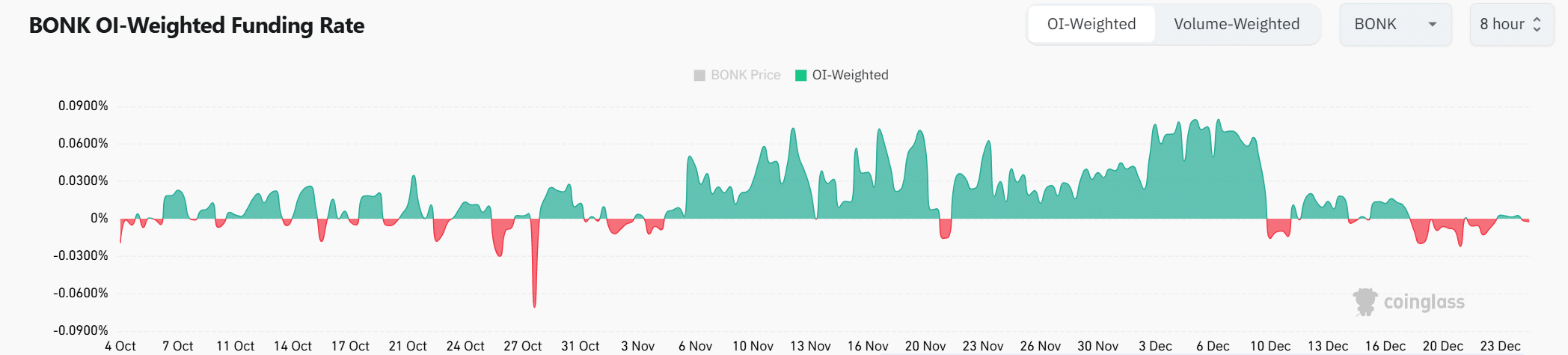

In recent months the OI-Weighted Financing Rate fluctuated from -0.09% to 0.09%, but was at 0% when we went to press.

It indicates that traders have a neutral stance on the market because they are not sure of its direction.

Click Here to Read Bonk’s [BONK] Price Prediction 2024–2025

Although the BonkDAO token burn reduces BONK supply, the current negative sentiment, which is reflected by Social Volume, Short/Long Ratios and weak technical indicator, suggests that this deflationary measure would not cause a significant rally in price in the short-term.

Without new catalysts it is therefore unlikely that BONK will see a significant price rise.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: ambcrypto.com