Trust is a good thing

Editorial policy that is strict and focuses on accuracy. Relevance, and neutrality

Expertly crafted by experts in the industry and thoroughly reviewed

Reporting and Publishing at the highest level

Editorial policy focusing on accuracy, relevance and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

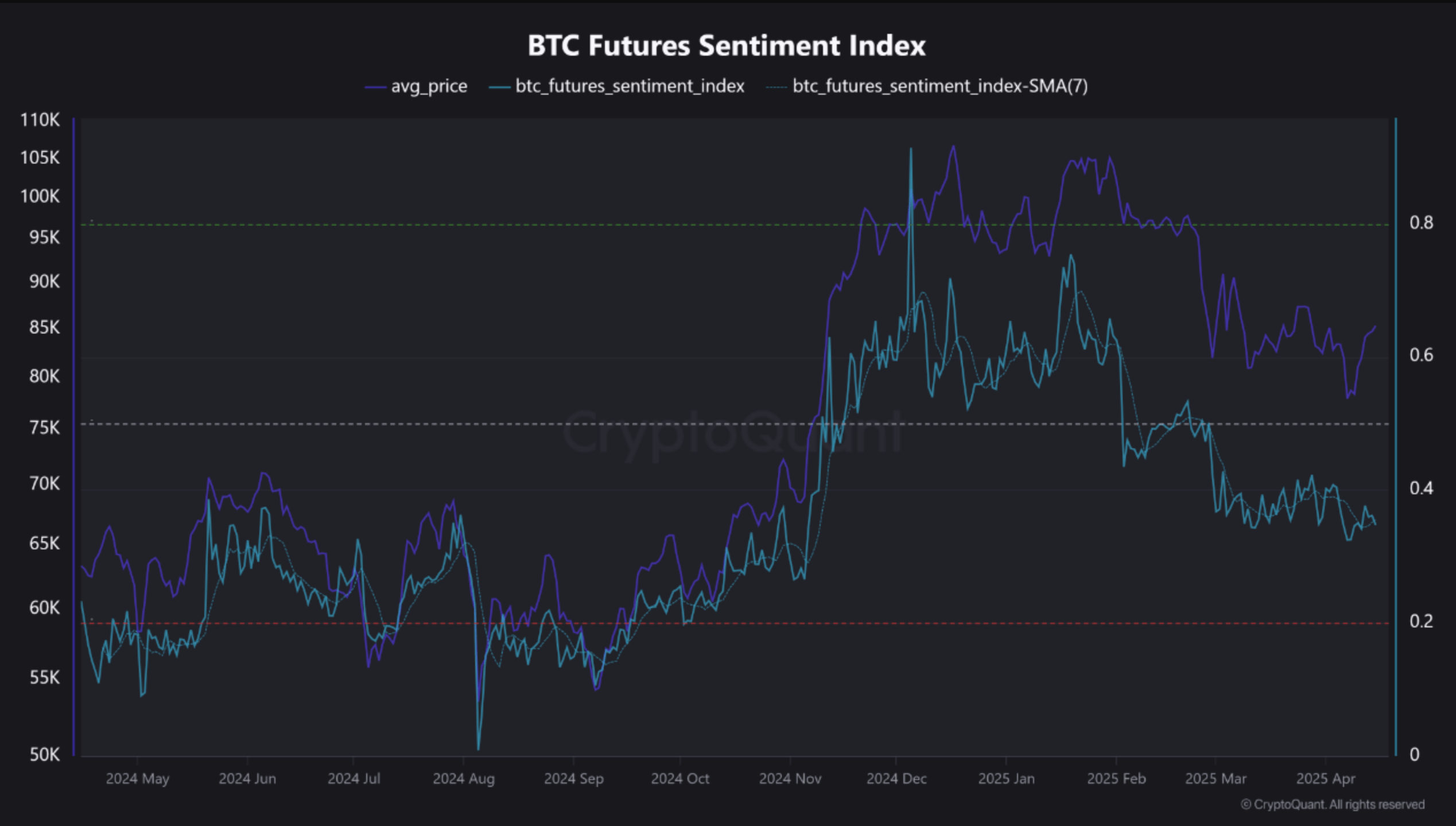

CryptoQuant Quicktakes have recently revealed some interesting facts. postWhile Bitcoin’s (BTC) price has steadily risen from November to February, the sentiment on the futures markets hasn’t reflected this.

