Bitcoin is recovering after the recent US Consumer Price Index data. The asset fell to $116,000 on July 15 in response to the news that June’s inflation rate was 2.7%. continued concerns Tariffs raised by the Trump Administration

Bitcoin has risen 1.8% in the past 24 hour to $118.439 and this suggests some confidence among investors despite recent market volatility.

Analysts are tracking the market and on-chain activity closely to see if there is a short-term recovery. One of these contributors, Trader Oasis recently published an analysis CryptoQuant outlines various indicators related to Bitcoin’s movement.

Read Related Articles

Bitcoin Open Interest: Price Divergence and Institutional Signals

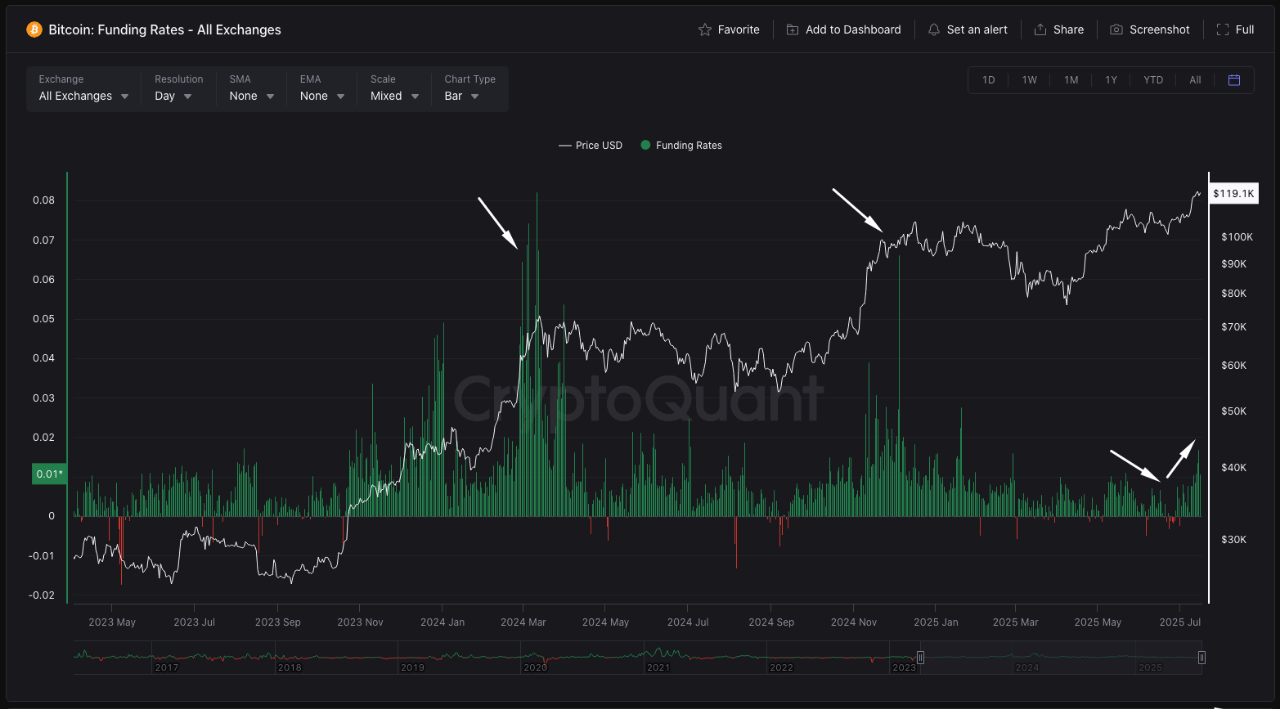

Analysts examined a variety of technical and behavior metrics including Coinbase Premium Index, open interest and funding rates that may be influencing BTC’s price behaviour and pointing to what lies ahead.

The Trader Oasis team began their analysis by pointing out that Bitcoin’s breaking of the $107,000 barrier signaled a potentially distribution phase. He noted that the a divergence between price The open interest signaled a positive trend before the asset rose.

Some see the current situation, in which both open interest and price are increasing at once, as an indication of a possible crisis. strengthening momentum In the market.

He also evaluated Coinbase Premium Index data, which is still above zero. This index, usually regarded as a sign of institutional interest, remains higher than 0. Oasis noted that, despite the price increases, this indicator has a flat pattern. This could indicate large companies are making profits. Source: CryptoQuant

Further, he suggested that an upward breakout could be triggered by a break above the trendline. However, a drop below zero may represent a signal for a new entry.

In terms of funding rates, the current increase reflects renewed market confidenceAlthough it remains below the extremes of previous levels, this is still a positive sign. According to him, this implies that, while there is enthusiasm, it’s not excessive.

Binance dominates the flow of realized funds, resulting in a rise in profit-taking.

The separate analysis By another CryptoQuant Contributor, Crazzyblockk. This contributor looked at the actual profit and loss across all centralized exchanges. Data shows Bitcoin investors have made a total of $9.29 billion profit on a single trading day. It is the highest ever for these flows.

The recent Bitcoin price surge has led to a large number of short-term investors taking profits.

Read Related Articles

Binance’s realized PnL is still below all-time records, but the share of profits has increased compared with other exchanges. Binance is credited with up to 60 percent of the realized profits on some days. shaping market behavior.

Crazzyblockk noted that the Binance user’s concentrated profits could be indicative of a change in market dynamics.

Binance’s dominance over realized PnL flows confirms the importance of its role for market sentiments and liquidity. To stay on top of volatility, traders and analysts must closely monitor Binance’s activity along with other exchanges.

Chart created by TradingView, DALL-E.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com