Important points

-

BlackRock’s Bitcoin and Ether exchange-traded funds (ETFs) bought more than $1 billion in Thursday’s trading, despite the fact that prices had fallen by 5%.

-

Institutions have shown interest in “buying the dip” On both assets, the reaction is positive.

-

Bitcoin is almost back to its previous CME gap, with an increase of nearly $117.200.

BitcoinBTCThe price hovered around $119,000 at the Wall Street Open on Friday as institutional investors were given priority.

BlackRock purchases the dip when liquidations surpass $500 million

Data from Cointelegraph Markets Pro The following are some examples of how to get started: TradingView Showed BTC/USD as a support for the daily opening.

Double hit hot US Producer Price Index (PPI) inflation Mixed signals about the Strategic Bitcoin Reserve Treasury Secretary Scott Bessent sparked an immediate 5% BTC decline the day before, with lows around $117,200.

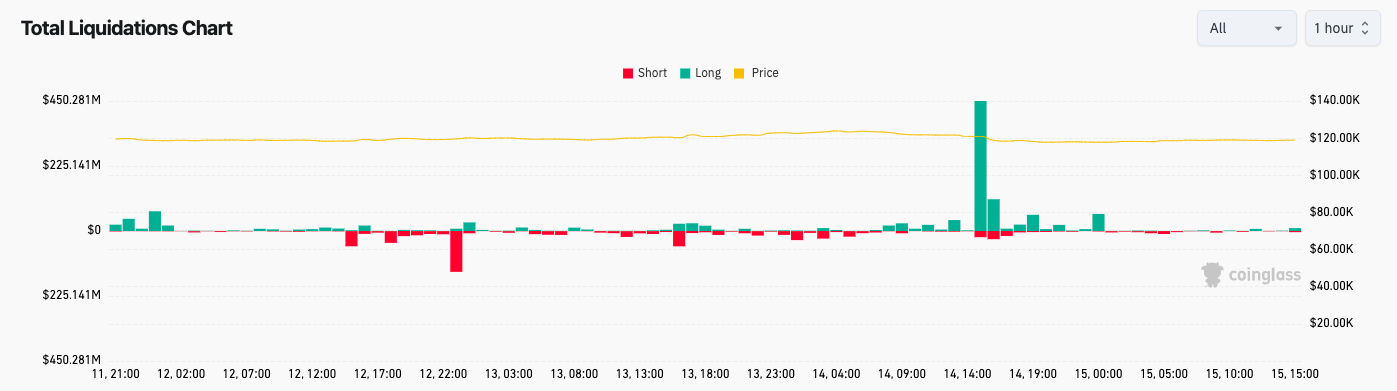

Monitoring resource data CoinGlass The crypto-liquidations that took place in just 24 hours came close to $1 billion.

As longs were unwound the interest of one particular source remained prominent.

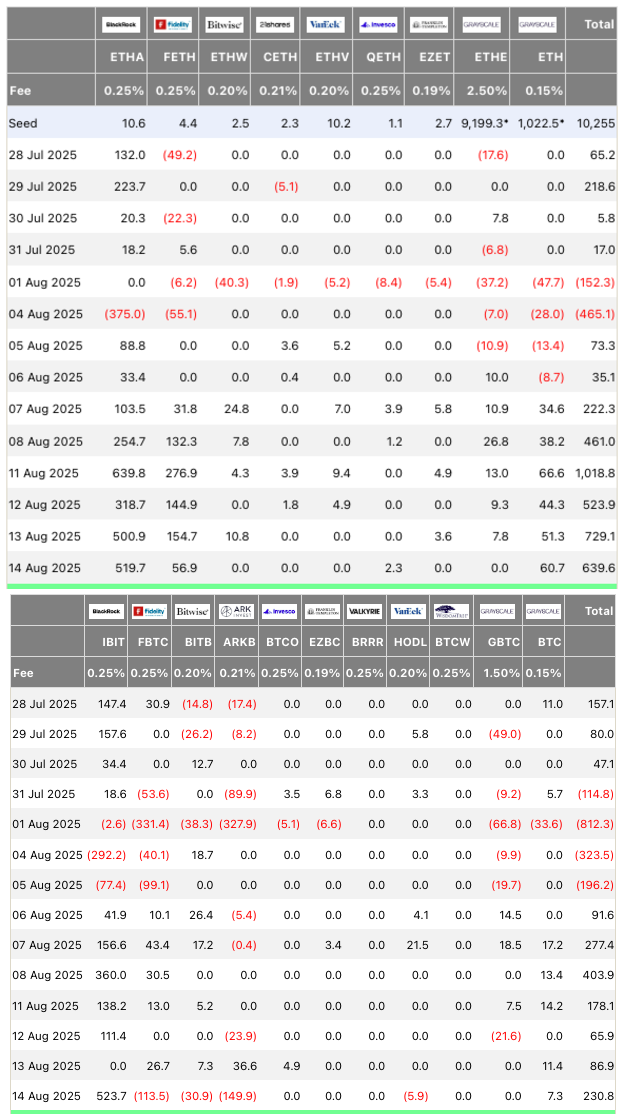

BlackRock’s iShares Bitcoin Trust added. The largest US Bitcoin spot exchange-traded (ETF) in the US, iShares Bitcoin Trust is managed by BlackRock. over $500 million in BTC It’s Thursday The Ether is ThursdayETH( ) added the same amount of money, defying short-term market trends.

BitBull identified the institutions’ interest in cryptocurrencies. “buy the dip.”

“BlackRock went all in $BTC and $ETH yesterday,” “He said” in the a post on X Alongside data from Arkham, a crypto-intelligence firm.

Bloomberg ETF analyst Eric Balchunas noted that on Thursday, the BTC spot ETF and ETH ETF combined volumes totaled over $11.5 billion.

“For context that’s about the same volume as Apple stock,” He told X Followers

CME gap shrinks to $117,000 as Bitcoin takes over

Bitcoin’s recent local bottom has also provided further optimism.

Related: Coinbase says a ‘full-scale altcoin season’ may be just ahead

Ted Pillows (a crypto investor, entrepreneur and other individuals) noted that Bitcoin/USD has mostly covered the weekend’s gap at CME Group. Bitcoin futures market.

“Now I think that the worst is in for BTC and a new rally will start,” He predicted.

The following are some of the ways to get in touch with us. Cointelegraph reported$117.200 was on the radar for an important level to flip between resistance and support.

“Bitcoin recovering well from that post-PPI panic,” Jelle, a fellow trader continued.

“Price held the support level – the CME gap filled for 75%, price is now back above the 4h 50EMA. $120,000 remains the area to turn into support, once that’s done -> price discovery is next.”

Daan Crypto Trades suggested This gap “can be a good level to keep an eye on in case price does decide to do one more drive lower to take out those lows.”

This article contains no investment recommendations or advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making a final decision.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com