The financial markets have mixed signals, as the level of uncertainty continues to rise. On February 25, the US government raised its debt ceiling from $36.1 billion to $40.1 trillion.

According to historical patterns, 10-year Treasury rates dropped from 4,4% to 4.29% in response to this news. Although it may sound counter-intuitive, the markets interpret resolutions of debt ceilings as stabilizing, even though they imply increased borrowing in the future.

Since last week, both the S&P 500 and Nasdaq100 have lost 3%, 5%, and 6% respectively. Since Feb. 21, the S&P 500 has lost 3%, the Nasdaq100 has dropped 5%, and Bitcoin has plunged 16%. The top cryptocurrency, which reached its highest price on the day of President Donald Trump’s Inauguration, is currently trading at 26% less than that. Trump pump.

It is unusual for stocks to fall simultaneously with bond yields. This suggests a growing fear of economic recession and a risk-aversion.

The market is dominated by uncertainty

The recent US economic data, released on February 21, showed signs of weakness. Consumer sentiment at the University of Michigan dropped from 71.7 to 64.7, in February. It is the lowest reading since November 20,23. This was below the initial estimate of 67.2, which also reflected the consensus among the economists polled. Reuters.

Existing home sales dropped 4.9%, and the S&P Global Purchasing Managers’ Index (PMIThe PMI fell to its lowest point since September of 2023, from 52.7 points in January. PMI is a measure of manufacturing and service activities. If the reading hovers just above 50 (the threshold that divides contraction from expansion), then the growth rate in the private industry has stagnated.

Uncertainty in the market is a result of trade tensions. Trump declared on Feb. 24 that he would be imposing tariffs on Canada, Mexico “will go forward” After the deadline of the month-long delay expires next week. Trump’s announcement on 26th February of his plan to apply 25% tariffs to European Union goods and another 10% on Chinese imports added to market tensions.

Chris Rupkey Chief Economist, FWDBonds unapologetically commented on CNBC in a commentary said,

“The economy is about to have the rug pulled out from under it as Washington policies are causing a rapid loss of confidence on the part of consumers.”

Rupkey elaborated on the subject. “The economy is coming in for a crash landing this year. Bet on it. The bond market is.”

In the crypto market, the Fear & Greed Index has plunged to 10, or Extreme Fear – a stark contrast to the Greed levels seen at the beginning of February.

Crypto Fear & Greed Index. Source: alternative.me

Is a small crisis enough to justify quantitative ease?

Arthur Hayes, the former BitMEX Chief Executive Officer was interviewed in January. speculated that a battle over the debt ceiling—combined with a reluctance to spend down the Treasury General Account—could push 10-year Treasury yields above 5%, triggering a stock market crash and forcing the the Federal Reserve to intervene.

According to him, it could be a way for President Trump of pressure the Fed towards a more dovish position. This is a way to stimulate the economy and justify QE.

For Hayes, this mini-crisis must occur early in Trump’s presidency, during Q1 or Q2, so he could blame it on the leverage built up during the Biden administration.

“A mini financial crisis in the US would provide the monetary mana crypto craves. It would also be politically expedient for Trump. I think we pull back to the previous all-time high and give back all of the Trump bump.”

Even though there was little drama surrounding the raising of the debt limit and the yield on 10-year Treasury bonds actually dropped, stock prices still fell. It is now the question of whether interest rates will be cut.

Recent economic data provide little evidence for a policy change imminent. Inflation accelerated to 0.5% monthly, and the rate of annual inflation reached 3%. Both figures exceeded expectations. Fed Chair Jerome Powell is emphasized It is unlikely that the Fed will cut interest rates in a hurry. This is despite the Fed’s position that a combination with weakening indicators of economic growth and an expansion in liquidity may force its hand at some point this year.

Related: Short-term crypto traders sent record 79.3K Bitcoin to exchanges as BTC crashed to $86K