Bitcoin Futures Sentiment Index Signals Warning

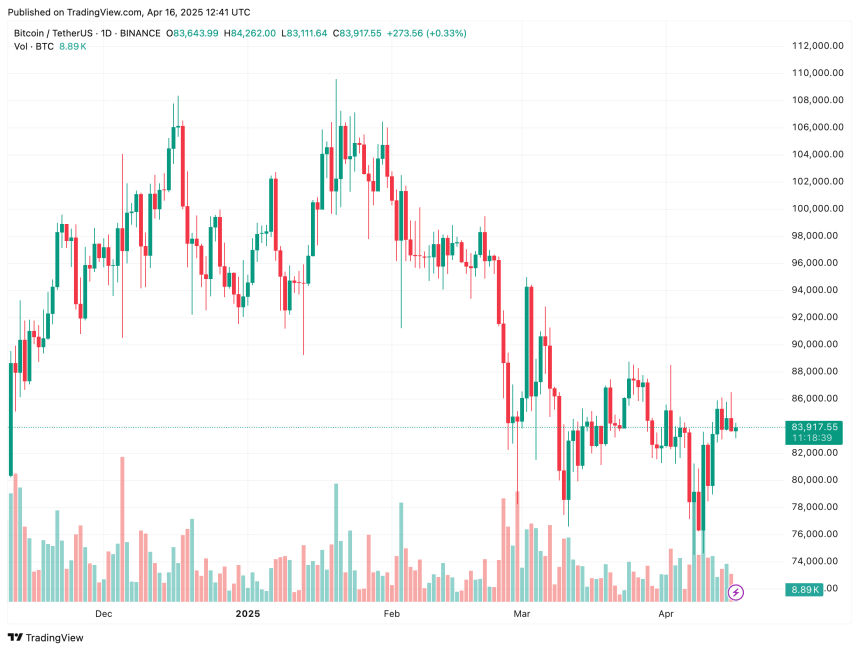

Bitcoin’s value soared from about $74,000 at the end of November 2024, to as high as $101,000 early in February 2025. However, following US President Donald Trump’s tariff announcements, risk-on assets – including BTC -have experienced a significant pullback.

Related Reading

The apex crypto has recovered from some recent losses after hitting a local potential bottom at $74,508 on the 6th of April. As of the writing date, the top asset digital is currently trading between $80 and $100.

BTC’s outlook for futures has declined since February despite the price recovery. Even though the price is near the local highs the sentiment on the futures markets has significantly cooled.

Abramchart, a CryptoQuant contributor, highlighted the divergence and noted that it may indicate increased caution or profits-taking behavior in spite of a bullish trend. The analyst said:

It could be due to macroeconomic uncertainties, regulatory worries, or anticipated corrections.

Looking at the BTC sentiment index, we can see a range of values between 0.8 and 0.22. Index is hovering at 0.4 currently, which indicates that futures markets are dominated by a bearish outlook.

Bitcoin’s average price also has been steadily declining since its high in early 2025. Now, it is ranging from $70,000-$80,000. It could indicate a lack of confidence in the market amid rising tariff tensions.

If futures sentiment stays low, BTC might face a price decline or consolidation in the short term. However, a new bullish catalyst can quickly change the mood and re-energize upward momentum.

Is BTC Close To A Momentum Shift?

Bitcoin could be about to break out, according to some analysts. On-chain metrics have been consolidating at around $80,000 for a few weeks. suggest BTC is undervalued in its current state. The Stablecoin Supply Ratio and BTC Exchange Reserves support this opinion.

Related Reading

The Relative Strength Index (RSI) of Bitcoin, which is calculated weekly, has also been shown to be a good indicator. begun to break out of a long-standing downward trendline – raising hopes for a potential bullish rally back toward $100,000.

However, several risks still remain. Recent developments have shown that there are still several risks. appearance of a ‘death cross’ on BTC’s price chart – combined with persistent macroeconomic concerns related to trade tariffs – could still weigh heavily on market sentiment. BTC was trading at $83,917 as of press time. That’s a drop of 1.8% in 24 hours.

Images from Unsplash and charts from TradingView.com, CryptoQuant

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com