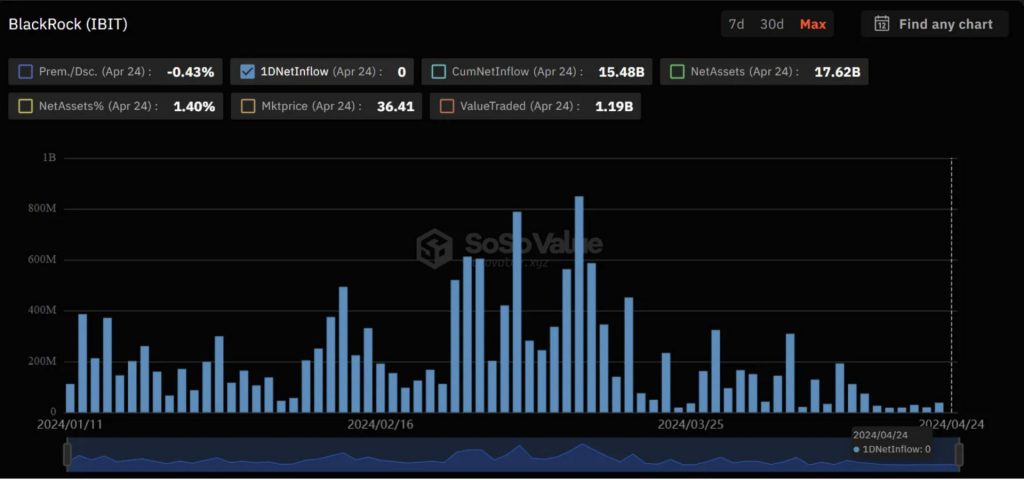

BlackRock’s iShares Bitcoin Trust, (IBIT), has experienced no inflows at all after 71 straight days of inflows. BlackRock’s IBIT ETF, Exchange Traded Fund, still boasts the biggest cumulative inflow of $15.4 billion.

Also Read: Bitcoin: Blackrock’s Spot BTC ETF Inches Closer To Top 10 List

BlackRock’s Bitcoin ETF may have experienced a drop in interest due to changes in macroeconomic conditions. US core durable goods orders increased by 2.6% in March. Investor expectations for a Federal Reserve interest rate reduction are diminishing as long as inflation is above its 2% target.

Bitcoin (BTC), will it fall after BlackRock BTC ETF does not see any inflows?

BTC reached an all-time record high of $73,737 this March. BTC’s phenomenal performance was made possible by SEC’s historic decision of approving 11 BTC spot ETFs. They were a huge success. A drop in ETF flows could negatively impact BTC.

Hong Kong ETFs for spot BTC or Ethereum are growing in interest, even though BlackRock spot Bitcoin ETF inflows have been falling. Hong Kong’s financial The ETFs are expected to begin trading in April 2024. 30, 2024. BlackRock’s BTC ETF could be cushioned by the launch of Hong Kong BTC and ETH ETFs.

Also Read: Hong Kong Bitcoin & Ethereum ETFs to Begin Trading April 30th

Bitcoin (BTC), too, recently went through its cycle of halving. Halvings are considered bullish by many because they decrease the supply of a particular asset. The crypto market also rallies after each BTC cycle of halving. Many analysts predict a rally in the market soon.

CoinCodex predicts that Bitcoin (BTC), will reach a new record high of $74,172 in May 2024. The platform also predicts that BTC will continue to rise throughout the month of May and reach $85,033 by May 22nd 2024.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: watcher.guru