Trust is a good thing

Editorial policy focused on accuracy and relevance.

Expertly crafted by experts in the industry and thoroughly reviewed

Reporting and Publishing at the highest level

A strict editorial policy that emphasizes accuracy, relevancy, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin (BTC), with a price of $82,346 is still trading below the $90,000.000 psychological level. It is down 24.3% since its January high of $109,000.

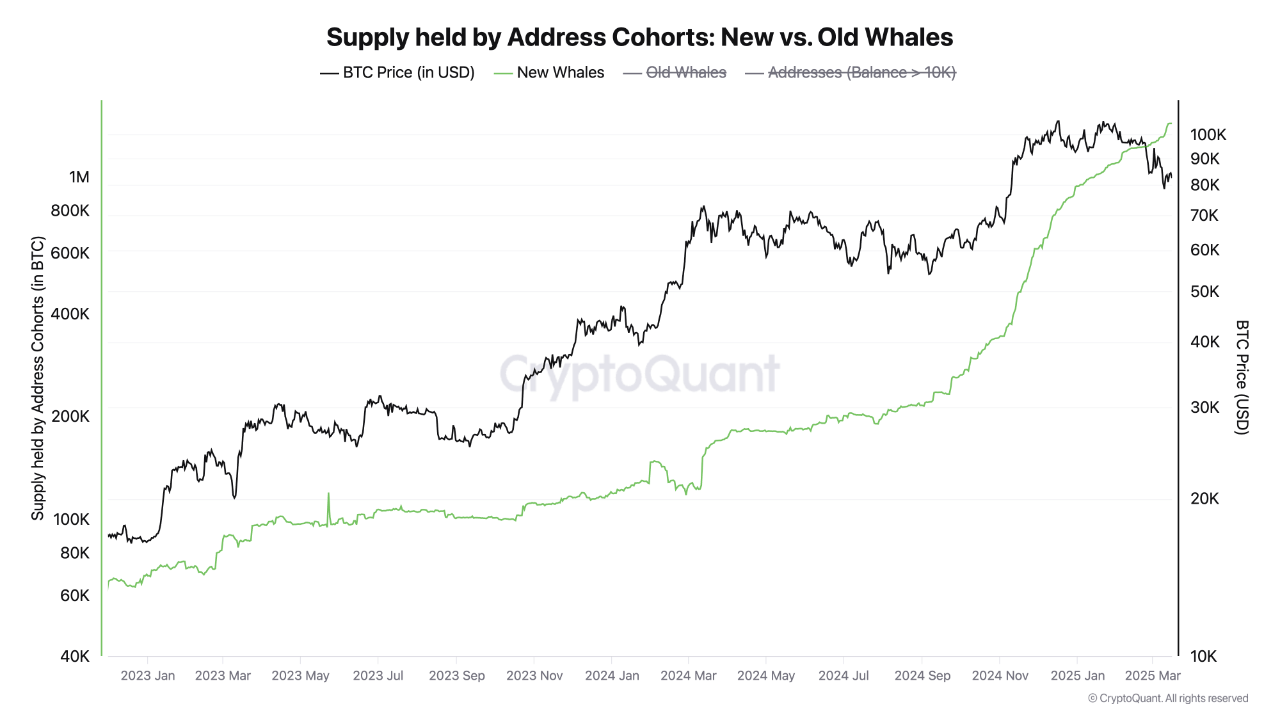

New on-chain data indicates that, despite this decline, a surge in high-net worth investors or “new whales,” The market could be affected by the aggressive accumulation of BTC.

According to CryptoQuant analyst onchained, a distinct group of Bitcoin holders with at least 1,000 BTC—acquired within the past six months—has been actively accumulating.

The trend that began in November 2024 has increased significantly over the last few weeks. These new whales have amassed more than 1 million BTC and added more than 200,000 BTC this month.

Read Related Articles

The New Whales Drive the Market Upsurge

Onchained’s analysis shows that the unprecedented trend of accumulation indicates a strong belief in Bitcoin’s future. This rapid increase in whale investments suggests institutional investors and high-net worth individuals. increasing their exposure Bitcoin

This data also indicates that these holdings were retained by investors for short time periods, less than six months. It is clear that they see the value in the investments. current price levels And are willing to keep their investments despite the fluctuations of the market.

This accumulation trend could be a powerful support for Bitcoin in the months to come. Onchained speculated as well that Bitcoin would also revisit its all-time high The price could rise to $150,000 and even higher.

Market conditions, liquidity and investor sentiment are key factors in determining whether this trend will continue.

New Bitcoin Whales: The Surge

“Since November 2024, these wallets have collectively acquired over 1 million BTC… Their accumulation pace has accelerated notably in recent weeks, accumulating more than 200,000 BTC just this month.” – By @0nchained pic.twitter.com/jVsFPjY8WA

— CryptoQuant.com (@cryptoquant_com) March 18, 2025

Bitcoin demand is declining.

BilalHuseynov from CryptoQuant has stated that the accumulation of whales is indicative of a long-term investment. potential concerns Bitcoins’ demand has been growing.

It is not a good idea to use the word “you” analysis It is shown that Bitcoin’s demand peaked both in March and in December of 2024. For the first two time, demand has peaked so closely together. Following the peak of March, there has been a noticeable decline in demand.

Read Related Articles

BilalHuseynov compares the current market trend with previous cycles. Specifically, the period 2017-2018, where momentum peaks followed by price fluctuations, and then a decline in demand.

Bitcoin has seen a significant increase in its value since the beginning of 2014. demand may be softeningThis could have an impact on price movement in the short term.

TradingView chart and DALLE created the feature image.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com