BitcoinBTC) price hit a new all-time high above $123,231 on Wednesday on Coinbase, following a similar performance from the S&P 500 which rallied to a record high of 6,457.

Bitcoins’ ascent to new heights follows a day after US CPI data for July showed that inflation was at 2,7%, unchanged since June but below the expected 2.8%. Overall CPI was up 0.2% in July compared with a 0.3% gain in June.

The CME FedWatch tool, which tracks the Federal Reserve’s meeting scheduled for September, showed that market odds increased to 93.9% following the release of this report.

Bitcoin has historically benefited from Fed rate reductions and a move away from quantitative tightening. Some crypto-investors also believe that the One Big Beautiful Bill, the economic agenda of US President Donald Trump, will lead to heightened spending and inflation in financial markets.

The recent inflows into the Bitcoin and Ether ETF spots has also attracted traders’ interest and contributed to the overall bullish market sentiment. Farside Investors X shows that the BTC ETF saw netflows of $65.9 millions, while the ETH ETF instrument had $523.9 in purchases.

The ETH ETF received its first $1 Billion inflow on Tuesday. While the Bitcoin ETF’s netflows are slowing, it has still seen $1.02 Billion inflows from Friday. The success of ETH is having a cumulative effect on Bitcoin and other altcoins.

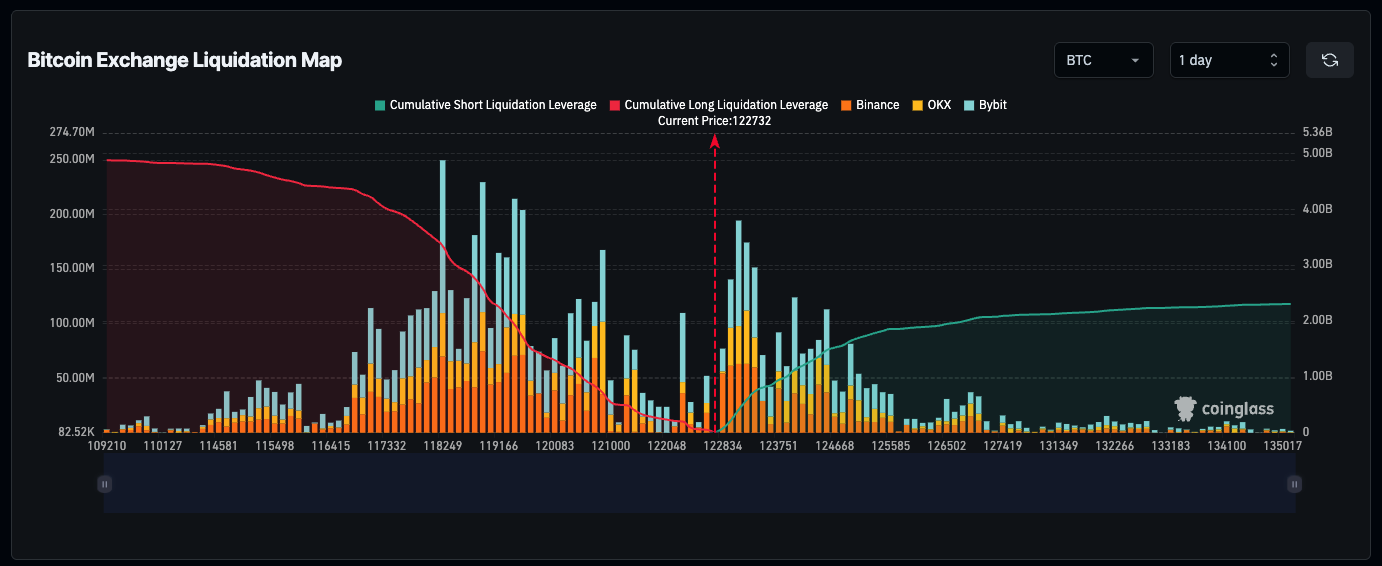

Hyblock’s liquidation heatmap shows Bitcoin moving through a cluster of short positions starting at $122,500. There is still room to close more positions up until $124,000. CoinGlass data suggests nearly $2 billion of short positions may be forced to liquidate if BTC is pushed past the 122,800-to-125,500 cluster.

Related: Bitcoin bulls charge at all-time highs as trader says $126K ‘pivotal’

Bitcoin’s new record high brings its total market capital to a staggering $4.15 trillion.

This article contains no investment recommendations or advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making a final decision.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com