Trust is a good thing

Editorial policy that is strict and focuses on accuracy. relevance, impartiality, and relevancy

Expertly crafted by experts in the industry and thoroughly reviewed

Reporting and Publishing at the highest level

A strict editorial policy that emphasizes accuracy, relevancy, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

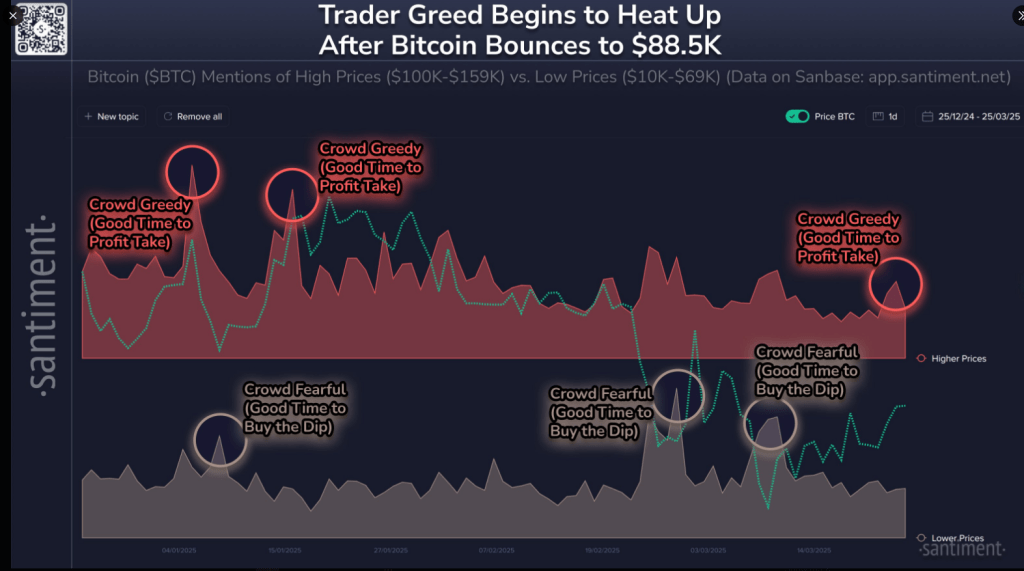

Bitcoin has once again become a hot topic. The price of bitcoin soared today to $88,500, enthusing traders who predict that it will soon reach $95,000. While optimism is high and caution is also, it is important to be cautious. Some analysts warn of a possible retreat down to $80,000, before the next rally.

Read Related Articles

The Greed of Traders

Santiment’s market intelligence reports show that crypto-investors are becoming greedier. Referrals to Bitcoin Social media has been flooded with posts about reaching $100,000, or as high as $159,000. Santiment says that while the hope of a price increase is driving all the hype, such spikes in greed usually occur before a change.

🤑 Crypto has rebounded well in the second part of March. Traders have returned to mild greed. After showing major fear in late February and early March following two stints of Bitcoin dipping as low as $78K, it appears that this rebound to $88.5K has… pic.twitter.com/WGvmvKSv2X

— Santiment (@santimentfeed) March 25, 2025

Early in the year, traders also held back when Bitcoin dropped to $78,000. The recent surge back up to $88,500 has changed general perception. Santiment believes that this could be a great time to sell.

Bitcoin Miners Retain Reserves

Bitcoin miners are confident in the future. CryptoQuant data shows that Bitcoin miners did not sell much Bitcoin in the last few months. Miner reserves currently total around 1.81 BTC or $159 billion.

Ali Martinez, a cryptocurrency analyst, confirmed on X in a post that no significant selling activity Over the last 24 hours, miners have been exhibiting a certain behavior. It could mean that the miners expect higher prices in the future and are holding onto their current earnings.

The Institutional Investors Grow With the Inflow of ETFs

Investors from the institutional sector are also playing an important role in boosting market momentum. The US Bitcoin ETFs recorded an inflow total of $27 millions on March 25. BlackRockThe largest asset manager led the charge with a $42 million increase in capital on that particular day.

BlackRock’s demand helped to push the overall trend in a positive direction. BlackRock’s assets are reflected in the company’s earnings. Bitcoin spot ETF Bitcoin holdings currently total a little more than 50 billion dollars, showing that institutional investors are still passionate about Bitcoin.

Read Related Articles

Analysts expect a short-term fall before rally

The technical analysis suggests that Bitcoin may experience a brief decline prior to the next high. Bitcoin’s 4-hour chart shows that it is struggling to break through a resistance trendline, creating what analysts call a “double top” formation. Pattern suggests a possible price decline towards $85,000.

According to the Fibonacci level of 61.80%, $86,146 is the level that represents the strongest support. Analysts indicate that if Bitcoin is able to remain above this level the price could rebound towards $95,000.

Chart by TradingView. Image from Gemini Imagen.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com