BlackRock’s European Bitcoin ETP is an important step towards Bitcoin institutionalization in Europe. Analysts expect smaller inflows compared to its US counterpart.

The iShares Bitcoin ETP managed by the biggest asset manager in the world. began trading on March 25 Xetra Amsterdam Euronext Paris

The launch of Bitcoin is a major step forward in the adoption (BTCThe product will not be able to compete with the US-based iShares Bitcoin Trust ETF, which is a popular choice among institutional and retail investors.

SiShares Bitcoin ETP listings. Source: BlackRock

“The US spot Bitcoin ETFs benefited from pent-up institutional demand, a deep capital market and significant retail investor participation,” Bitfinex analysts have told Cointelegraph that they will be adding to the following:

“The presence of a BlackRock Bitcoin ETP in Europe still represents progress in terms of mainstream adoption, and as regulatory clarity improves, institutional interest could grow over time.”

The report added that, although Europe’s Bitcoin ETP markets may be developing at a lower pace than the global Bitcoin adoption story, they remain a critical part.

BlackRock’s management of more than $11.6 trillion could lead to a wider adoption in Europe of Bitcoin-based investment products and create new opportunities for the institutional sector.

Bitcoin ETF: Institutional holder growth. Source: Vetle Lunde

In the US, there is a growing trend of institutional adoption Bitcoin ETFs surged Cointelegraph, a report from August 16, reported that Bitcoin ETFs will increase in value by over 27 percent during the second quarter 2024.

Related: BlackRock increases stake in Michael Saylor’s Strategy to 5%

BlackRock’s reputation in the global market may help to drive adoption of Bitcoin ETPs across Europe

BlackRock’s reputation as a global leader and expert in financial services may not be accurate. “gradually build momentum” Iliya Kachev, a dispatch analyst with digital asset investment platform Nexo, said that European Bitcoin ETPs are a good option,

“Modest inflows shouldn’t be interpreted as a failure but rather as a function of structural differences in the market,” Kalchev, who told Cointelegraph:

“Long-term success in Europe may depend less on first-week flows and more on consistent access, education and infrastructure — elements BlackRock is well-positioned to deliver.”

BlackRock’s European Bitcoin ETF may not have the same explosive growth as its US Bitcoin ETF but it should still be considered. “seen in context, not as a red flag,” Consider the limited liquidity of Europe’s smaller market.

Related: Michael Saylor’s Strategy surpasses 500,000 Bitcoin with latest purchase

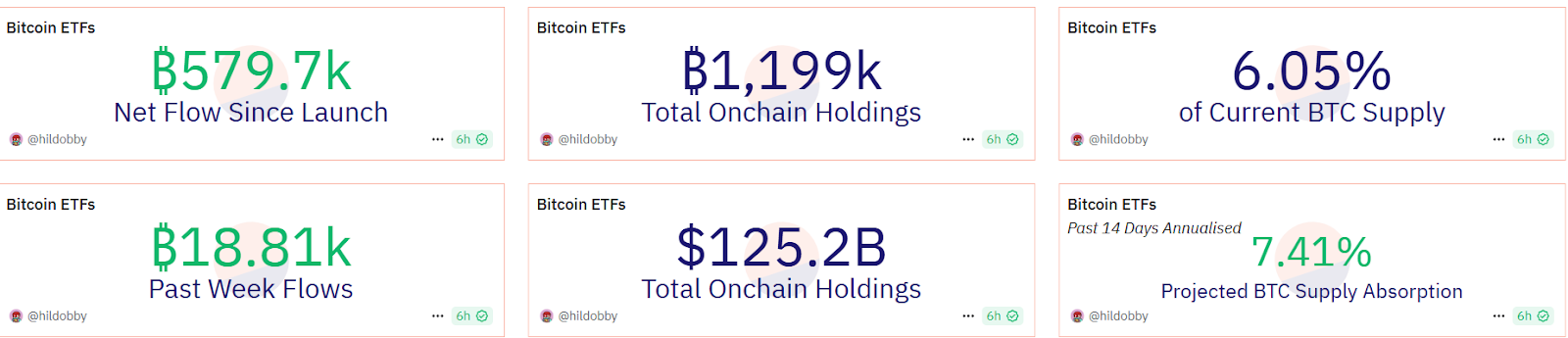

Bitcoin ETF dashboard. Source: Dune

BlackRock’s US Spot Bitcoin ETF briefly exceeded $58 billion. This made it the 31st largest ETF in both digital and traditional asset funds. Bitcoin ETFs surpassed $126 Cointelegraph, a news outlet that was published on January 31, reported that BTC totals had reached $1.25 billion.

BlackRock ETF is currently responsible for 50.7% share of US Bitcoin ETFs. The ETF was valued at $49.3 billion on March 27, 2019. Dune Data shows

Magazine: Bitcoin’s odds of June highs, SOL’s $485M outflows, and more: Hodler’s Digest, March 2 – 8

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com