The Key Take-Aways

What is the reason for BNB’s drop this week?

BNB has dropped by nearly 10% since failing to reach the $1,000 threshold.

What are the latest developments on the derivatives Market?

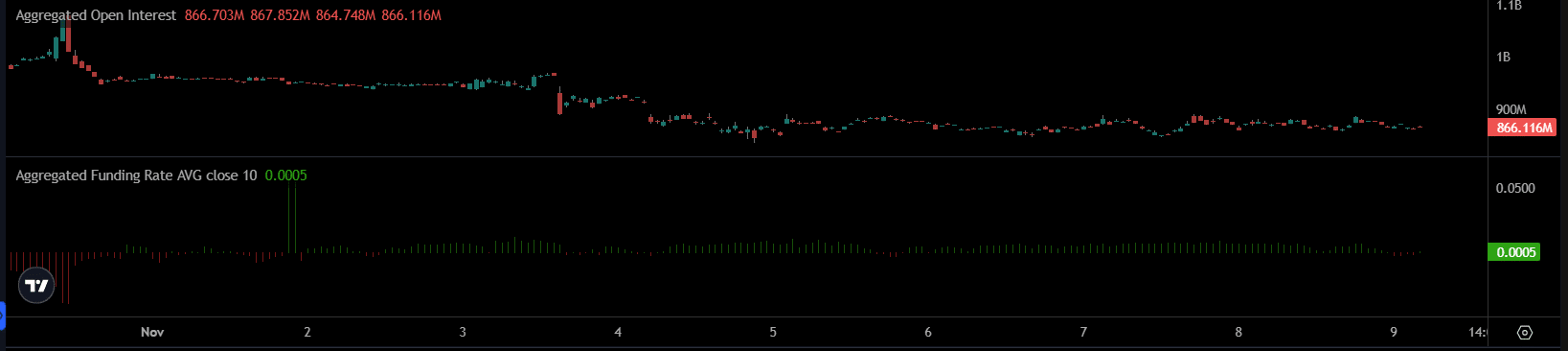

The open interest is flat at $866M. This shows that traders remain cautious, and do not take large leveraged positions either way.

Binance Coin [BNB] The coin is down again. This week the coin has dropped almost 10%, while the derivatives market confirms the slide.

Binance co-founder CZ publicly responded to news about a presidential pardon by expressing visible surprise and insisting that he does not have any connection with the Trumps.

BNB momentum fades

BNB’s share of the market has fallen by nearly 10 percent this week. And, technical indicators are in line with that decline.

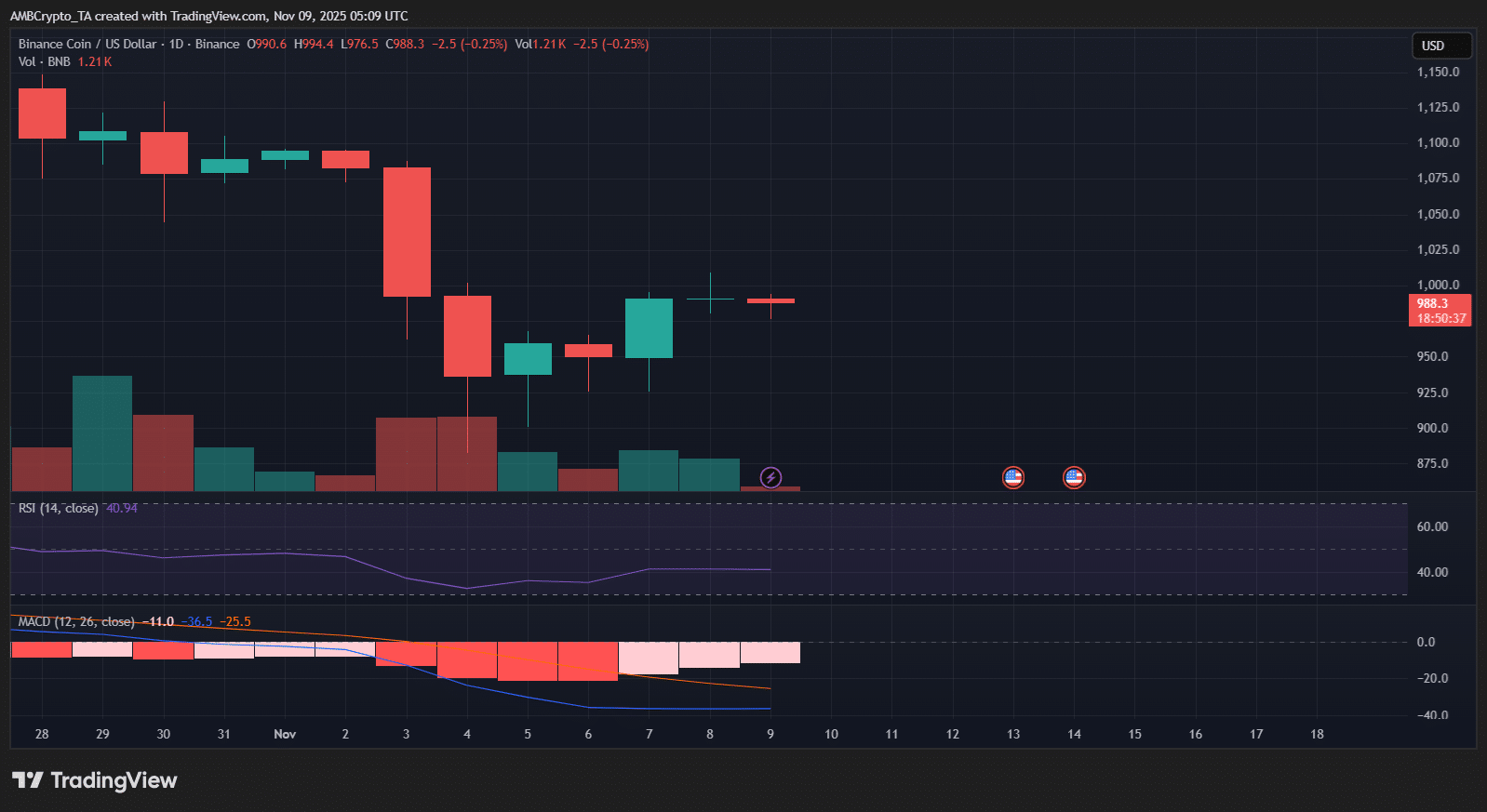

The daily chart shows that the price has failed to rise above $1,000, and the volume is still low. The traders appeared to be unwilling to pursue dips.

RSI was at 41. It is bearish, but not so washed-out as to be indicative of capitulation. MACD was also in deep negative territory at the time of press, indicating that the downward trend was still dominant.

This is controlled weakness. BNB could fall further before it sees any meaningful support if there is no surge in demand.

Derivatives stay quiet

The Open Interest has been stable at around $866 million this week. The chart displayed a flatline which indicates traders’ reluctance.

The aggregated funding rates also moved near 0.0005%. This shows a lack in leverage from longs and shorts. The money is not being bet aggressively either way.

Although BNB has dropped in price, traders of derivatives seem to be content to watch the situation out. They kept activity low, and momentum at press-time was slow.

CZ Speaks Out During Controversy

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: ambcrypto.com