The key takeaways

-

Bitcoin prices are falling but BTC dominance continues to rise.

-

The institutional investor’s appetite for Bitcoin is evident in the large purchases made by Strategy BTC and spot BTC ETFs.

Bitcoin’s (BTC) price has dropped by 4.3% in the last three days after nearly reaching $97,900 on May 2. Some traders have expressed disappointment that despite showing resilience on the level of $94,000 in May 5, strong institutional flows were not enough to sustain bullish momentum. There are several signs that suggest a new Bitcoin high in 2025 may be within reach.

Bitcoin has risen to 70% dominance of the cryptocurrency market, which is its highest level since January 2021. It has happened despite a flurry of new tokens, which include several top-50 projects, including SUI, Toncoin, Official Trump, PI, Bittensor, Ethena, and Celestia. Due to this dominance, riskier altcoins are less attractive for new market entry.

Bitcoin ETFs on the Spot $4.5 billion in net inflows The period between April 22 and may 2 is a time frame where the price of Bitcoin will be able to increase. The increasing demand for Bitcoin futures indicates a growing adoption by institutions, regardless of whether they are using leverage to protect against downside or make bullish bets.

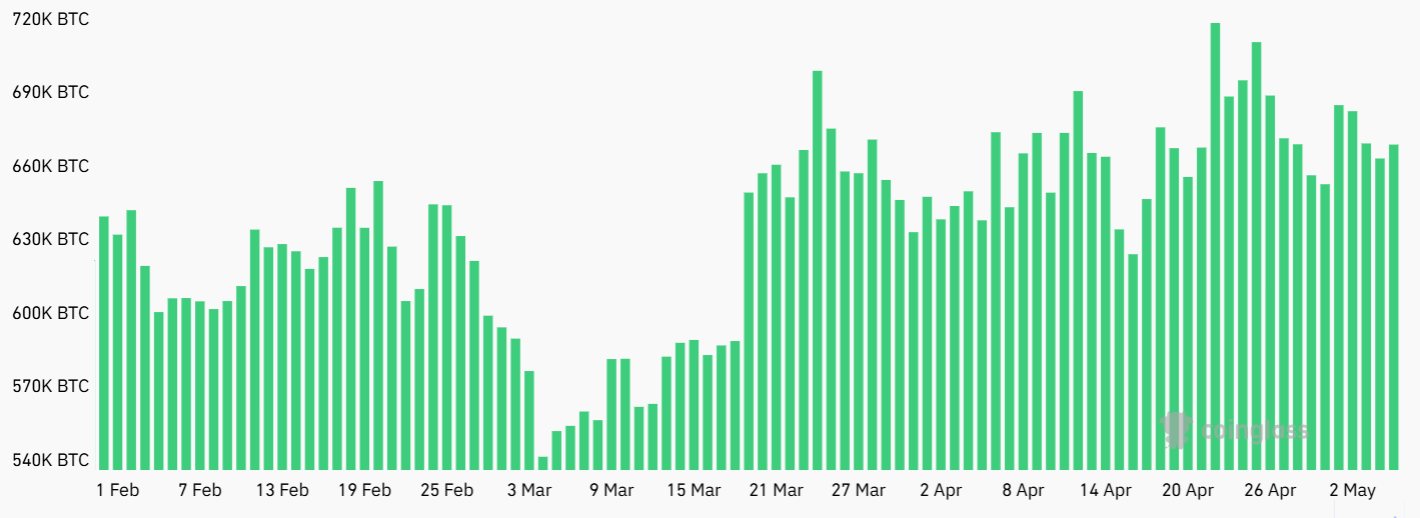

CoinGlass reports that there are currently a total of 146,438 coins. open interest Bitcoin Futures Markets have reached 669.090 BTC. This is a 21 percent increase from March 5th. Demand for leveraged position remained high even after Bitcoins’ price fell below $75,000 at the beginning of April. Open interest for BTC futures at the Chicago Mercantile Exchange alone is more than $13.5 billion. This indicates a robust demand from institutions.

Bitcoin’s struggle to return to the $100,000 threshold is due in part, according several factors. The traders who had bought Bitcoin in anticipation that the US would be introducing a new currency. Strategic Bitcoin Reserve Bill on March 6, as the government is yet to reveal its BTC assets or plans for future purchases. Similar state-level Bitcoin laws have failed in the past, and this latest bill is no exception. setback in the US state of Arizona.

Despite the trade war, Strategy has doubled its BTC plans.

Over the past three months, gold has outperformed most assets, rising 16%, while Bitcoin has declined by 5% and the S&P 500 has corrected by 6.5%. This has challenged the notion of Bitcoin as an uncorrelated asset, as the cryptocurrency has repeatedly failed to decouple from the S&P 500 amid rising economic risks. Due to the trade war, investors have been inclining towards fixed-income investments and cash.

Bitcoin’s recent fall to $94,000 was particularly alarming, given that Strategy, an American-listed company headed by Michael Saylor announced the drop. acquisition of 1,895 BTC After doubling its plan, the firm announced a capital increase on May 5 to help fund additional Bitcoin purchases. Investors were initially unsure about Strategy’s capacity to raise capital. The announcement of the $84 billion increase in funding was therefore welcomed by investors. plan On May 1, this risk has been reduced.

Investors will need to be reassured that US-China relations are improving before Bitcoin can reach its next all-time record high. Tariffs have a negative impact on risk appetite. However, it appears that the elements are present for BTC to reach a bull run of over $100,000.

The information contained in this article is meant to provide general knowledge and not as legal advice. These are solely the opinions, views, and thoughts of the author and may not reflect the opinions and views of Cointelegraph.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com