BitcoinBTCOn March 14,, which had been in place for more than 12 years now, broke a trendline of rising support against gold (XAU).

Weekly performance of the XAU/BTC rate. Source: TradingView/NorthStar

NorthStar, a well-known analyst says this breakdown could spell the end of Bitcoin’s 12-year bull run if it stays under the gold trendline for even a week or—worse—a month.

Has Bitcoin’s bull run ended? We’ll take a closer at BTC’s relationship with gold.

Bitcoins’ uptrend is cooling as Gold’s record rises.

BTC/XAU broke down as gold spot rates reached a record-high of $3,000 an ounce, on 14 March after rising 12.80% in the past year.

Bitcoins, also known as “digital goldSince 2025, the number of “has dropped by 11%.

Chart comparing BTC/USD and XAU/USD performance over the last 12 months. TradingView

This is due to the divergent net flows of US spot ETFs tracking Bitcoin or gold.

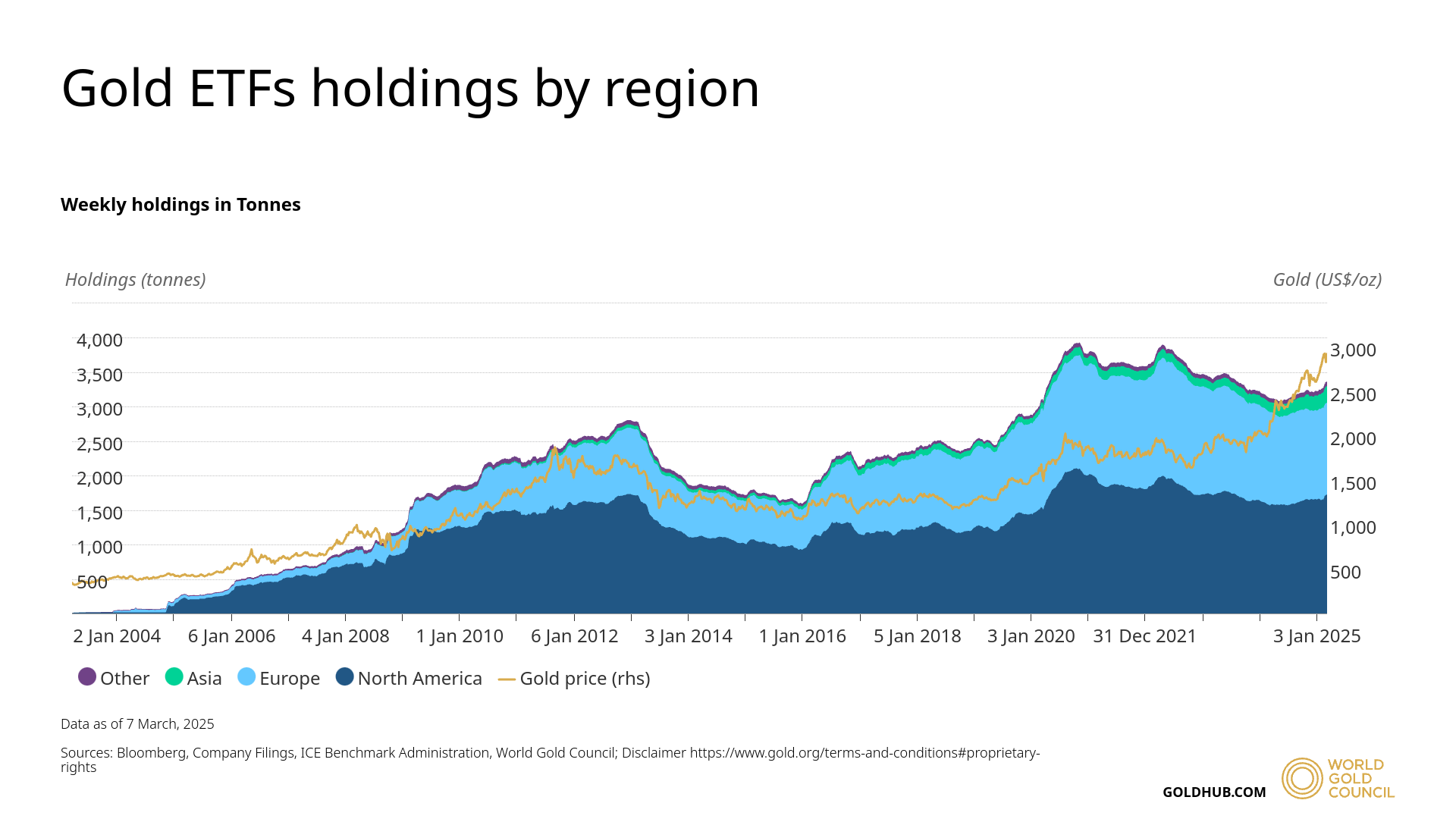

Data resource reports that as of the 14th March, US-based gold spot ETFs have attracted collectively over $6.48bn YTD. World Gold Council. Inflows into gold ETFs totaled $23,18 Billion globally.

Weekly holdings of Gold ETFs in each region Source: GoldHub.com

The US-based spots Bitcoin ETFs Glassnode, a data-platform on blockchains, reports that the outflows have reached nearly $1.46 Billion YTD.

US Bitcoin ETFs net flows year to date. Source: Glassnode

This divergence is driven by growing macroeconomic uncertainties. risk-off sentimentThe President Donald Trump’s policies have exacerbated the problem. aggressive trade policies.

Related: Bitcoin panic selling costs new investors $100M in 6 weeks — Research

New tariffs Fears of an economic downturn in China, Mexico and Canada has accelerated, driving investors to traditional safe havens like gold.

While central banks have accelerated gold purchases in countries such as the US, China and UK, gold prices continue to rise.

Source: GoldHub.com. Source: GoldHub.com

Bitcoin, on the other hand, reflects the riskier market. The Nasdaq Composite Index and Bitcoin’s 52-week correlation coefficient was 0.76 as of 14 March.

