The key takeaways

-

Bitcoin bulls were surprised by the rally of BTC above $90,00,000.

-

Bitcoin’s rally is driven by the spot volume.

-

Liquidation of derivatives positions that have a bullish bias is still possible.

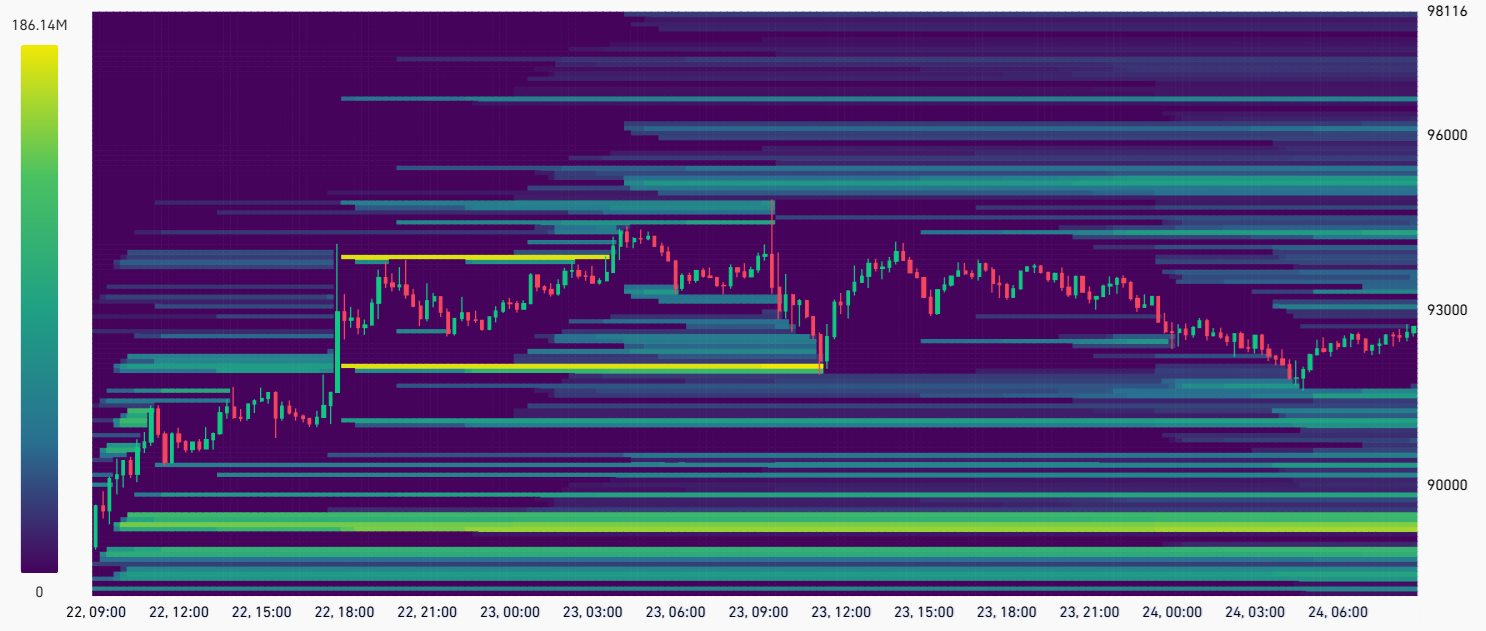

BitcoinBTC() was above $93,000 on the 24th of April, suggesting that the bear market which began at $74,400 and lasted 52 days may be coming to an end. Although Bitcoin has begun to decouple from the stock exchange, professional traders’ strategies haven’t changed, according to BTC futures data and margin markets.

Higher long-to short ratios indicate a tendency to buy long positions (buy), while lower ratios show a bias toward selling contracts (short). Binance’s top traders have a long-to short ratio of 1.5x. This is notably lower than the previous 2x. OKX’s long-to-short ratio reached a peak of 1.1x around April 17, but it has now dropped to 0.9x.

Bitcoin shines as dollar weakens and S&P 500 targets are slashed

Bitcoin’s 10% rise between April 20-24 coincided with President Donald Trump adopting a more accommodative stance on import tariffs, and also his criticizing of Federal Reserve Chairman Jerome Powell who had been criticized for keeping interest rates high. Trump announced on April 24 that he was announcing a 10% increase in Bitcoin between April 20 and 24, coinciding with softer stances from US President Donald Trump regarding import tariffs, as well as his criticism of Federal Reserve Chair Jerome Powell for maintaining high interest rates. “no intention” Powell is fired. This marks a significant shift in his rhetoric from previous statements.

Amid economic uncertainty, Deutsche Bank strategists have reduced their year-end S&P 500 target by 12% to 6,150. The US dollar has weakened In comparison to other major currencies the DXY fell below the 99 mark for the very first time in the last three years. Bitcoin, despite its modest 6% increase over the past thirty days, has secured a spot among the top eight trading assets in the world, with a total market capitalization $1.84 billion.

Bitcoin’s sharp rise above $90,000 surprised bears, and resulted in more than $390,000,000 in short-term (sell) leveraged futures. liquidations Between April 21-April 22. Open interest aggregate in BTC Futures has remained just 5% under its record high. That indicates that the bearish traders are not yet fully out of their positions.

CoinGlass estimates that an additional $700 millions in sell (short) futures could be liquidated if Bitcoin maintains its upward trend and breakss above $95,000. The potential for a short squeeze could prove particularly challenging for bears given the robust inflows Bitcoin ETFs totaled more than $2.2 Billion between April 21-23.

SoftBank Cantor and Tether have recently announced a joint venture. aims to accumulate Bitcoin Convertible bonds and equity financing could be used to further strengthen bullish arguments. The Named “Twenty One Capital,” Jack Mallers is the founder of Strike and his Bitcoin Treasury company will launch in April with 42,000 BTC.

Related: Sovereign wealth funds piling into BTC as retail exits — Coinbase exec

Top traders on BTC futures and margin markets have reacted with a muted reaction, suggesting that recent demand has come primarily from the spot market. This is considered to be a good sign for a long-term bull run.

As long as Bitcoin remains above $90,000. The more pressure there is on shorts. Because this level confirms that Bitcoin’s decoupling with the stock market. The confidence gained could be enough to push past the $100,000 psychological barrier.

This is not legal or investment advise. It is intended as general information only. This article is solely for informational purposes. It does not represent or reflect Cointelegraph’s views.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com