Trust is a good thing

A strict editorial policy focusing on accuracy, relevancy, and impartiality

Designed by professionals and carefully reviewed

Reporting and Publishing at the highest level

Editorial policy that is strict and focuses on accuracy. Relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Open interest in Bitcoin is crucial to determine the current mood of the market, and the potential movements of its price.

A rise in Bitcoins is theoretically possible. open interest This suggests that liquidity can be used to support a price trend.

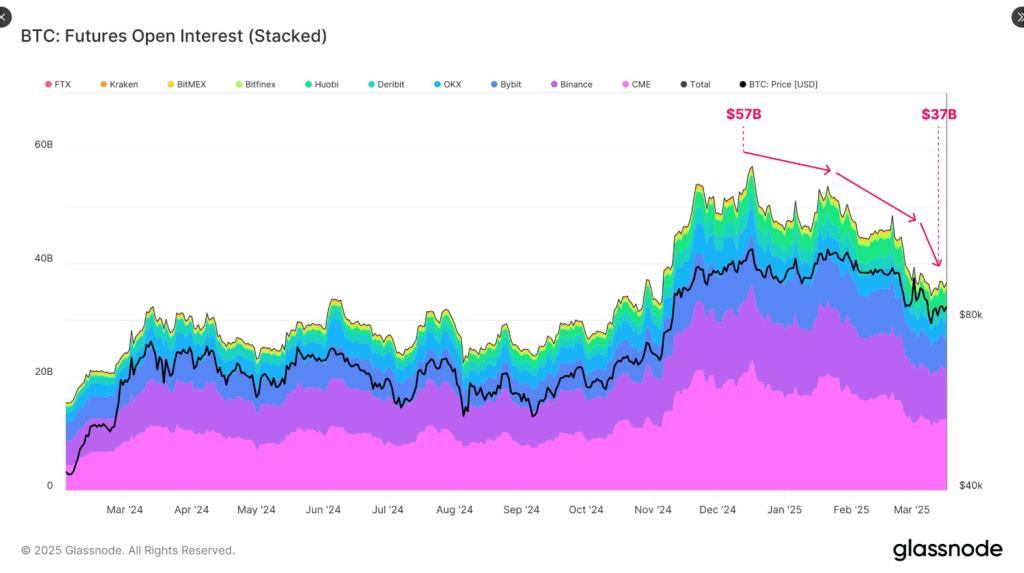

Glassnode has reported that Bitcoin OI is down from $57 billion (or a 35% loss) to $37 billion since its peak.

Read Related Articles

Bitcoin’s all-time record was $108,786 in January 20, the same day that Donald Trump began his second term as President of the United States.

Bitcoin The stock is now trading in the range of $83k-$86k, down by more than 22% since its high.

The Impact of Bitcoin Open Interest on Price

Open interest is a metric that investors and holders can use to gauge the market sentiment of an asset and its potential performance.

If the open interest of a digital asset is declining, it means traders or investors have closed their positions because they are uncertain or lacking confidence. They may also be moving away from trading leveraged.

Since then, the open interest for futures contracts has decreased from $57B down to $37B. #BitcoinATH of, indicating reduced speculation and hedging activities. The decline in liquidity on the chain is a reflection of a broader shift away from risk. pic.twitter.com/XPbXiHXlRS

— glassnode (@glassnode) March 20, 2025

Glassnode’s research shows that the decrease in Bitcoin OI is part of a wider trend where there are fewer transactions on the chain and fewer liquidities. This indicates investors’ lack of confidence in Bitcoin.

Bitcoins’ current state suggests that investors now prefer to trade short-term for gains, rather than long-term.

There’s A Shifting In Positions – Glassnode

Glassnode says that traders and investors have shifted to a cash-and carry trade with an overall decline in long positions. The CME closures of futures contracts and ETF withdrawals also reflect the shift in investor strategy, and add to selling pressure.

Also, ETFs with less liquidity, such as futures, could impact short-term volatility in the market for alpha crypto.

The Hottest Supply Metric

Glassnode has also highlighted its Hot Supply metric. It is an important metric for tracking Bitcoin’s holdings in a week or less.

The same Twitter/X thread shows that the number of BTCs in circulation has dropped by more than half in just three months, from 5,9% to 2,8%.

This decline suggests that there are fewer Bitcoins being traded on the market. The asset is therefore less liquid.

Read Related Articles

Glassnode also painted a grim picture of Bitcoin. It explained that the daily inflows had dropped by 54%, from 58.600 Bitcoins per day to just 26,900 Bitcoins.

The Bitcoin trend indicates a weaker demand, as fewer assets move to crypto exchanges.

TradingView chart with Olhar Digital’s featured image

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com