VanEck’s director of research, has pitched to the company a type of US Treasury bonds partially backed up by Bitcoin that could help refinance US debt of $14 trillion.

Matthew Sigel pitched The concept of “BitBonds” — US Treasury bonds with exposure to Bitcoin (BTC) — at the Strategic Bitcoin Reserve Summit 2025 on April 15.

Sigel, in a bid to appeal both to US Treasury and international investors, stated that the new 10-year bonds will be comprised of 90% US debt traditional and 10% BTC exposure.

Bitcoin is still a good option, even if it’s not the only one. “goes to zero,” BitBonds will allow the US the opportunity to reduce the amount of money needed to refinance debts that are estimated to reach maturity in three years.

Bitcoins to increase investor demand in T-bonds

“Interest rates are relatively high versus history. The Treasury must maintain continued investor demand for bonds, so they have to entice buyers,” Sigel spoke during the virtual event.

Bond investors are looking for protection against the US dollar and asset inflation. Bitcoin is a great fit to be a part of a bond as it has become a popular cryptocurrency. inflation hedge.

Matthew Sigel’s Bitbonds talk at the Strategic Bitcoin Reserve Summit, 2025. Source: Matthew Sigel

The proposed structure would allow BitBonds to return an average of 8% per year. “$90 premium, along with whatever value that Bitcoin contains,” Sigel said, adding that the investors will receive their Bitcoin gains to a maximum yield annualized to maturity of 4,5%.

“If Bitcoin gains are big enough to provide that above a 4.5% annualized yield, the government and the bond buyer split the remaining gains 50 over 50,” The executive said.

There are both upsides and downsides

Sigel explained that the 10-year BitBonds offer investors substantial gains compared with standard bonds in the event Bitcoin gains surpass the break-even rate.

Bitcoin’s downside is the fact that it must be able to reach a certain level of acceptance. “relatively high compound annual growth rate” He added that the investor must be able to make a profit by using lower coupons rates.

Source: Matthew Sigel

The government saves money if it is able to buy the bond with a coupon rate of 1%. “even if Bitcoin goes to zero,” Sigel estimated, adding:

“The same thing if the coupon is sold at 2%, Bitcoin can go to zero, and the government still saves money versus the current market rate of 4%. And it’s in these 3% to 4% coupons where Bitcoin has to work in order for the government to save money.

Previous BitBonds pitches to the government

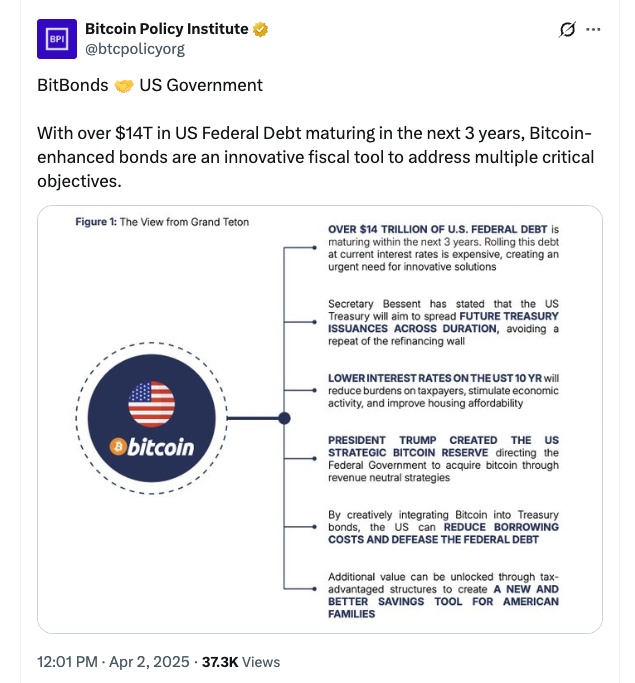

While the idea of crypto-backed government bonds is not new, Sigel’s BitBond pitch follows a similar proposal by the Bitcoin Policy Institute in March.

The BPI estimates the program could generate potential interest savings of $70 billion annually and $700 billion over a 10-year term.

Treasury bonds are debt securities To investors who give money to the government as a loan in return for receiving future dividends with a predetermined interest rate.

Related: Bitcoin could hit $1M if US buys 1M BTC — Bitcoin Policy Institute

Investors can gain access to potentially greater rewards by investing in crypto-enabled bond.

Source: Bitcoin Policy Institute

US government grows bullish on crypto The narrative of possible Bitcoin-enhanced Treasury bond has risen under the Trump administration.

Magazine: Bitcoin eyes $100K by June, Shaq to settle NFT lawsuit, and more: Hodler’s Digest, April 6 – 12

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com