The Bitcoin and M2 price changes are at different speeds

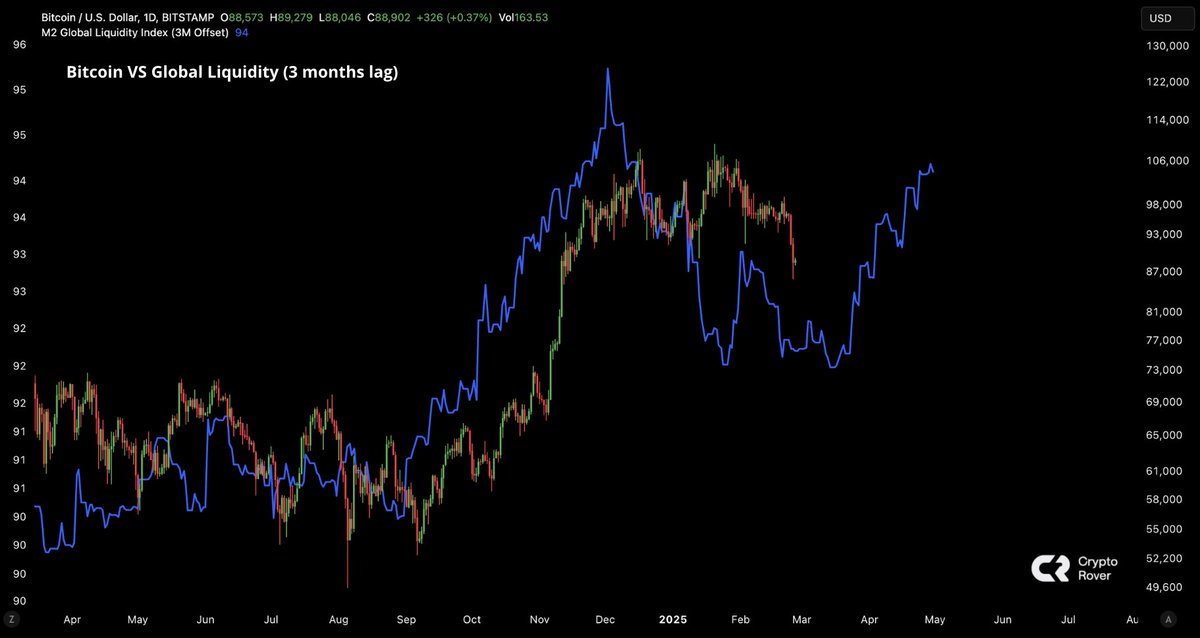

Not all is lost despite the market’s current downturn. A massive expansion of liquidity could be coming. It is possible that a large wave of increased liquidity could appear on the horizon. expanding M2 global liquidity supply Bitcoin in particular could be a new breath of air for the market. It could be a while before this happens.

The M2 Global Liquidity Index 3 Months Offset is a helpful tool for predicting market moves driven by liquidity. The M2 Money Supply data is shifted forward by 3 months for the purpose of analyzing its relationship to risk assets.

Crypto analyst Crypto Rover has highlighted this in X. stating:

“Global liquidity strengthening significantly. Bitcoin will follow soon.”

Bitcoin vs the M2 Global Liquidity Index (with 3M offset). Source: CryptoRover

BTC has historically lagged behind global liquidity trends by approximately 60 days. It is clear that the current fall fits into this pattern, which promises an impressive rebound in June if liquidity trends continue.

Jeff Park is head of Alpha Strategies at Bitwise echoed “The sentiment”

“Bitcoin can certainly go lower in the short term as it thrives on trend and volatility, both recently absent. But astute institutional investors don’t need to catch every wave; they just can’t miss the biggest one. And the biggest wave of global liquidity is coming this year.”

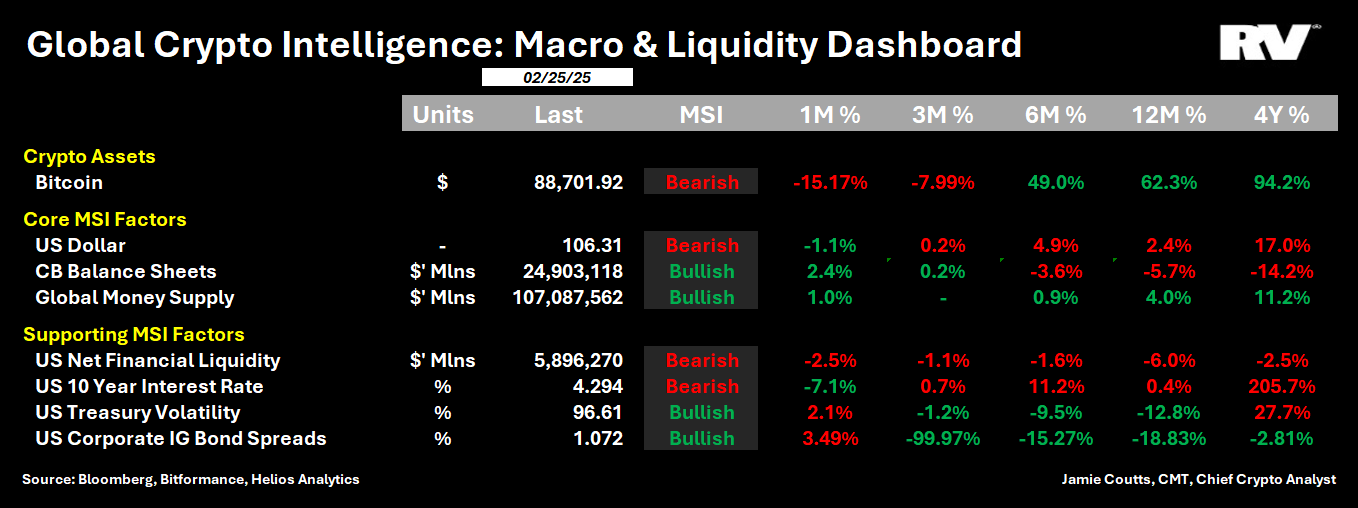

Jamie Coutts is a Crypto Analyst from Realvision. shared He shares his thoughts on how the expansion of Bitcoin liquidity impacts its price.

“2 of 3 core liquidity measures in my framework [global money supply and central bank balance sheets] have turned bullish this month as markets dive. Historically, this has been very favorable for Bitcoin. Dollar is the next domino. Confluence is king.”

Macro and Liquidity Dashboard. Source: Jamie Coutts

The information in this article is neither investment advice nor a recommendation. Each investment or trading decision involves some risk. Readers should do their own research before making any decisions.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com