BTC/USD vs. Nasdaq Composite 52-week correlation coefficient chart. TradingView

Bitcoin: has the price reached its maximum?

It is important to note that the word “you” means “you”. current Bitcoin-to-gold breakdown aligns with historical patterns, particularly the March 2021–March 2022 fractal, which preceded the last bear market.

The BTC/XAU rate then showed a divergence that was bearish, with rising prices and a decreasing relative strength index.RSI). This pattern suggests a diminishing upward movement.

BTC/XAU performance two-week chart. TradingView

Consequently, initially, the ratio retreated towards the support level of the exponential moving average for two weeks, 50 periods, before finally plummeting to 60%.

The BTC/XAU decline coincided with Bitcoins 68% drop against the US Dollar.

Two-week BTC/USD Performance Chart. TradingView

BTC/XAU has once again completed a two-phase EMA retest, echoing the 2021–2022 fractal.

Two-week BTC/USD Performance Chart (zoomed). TradingView

The RSI is showing a bearish divergence. This suggests that momentum may be fading. Further declines are more likely, particularly if the ratio falls below the support of the 50-2W EMA (26 XAU).

This could be a sign of Bitcoin’s vulnerability to price drops in dollars, the 50-2W EMA being the target for the next downside.

BTC/USD 2-W Price Performance Chart TradingView

Bitcoins’ record high was $110,000, a drop of about 40%.

Still, Nansen analysts consider Such a decline is a “correction within a bull market,” raising possibilities of a bullish revival if the 50-2W EMA holds as support. Bitcoin could fall into bearish territory if the EMA is broken.

If this Bitcoin-gold fractal is repeated, the 2025 Bitcoin downside target could be pushed to $34,850 based on the 200-period EMA of two-weeks (the blue waves).

This article contains no investment recommendations or advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making their final choice.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com