Takeaways:

-

Bitcoin’s correlation to Nvidia is at its highest level in over a year.

-

Analysts worry that such a correlation might result in a BTC price drop of up to 80%.

BitcoinBTCNVDA), and the stock of Nvidia (NVDA), are more closely aligned than they have ever been in the previous year. This has market watchers concerned about an impending crash, like the one that occurred during the dot-com boom in the late 90s.

Crypto crash risk: AI on AI deals that are too risky

BTC’s 52-week relationship with the leading chipmaker of the world grew to 0.75 on Friday. The news comes at the same time that Nvidia, and Bitcoin have both reached record highs.

Nvidia’s stock price rose 43.6% over the last year to $195.30, and Bitcoin’s value grew 35.25% on Monday, surpassing $126.270.

Lockstep rallies may indicate traders are treating each other differently Bitcoin as a high-beta tech asset. But the similarities also fuel fears of an AI bubbleSome analysts have drawn comparisons with the dotcom boom of late 1990s.

Market Commentator The Great Martis said AI-crypto rallies may not be the best way to promote a “double bubble.”

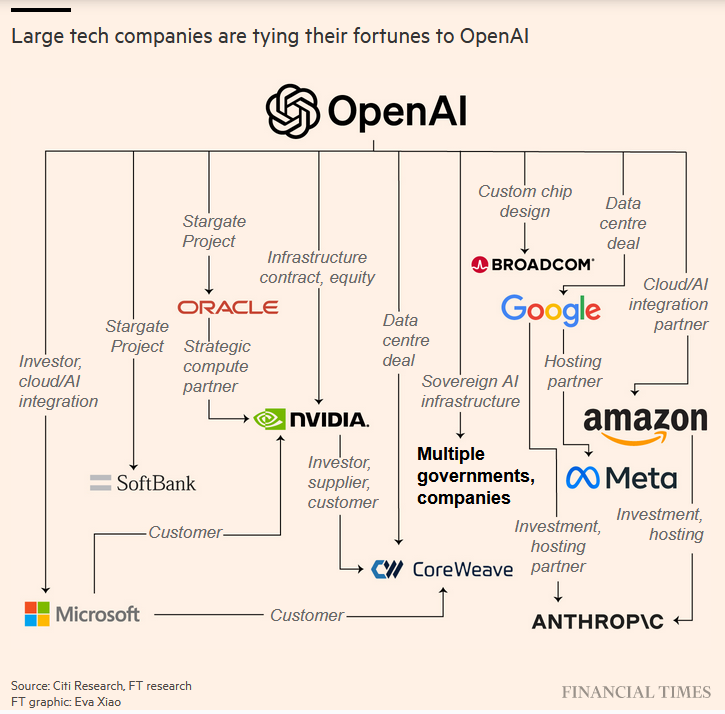

This frenzy is evident in the surge of AI-related deals. OpenAI is this week. agreed OpenAI will be one of AMD’s largest shareholders. AMD plans to invest tens or hundreds of millions of dollars in AMD chips.

It creates a loop of investment among a small group AI companies. OpenAI signed a $300 Billion deal, as an example. with Oracle.

Oracle also serves as Nvidia’s strategic computer partner. Nvidia plans, by the way to invest in OpenAI $100 billion.

CoreWeave, a cloud-based company also owned by Nvidia and OpenAI, is one of the companies that both invest heavily in. Nvidia bought services worth $6.3 billion, while OpenAI pledged up to $22.4.

This is a self-reinforcing investment loop that keeps the money flowing in one small circle. This self-reinforcing cycle is now referred to as a “massive red flag.”

When comparing the current situation to that of the bubble in dotcoms, Cisco funded gear purchasesThe bubble inflated valuations and fueled demand for the company’s own network infrastructure.

“People often forget that the Dotcom bubble caused an 80% Nasdaq crash,” He added, “The Great Martis”

“Today, similar irrational exuberance and a trillion-dollar crypto sector resembling a Ponzi scheme exist.”

“AI, crypto, quantum, nuclear” Bubble warning

Adam Khoo is a trader and an educator warns Bitcoin could be the worst-performing cryptocurrency when the AI/crypto boom ends.

Related: Crypto treasury companies pose a similar risk to the 2000s dotcom bust

Khoo recalls that during the 2000–2002 crash, Warren Buffett’s Berkshire Hathaway gained 80% by avoiding the tech sector entirely and holding profitable companies such as Coca-Cola, American Express and Moody’s.

“Money ran out of tech and flowed into all the non-tech,” Khoo says, adding:

“When the AI/Crypto/Quantum/Nuclear bubble bursts, the overvalued and unprofitable names in these sectors will drop 50% to 80%.”

Buffett doesn’t own Nvidia shares or AMD.rat poison squared” BTC. Instead, he is sitting on an record $350 billion cash pileBerkshire’s cautionary stance before the burst of the 2000 tech bubble was echoed.

This article contains no investment recommendations or advice. Each investment or trading decision involves some risk. Readers should do their own research before making any decisions.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com