Quicktake: A Recent Analysis of the on-chain analytics platform CryptoQuant highlighted how Bitcoin’s short-term holders’ (STH) The behaviour of 2019 is very similar. Bitcoin is below $6000, continuing a downward trend that began in September.

Bitcoin Short-Term Investors Peak Similar to 2019 Structure

CryptoQuant contributor Avocado_onchain noted There was a “small peak” Unspent Transaction Outputs under six-months, which looks similar to a structure that was observed in 2019. Analyst explained that UXTOs below six months were new investors or short-term holders who entered the market in March this year, when Bitcoin hit an all-time high. new all-time high (ATH).

The analyst believes that the decline in UXTOs is a sign of investors either leaving the Bitcoin market because the price has been choppy since March. Or, they have held Bitcoins and are now transitioning to long-term holders (UTXOs older than 6 months)

Charts showed that the same structure was present around Bitcoin’s local high in 2019, when Bitcoin experienced a halving. Then, Bitcoin’s price It took Avocado_onchain almost 490 calendar days for the new high to be reached, but the COVID-19 epidemic was also a factor.

Even though the price of Bitcoin is still choppy, this development provides insight into the future prospects for the crypto. Avocado_onchain stated that he was confident in Bitcoin’s future. long-term upward trend. He believes that investors should be cautious in the near term. “temper expectations and closely monitor the market.”

The analyst acknowledged that there was no single trigger that would cause Bitcoin to surge in price, but he also noted that new capital has been crucial for the past few years. Bitcoin reached a new ATH after the launch of The Spot Bitcoin ETFsThe new currency introduced into the Bitcoin eco-system was.

Bitcoin Continues to Show a Bearish September Trend

Bitcoin continues to be a popular cryptocurrency bearish September trend The flagship crypto has already dropped by more than 4% in the first month of this year. Historically, September This month is generally a bearish one. data Coinglass data shows that Bitcoin suffered monthly losses in six of the seven previous Septembers, going back to 2017.

Related Reading

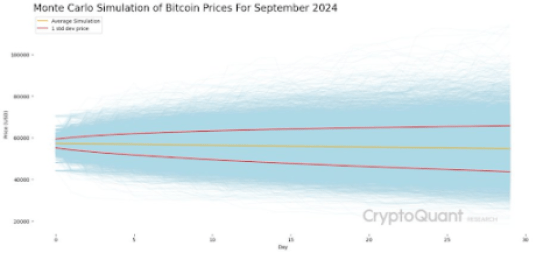

Follow his simulation CryptoQuant’s head of research, CryptoQuant, has a look at the price of Bitcoin for this month. Julio MorenoMoreno had said that the crypto’s flagship could, in average, end up at $55,000 per month. Moreno had earlier mentioned A drop of Bitcoin below $56,000 puts it at greater risk for a price correction, and the possibility that the cryptocurrency will enter a long-term bearish phase.

The crypto community is hoping that at the next FOMC meeting scheduled on September 17-18, 2018, the US Federal Reserve cuts rates. Rate cuts are a possibility. believed To be the one who could cause Bitcoin to rise and achieve a breakout over $60,000.

Bitcoin’s price is currently around $56,400. This represents a drop of over 4% from the previous 24 hours. data CoinMarketCap.

Featured Image created using Dall.E and chart from Tradingview.com

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com