Why trust?

A strict editorial policy that emphasizes accuracy, relevancy, and impartiality

Expertly created and reviewed by professionals in the field

Highest standards of reporting and publication

A strict editorial policy that emphasizes accuracy, relevancy, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

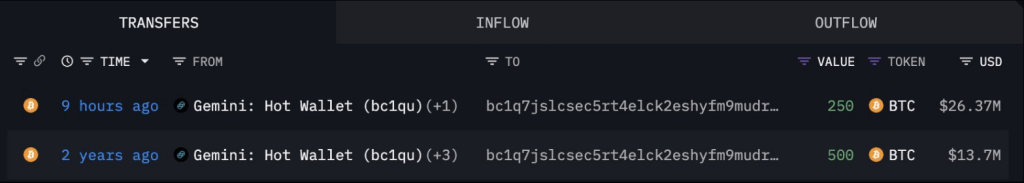

According to reports, the long-dormant Bitcoin This week whale surprised the market by buying 250 BTCs for only about $26.37 million. The wallet is active for the first time in more than two years.

Read Related Articles

Traders and analysts have been talking about the purchase. Others see this as an indication that the big players will be taking more actions in the coming weeks.

Whales Return to the Sea after Two Years

Lookonchain’s data indicates that both are true whale In 2022, when Bitcoin traded at $27,400 per coin, the whale pulled out 500 BTC from Gemini, which was worth over $14 million. BTC has hovered around $105,000 for the past few months, and now, this whale holds a gain that is unrealized of nearly $39 million.

This kind of margin gets attention. These moves are often closely watched by other large holders. Some people wonder whether this represents a trend that will spread or if it is just a wallet playing around.

Whale that was dormant 2 years purchased another 250 $BTC(26.37M USD) 9 hours back

This whale retreated 500 metres 2 years ago. $BTCGemini has a $13.7M profit at $27.401 and a $39M unrealized gain.https://t.co/c0U92isSfc pic.twitter.com/vcb4V3M0Uz

— Lookonchain (@lookonchain) June 8, 2025

Early Bets Offer Big Profits

Bitcoin has seen massive gains over time for early adopters. This whale made a withdrawal in 2022, just before the price surge of several years. Bitcoin’s price has increased by nearly 3000% since then.

It’s not for everyone. Many small investors are left behind by a wallet that is this large. Even so, traders have said that it may create an optimistic ripple. Retail traders can sometimes buy in to chase the same gains as big holders.

Tech Indicators Give Mixed Signals

BTC appears to be forming an inverse cup and handle pattern on the charts with $100,800 as a major support. Price has dropped into handle phase, and a drop below $100,800 can propel Bitcoin towards $91,000 which is its 200-day moving exponential average (EMA).

Bitcoin’s relative Strength Index (RSI) stands at 52. It indicates that the bullish trend is fading. Falling below 50 may increase selling pressure. BTC’s bulls must recapture resistance at the 20-day EMA which is located just over $105,000.

Read Related Articles

Market Volatility and Liquidations

There were some wild price movements last week fueled in part by social media battles Elon Musk, a billionaire and US president Donald Trump met for a meeting. The price of bitcoin fell below $101,000 for a moment, causing close to $1 billion in liquidations across futures markets, before recovering to above $105,000 within hours.

CryptoQuant’s Hash Ribbons also showed the signal of miner surrender. This could mean near-term hardship for those who are in worse shape, with potential future rallies if and when they pull through.

Chart from TradingView, image is from Unsplash

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com