Bitcoin broke a new record over the weekend. This prompted analysts to suggest a renewed phase of accumulation that could drive a rise to $150,000 or more before the year’s end.

BitcoinBTCSet a new timer all-time high above $125,700The market cap briefly passed the $2.5 billion milestone. in crypto historyCointelegraph published an earlier report on Sunday.

The rally was supported by multiple macroeconomic factors, including the recent US government shutdown — the first since 2018 — which some analysts say has renewed interest in Bitcoin’s store-of-value role.

In the past similar circumstances have led to “major price milestones,” Fabian Dori is the chief investment officer of digital asset bank Sygnum Bank.

US Government Shutdown has “renewed discussion around Bitcoin’s store-of-value role, as political dysfunction underscores interest in decentralised assets,” Dori tells Cointelegraph. “At the same time, the broader environment — characterised by loose liquidity conditions, a service-led acceleration in the business cycle, and narrowing underperformance relative to equities and gold — has drawn attention to digital assets,” He also added.

Jake Kennis a senior researcher at Nansen told Cointelegraph the effect of a government shutdown on the cryptocurrency market would ultimately be determined by how the US Federal Reserve views interest rate decisions.

“Crypto markets could benefit from a shutdown resolution if it reduces uncertainty and pushes the Fed toward a more dovish stance,” Kennis Added.

Some analysts saw the shutdown of government as an indication that a possible crypto market bottomKennis stated that it was “premature to call this a local market bottom,” Confirmation would be required “multi-week stability above key support levels.”

Related: Bitcoin ETFs kickstart ‘Uptober’ with $3.2B in second-best week on record

Bitcoin enters new accumulation phase

Analysts believe that Bitcoin’s recent rise is an indication of a new phase in which large companies are accumulating assets. Data from onchain suggests there has been a drop in whales selling their Bitcoins.

“Market data indicates the current price action may be linked to an accumulation phase,” Dori, the Sygnym Bank Dori.

“Selling pressure from long-term holders appears to be easing, while short-term investors show signs of stabilisation after a period of realised losses.”

There are periods of “cooling speculative activity and steadier positioning” He added that significant Bitcoin rallies have always been preceded by a period of volatility.

Related: Crypto trader turns $3K into $2M after CZ post sends memecoin soaring

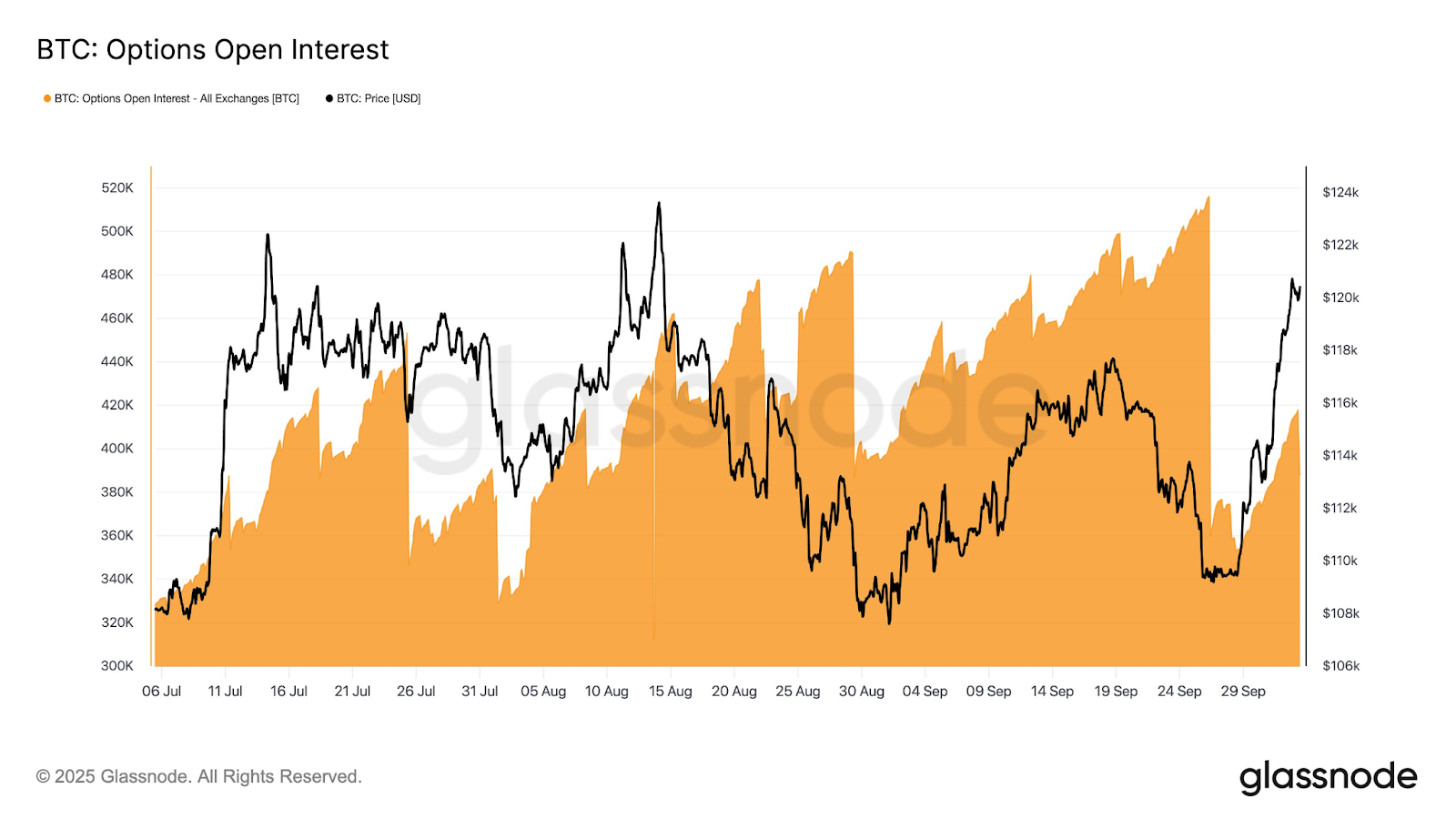

Bitcoin’s interest is open “reset sharply” What may have happened after the expiry date of last week? “set the stage” The fourth quarter is approaching. according Glassnode is a blockchain-based data platform.

Analysts predict that Bitcoin will gain more popularity as a result of the slowdown in speculative activities. breakout to $150,000 Charles Edwards said at Token2049 that BTC could reach $120,000 in 2025, provided it maintains its momentum.

Magazine: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com