Takeaways from the conference:

-

The growing demand for BTC miner deposits and put options highlights the increasing caution of traders, despite the price stability near $108,000.

-

Bitwise’s analysts claim that market corrections are usually preceded by deep falls in the sentiment of investors. “contrarian buying window”.

BitcoinBTC() dropped to $107 600 on Thursday. This prompted traders to wonder if Friday’s crash was a sign of the end to the bull market that reached its peak on October 6. The Bitcoin options market is a source of concern for traders, particularly amid the increasing miner withdrawals. This has pushed the support level to $108,000 into question.

Bitcoin delta skew is now above 10%. Professional traders are buying put (sell), a bearish sign. In neutral conditions, the indicator ranges from -6% to +6%. It is important to note that the skew of this indicator has worsened from Friday. This indicates traders’ growing doubts about Bitcoin’s bullish momentum.

US President Donald Trump has confirmed that the US-China trade war is still ongoing, which also affected market sentiment. Trump has warned that he will further restrict the trade between China and US following China’s suspension of US soya purchases. according Yahoo Finance. The uncertainty around US economic data during the government shutdown is another factor that adds pressure.

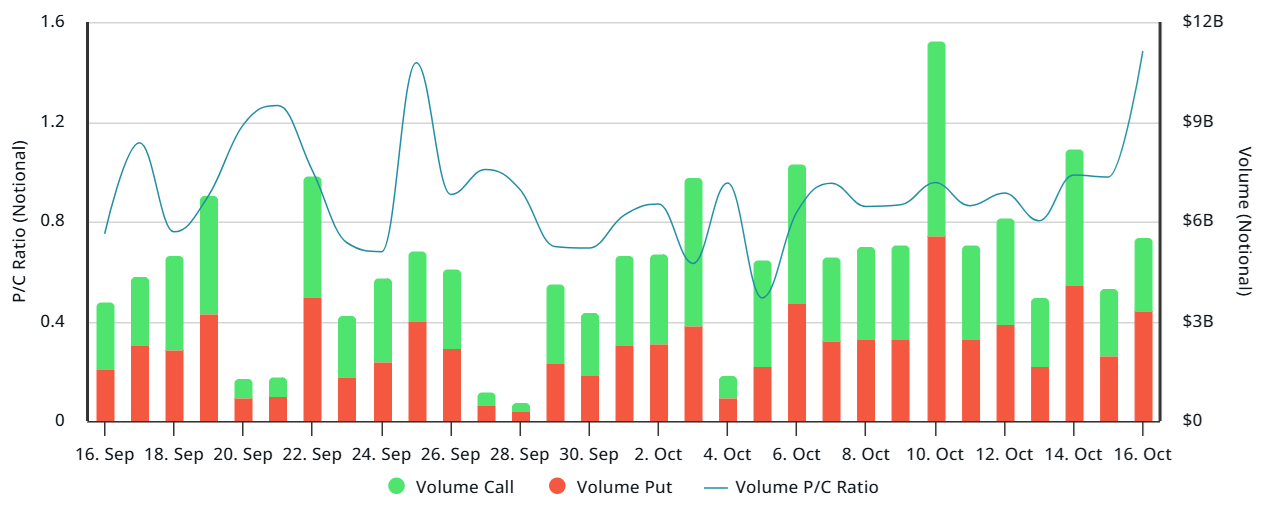

Deribit’s demand for protection against the downside surged Thursday, when trading volumes of put options outnumbered call options 50%. It was a sign that market pressure had increased. This indicator has reached its highest point in more than 30 days. A neutral reading of the put-to call ratio is around -20% for cryptocurrency traders, which favors calls.

Bitcoin derivatives only reflect a worsening US economic situation

As gold reached a new record on Thursday, investors’ sentiments have shifted. Demand for short-term US government bonds also spiked, even as two Federal Reserve Governors signaled further interest rate cuts in October — a move that typically reduces the appeal of fixed-income investments.

The yields of the US 2-year Treasury fell to the lowest levels in over three years. This shows that investors will accept lower returns for government-backed assets. While gold rose to $4,300 in September, a 23% increase, the central bank’s gold reserves now exceed their US Treasury holdings. according Reuters.

Despite positive developments in the tech sector, including chipmaker TSMC’s (TSM) upgraded 2025 outlook and strong quarterly results from Bank of America and Morgan Stanley, the S&P 500 fell 0.9% on Thursday. Dow Jones US Select Regional Banks Index fell 4.4% following two financial companies reporting losses on the private credit market. according The Financial Times

Related: SEC chair: US is 10 years behind on crypto, fixing this is ‘job one’

The movement of Bitcoin addresses that are linked with bitcoin miners has also caused concern. Data CryptoQuant’s analysis shows that over the last seven days miners have deposited over $5 billion worth of BTC on exchanges, which is the biggest outflow since the beginning of July. Analysis noted that this behavior usually precedes price declines, since miners are historically among Bitcoin’s biggest holders.

Bitwise analysts noted that while the Bitcoin options market has warned of a possible further decline in Bitcoin sentiment, extreme falls have occurred before. “marked favorable entry points,” Add to that “the recent correction was driven largely by external factors.” Bitwise head of research André Dragosch added that Friday’s liquidation event has set the stage for a “contrarian buying window.”

Bitcoin could still fall further, however, the increase in put option demand should not be interpreted as an indication of a sustained downward trend, because external factors may have made traders less risk-averse.

This is not intended as legal or financial advice. These are solely the opinions, views and thoughts of the author and may not reflect the opinions and views of Cointelegraph.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com